Region:Global

Author(s):Rebecca

Product Code:KRAA2923

Pages:85

Published On:August 2025

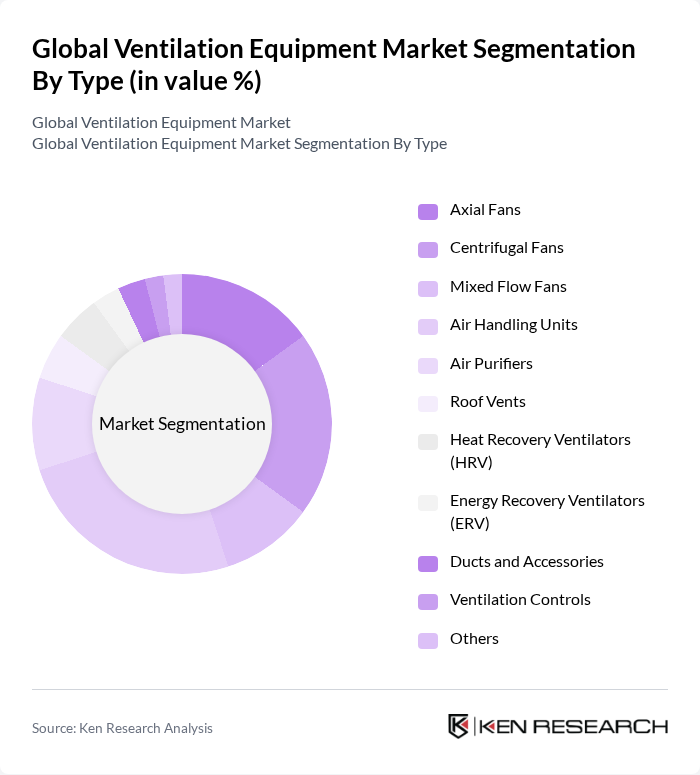

By Type:The ventilation equipment market is segmented into various types, including Axial Fans, Centrifugal Fans, Mixed Flow Fans, Air Handling Units, Air Purifiers, Roof Vents, Heat Recovery Ventilators (HRV), Energy Recovery Ventilators (ERV), Ducts and Accessories, Ventilation Controls, and Others. Among these, Air Handling Units and Air Purifiers are leading the market due to their essential roles in maintaining indoor air quality and energy efficiency. The growing awareness of health and environmental issues, as well as the adoption of energy-saving and automated ventilation technologies, has driven demand for these products, making them critical in both residential and commercial applications .

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the largest due to the increasing focus on home comfort, air quality, and the integration of smart ventilation solutions. Consumers are becoming more aware of the health impacts of indoor air quality, leading to a rise in demand for ventilation solutions in homes. The Commercial sector is also growing rapidly, driven by the need for efficient HVAC systems in office buildings, retail spaces, and the adoption of sustainable building standards .

The Global Ventilation Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Trane Technologies plc, Johnson Controls International plc, Daikin Industries, Ltd., Honeywell International Inc., Siemens AG, LG Electronics Inc., Panasonic Corporation, Mitsubishi Electric Corporation, Rheem Manufacturing Company, Nortek Air Management, Systemair AB, Vent-Axia Ltd., Broan-NuTone LLC, Fantech Inc., Greenheck Fan Corporation, FläktGroup, S&P Sistemas de Ventilación S.L.U. (Soler & Palau), TROX GmbH, Twin City Fan Companies, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ventilation equipment market appears promising, driven by technological advancements and a growing emphasis on sustainability. The integration of smart technologies, such as IoT-enabled systems, is expected to enhance operational efficiency and user experience. Additionally, as urbanization continues to rise, particularly in developing regions, the demand for innovative ventilation solutions that prioritize health and energy efficiency will likely increase, creating a dynamic landscape for market participants.

| Segment | Sub-Segments |

|---|---|

| By Type | Axial Fans Centrifugal Fans Mixed Flow Fans Air Handling Units Air Purifiers Roof Vents Heat Recovery Ventilators (HRV) Energy Recovery Ventilators (ERV) Ducts and Accessories Ventilation Controls Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | HVAC Systems Indoor Air Quality Management Energy Recovery Applications Ventilation for Specialized Environments (e.g., Cleanrooms, Laboratories, Hospitals) |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesale |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, ASEAN, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of Middle East & Africa) |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Mechanical Ventilation Natural Ventilation Hybrid Ventilation Smart Ventilation Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Ventilation Systems | 120 | Homeowners, HVAC Contractors |

| Commercial HVAC Solutions | 90 | Facility Managers, Building Owners |

| Industrial Ventilation Equipment | 60 | Plant Managers, Safety Officers |

| Energy-Efficient Ventilation Technologies | 50 | Energy Auditors, Sustainability Consultants |

| Smart Ventilation Systems | 70 | Technology Integrators, System Designers |

The Global Ventilation Equipment Market is valued at approximately USD 32 billion, driven by factors such as urbanization, awareness of indoor air quality, and the demand for energy-efficient ventilation systems.