Region:Middle East

Author(s):Rebecca

Product Code:KRAC8501

Pages:88

Published On:November 2025

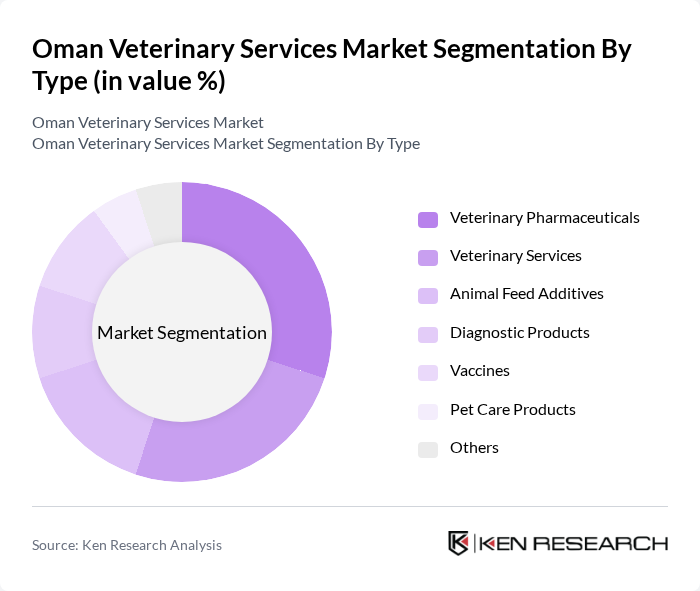

By Type:The market is segmented into various types, including Veterinary Pharmaceuticals, Veterinary Services, Animal Feed Additives, Diagnostic Products, Vaccines, Pet Care Products, and Others. Among these, Veterinary Pharmaceuticals and Veterinary Services are the most significant segments, driven by the increasing need for effective treatment and preventive care for animals.

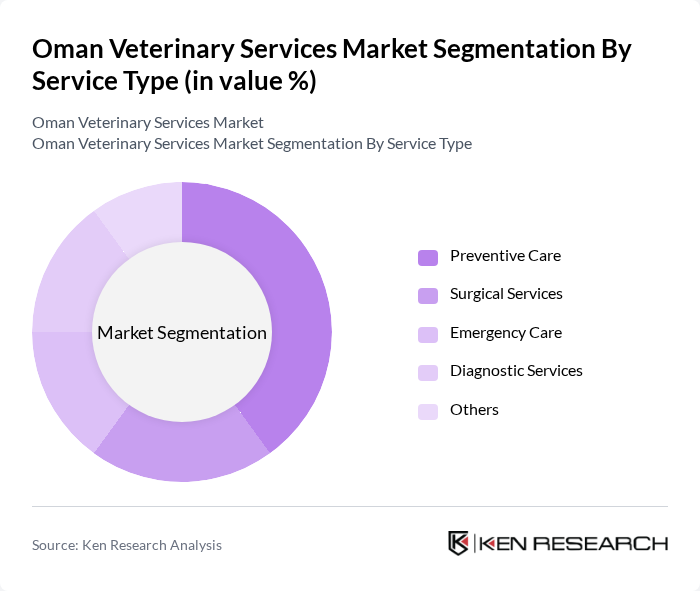

By Service Type:The service type segmentation includes Preventive Care, Surgical Services, Emergency Care, Diagnostic Services, and Others. Preventive Care is the leading segment, reflecting the growing trend among pet owners and livestock farmers to prioritize regular health check-ups and vaccinations to ensure the well-being of their animals.

The Oman Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Veterinary Clinic, Al Batinah Veterinary Services, Muscat Veterinary Hospital, Dhofar Veterinary Clinic, Oman Animal Health, Veterinary Services Oman, Al Shamal Veterinary Clinic, Pet Care Oman, Oman Veterinary Association, Al Waha Veterinary Services, Muscat Pet Hospital, Oman Animal Hospital, Al Hail Veterinary Clinic, Vetco Oman, Al Ain Animal Health, Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim, IDEXX Laboratories contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman veterinary services market appears promising, driven by increasing pet ownership and a growing emphasis on animal welfare. As the government continues to invest in veterinary infrastructure and education, the market is likely to see enhanced service delivery. Additionally, the integration of technology in veterinary practices, such as telemedicine, is expected to improve access to care, particularly in underserved areas, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Veterinary Pharmaceuticals Veterinary Services Animal Feed Additives Diagnostic Products Vaccines Pet Care Products Others |

| By Service Type | Preventive Care Surgical Services Emergency Care Diagnostic Services Others |

| By Product Type | Pharmaceuticals Vaccines Diagnostic Products Animal Feed Additives Pet Care Products Others |

| By Distribution Channel | Veterinary Clinics Online Retail Pharmacies Direct Sales Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions Government Agencies Others |

| By Animal Type | Companion Animals Livestock Aquatic Animals Exotic Animals Others |

| By Region | Muscat Dhofar Al Batinah Others |

| By Policy Support | Subsidies for veterinary services Tax incentives for veterinary practices Grants for animal health research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Companion Animal Veterinary Services | 100 | Veterinarians, Pet Owners |

| Livestock Health Management | 70 | Farmers, Livestock Veterinarians |

| Veterinary Supply Chain Insights | 50 | Distributors, Veterinary Product Manufacturers |

| Pet Care Services Market | 60 | Pet Groomers, Pet Service Providers |

| Regulatory Impact on Veterinary Practices | 40 | Policy Makers, Veterinary Association Representatives |

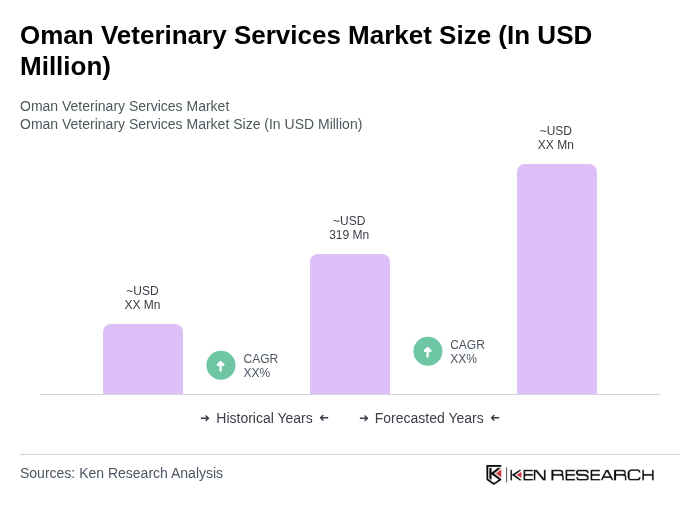

The Oman Veterinary Services Market is valued at approximately USD 319 million, reflecting significant growth driven by increasing pet ownership, heightened awareness of animal health, and the expansion of livestock farming in the region.