Region:Global

Author(s):Shubham

Product Code:KRAD0738

Pages:93

Published On:August 2025

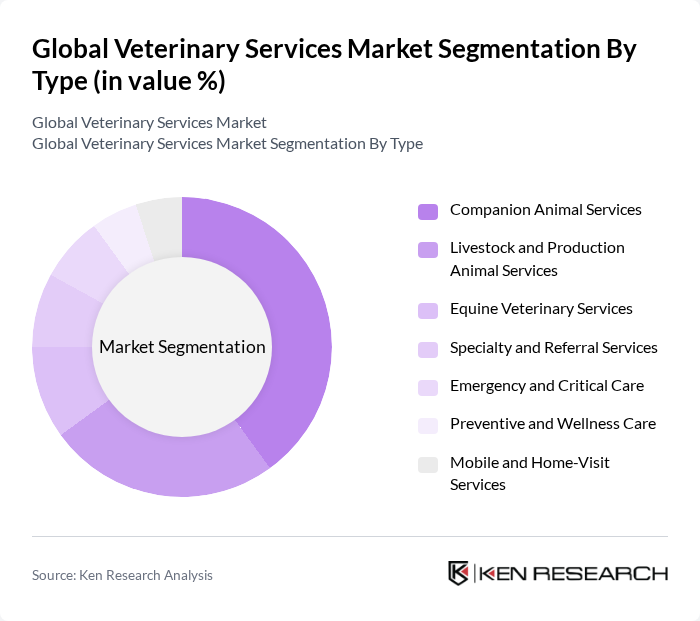

By Type:The market is segmented into various types of veterinary services, including Companion Animal Services, Livestock and Production Animal Services, Equine Veterinary Services, Specialty and Referral Services, Emergency and Critical Care, Preventive and Wellness Care, and Mobile and Home-Visit Services. Among these, Companion Animal Services dominate the market due to the increasing trend of pet ownership, growing willingness of owners to spend on preventive and specialty care, and broader access to diagnostics and insurance-supported services in developed markets .

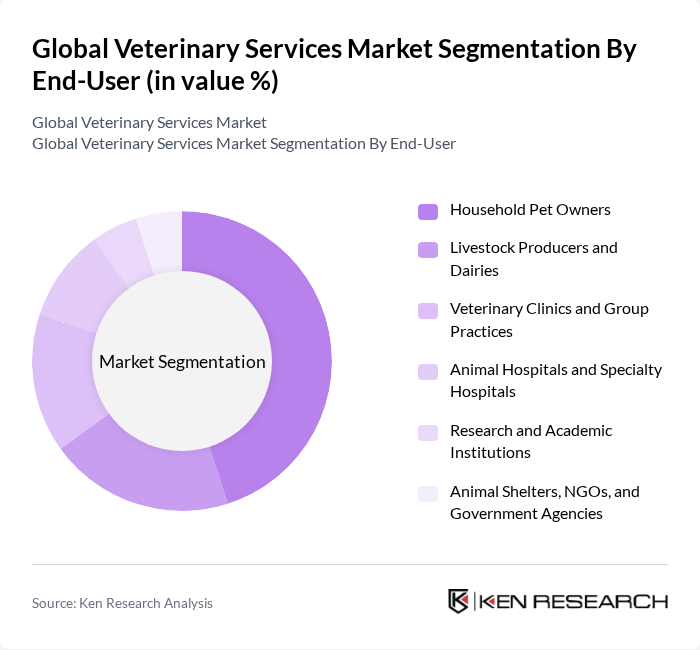

By End-User:The end-user segmentation includes Household Pet Owners, Livestock Producers and Dairies, Veterinary Clinics and Group Practices, Animal Hospitals and Specialty Hospitals, Research and Academic Institutions, and Animal Shelters, NGOs, and Government Agencies. Household Pet Owners represent the largest segment, driven by the increasing number of pet owners, higher per-visit spending in companion care, and the expansion of primary and specialty services accessed through clinics and hospitals .

The Global Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Veterinary Health (Banfield Pet Hospital, VCA Animal Hospitals, AniCura, BluePearl), National Veterinary Associates (NVA), IVC Evidensia, CVS Group plc, Greencross Pet Wellness Company (Greencross Vets), Medivet Group, Pets at Home Group plc (Vets4Pets), Petco Health and Wellness Company, Inc. (Vetco Clinics), PetSmart LLC (Banfield in-store partnerships), IDEXX Laboratories, Inc. (Reference labs and diagnostics services), Antech Diagnostics (Antech Imaging Services), Zoetis Inc. (Reference Labs and diagnostics services), Animal Health International, Inc. (a Patterson Company), Trupanion, Inc., Lemonade, Inc. (Lemonade Pet Insurance) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary services market in None appears promising, driven by ongoing trends in pet ownership and technological integration. As pet owners increasingly prioritize preventive care, the demand for regular health check-ups and vaccinations is expected to rise. Additionally, the incorporation of telemedicine and mobile services will enhance accessibility, allowing veterinary practices to reach a broader audience. These developments will likely foster a more robust and responsive veterinary care landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Companion Animal Services Livestock and Production Animal Services Equine Veterinary Services Specialty and Referral Services Emergency and Critical Care Preventive and Wellness Care Mobile and Home-Visit Services |

| By End-User | Household Pet Owners Livestock Producers and Dairies Veterinary Clinics and Group Practices Animal Hospitals and Specialty Hospitals Research and Academic Institutions Animal Shelters, NGOs, and Government Agencies |

| By Service Type | Primary Care and Consultation Surgical and Anesthesia Services Diagnostics and Imaging (Lab, Radiology, Ultrasound) Vaccination and Preventive Programs Rehabilitation, Physiotherapy, and Dentistry Telemedicine and Remote Care |

| By Distribution Channel | Direct-to-Client (Owned Clinics/Hospitals) Corporate Group Networks and DSOs Mobile and Field Services Online Booking and Digital Platforms Referral Networks and Partnerships |

| By Geographic Presence | Urban Suburban Rural Remote and Underserved Regions |

| By Pricing Model | Fee-for-Service Wellness Plans and Subscriptions Insurance-Reimbursed Services Value-Based and Bundled Care |

| By Customer Segment | Individual Pet Owners Multi-Pet Households Corporate and Consolidator Groups Agricultural Enterprises Non-profits and Public Sector |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Companion Animal Veterinary Services | 120 | Veterinarians, Clinic Managers |

| Livestock Veterinary Services | 90 | Farm Owners, Veterinary Technicians |

| Veterinary Diagnostics and Labs | 70 | Lab Managers, Veterinary Pathologists |

| Telemedicine in Veterinary Care | 60 | Veterinary Telehealth Providers, Pet Owners |

| Preventive Care and Wellness Programs | 80 | Veterinary Nurses, Pet Wellness Coordinators |

The Global Veterinary Services Market is valued at approximately USD 118 billion, reflecting a robust growth trajectory driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary technology.