Region:Middle East

Author(s):Rebecca

Product Code:KRAC8497

Pages:90

Published On:November 2025

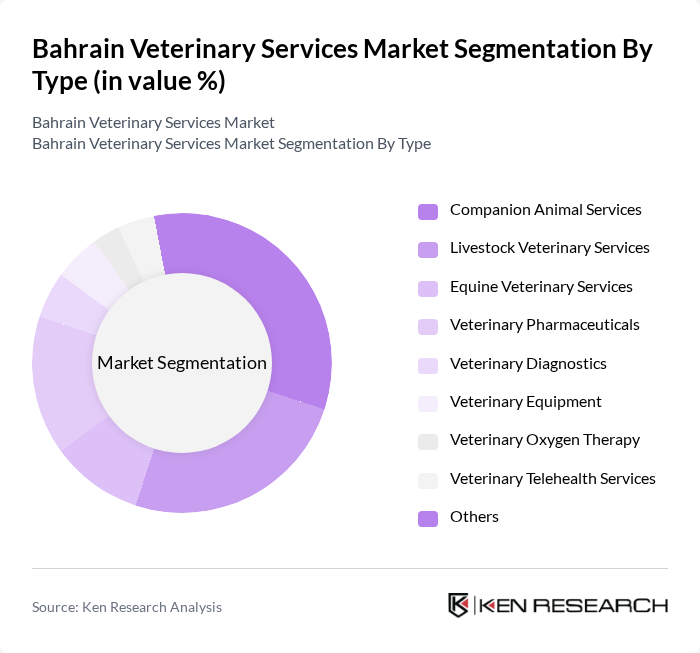

By Type:The market is segmented into various types, includingCompanion Animal Services,Livestock Veterinary Services,Equine Veterinary Services,Veterinary Pharmaceuticals,Veterinary Diagnostics,Veterinary Equipment,Veterinary Oxygen Therapy,Veterinary Telehealth Services, andOthers. Each of these segments caters to different aspects of animal health and welfare, reflecting the diverse needs of pet owners and livestock farmers. The segment descriptions are aligned with regional trends, such as the rapid growth of companion animal services and the increasing adoption of telehealth and advanced diagnostics in veterinary care .

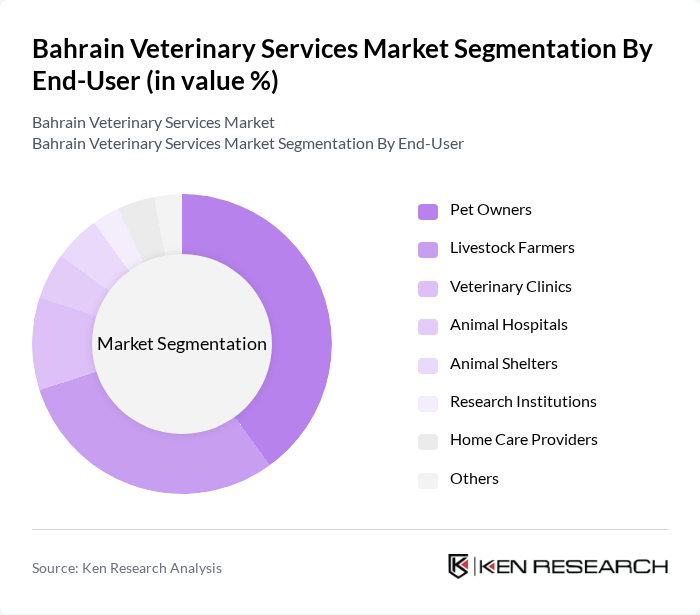

By End-User:The end-user segmentation includesPet Owners,Livestock Farmers,Veterinary Clinics,Animal Hospitals,Animal Shelters,Research Institutions,Home Care Providers, andOthers. This segmentation highlights the various stakeholders in the veterinary services market, each with unique requirements and expectations from veterinary service providers. The growing share of pet owners and livestock farmers reflects the dual focus on companion and production animals in Bahrain’s veterinary sector .

The Bahrain Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Veterinary Centre, Al Ahlia Veterinary Clinic, Pet Care Veterinary Clinic, Bahrain Animal Hospital, Vet Bahrain, Al Waha Veterinary Clinic, Animal Care Veterinary Clinic, Bahrain Veterinary Services, Al Noor Veterinary Clinic, Gulf Veterinary Services, Veterinary Care Centre, Bahrain Pet Hospital, Al Jazeera Veterinary Clinic, Oasis Veterinary Clinic, Animal Health Centre, Barri’s Vet Hospital, Al Hayat Veterinary Clinic, British Veterinary Centre contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain veterinary services market appears promising, driven by increasing pet ownership and heightened awareness of animal health. As the government continues to support animal welfare initiatives, the demand for veterinary services is expected to rise. Additionally, advancements in telemedicine and technology integration will enhance service delivery, making veterinary care more accessible. The focus on preventive care will likely lead to increased spending on veterinary services, fostering a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Companion Animal Services Livestock Veterinary Services Equine Veterinary Services Veterinary Pharmaceuticals Veterinary Diagnostics Veterinary Equipment Veterinary Oxygen Therapy Veterinary Telehealth Services Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Animal Hospitals Animal Shelters Research Institutions Home Care Providers Others |

| By Service Type | Preventive Care Surgical Services Emergency Care Specialty Services Diagnostic Imaging & Laboratory Services Telemedicine & Remote Consultations Others |

| By Product Type | Vaccines Antiparasitics Antibiotics Nutraceuticals Oxygen Therapy Equipment Others |

| By Distribution Channel | Veterinary Clinics Animal Hospitals Online Retail Pharmacies Direct Sales Veterinary Supply Stores Distributors Others |

| By Geographic Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Veterinary Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Companion Animal Veterinary Services | 120 | Veterinarians, Pet Clinic Owners |

| Livestock Health Management | 90 | Farmers, Livestock Veterinarians |

| Veterinary Pharmaceuticals Market | 70 | Pharmaceutical Distributors, Veterinarians |

| Pet Care Services (Grooming, Boarding) | 60 | Pet Service Providers, Pet Owners |

| Animal Welfare and Rescue Organizations | 50 | Animal Welfare Officers, Non-Profit Managers |

The Bahrain Veterinary Services Market is valued at approximately USD 50 million, reflecting a significant growth trend driven by increasing pet ownership, heightened awareness of animal health, and advancements in veterinary technology.