Region:Global

Author(s):Rebecca

Product Code:KRAA2842

Pages:96

Published On:August 2025

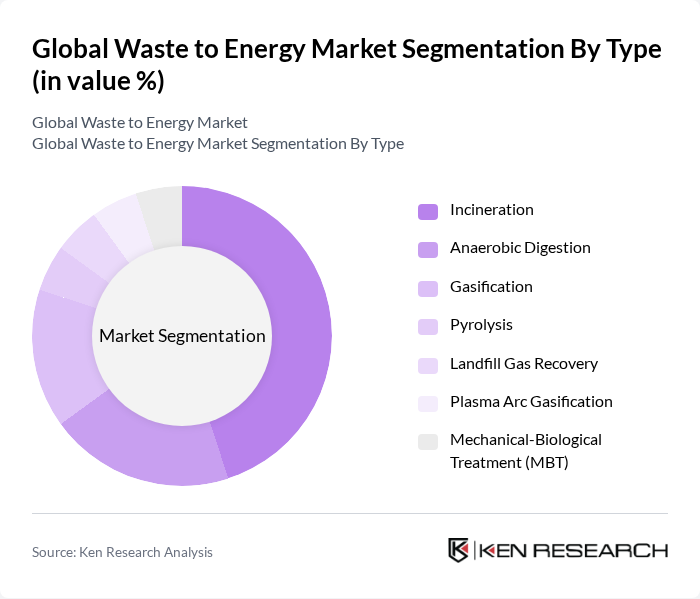

By Type:The market can be segmented into various types, including **incineration, anaerobic digestion, gasification, pyrolysis, landfill gas recovery, plasma arc gasification, and mechanical-biological treatment (MBT)**. Each of these methods has unique advantages and applications in converting waste into energy. Among these, **incineration remains the most widely adopted method** due to its efficiency in reducing waste volume and generating energy simultaneously.

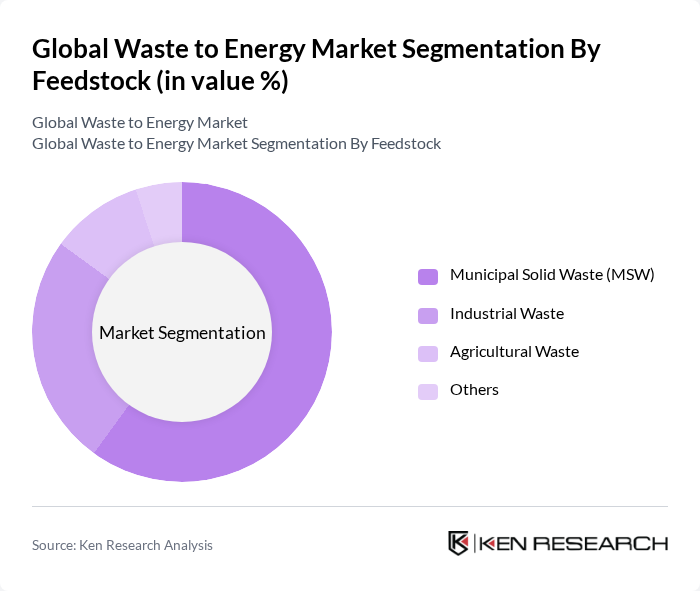

By Feedstock:The feedstock segment includes **municipal solid waste (MSW), industrial waste, agricultural waste, and others**. Municipal solid waste is the dominant feedstock due to its abundance in urban areas and the increasing pressure on municipalities to manage waste sustainably. The growing awareness of environmental issues and the need for effective waste management solutions are driving the adoption of waste-to-energy technologies utilizing MSW. Industrial waste is also gaining importance as manufacturing activities expand globally, contributing to higher waste generation and demand for energy recovery solutions.

The Global Waste to Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as **Veolia Environnement S.A., SUEZ S.A., Covanta Holding Corporation, Waste Management, Inc., Babcock & Wilcox Enterprises, Inc., Ørsted A/S, Hitachi Zosen Corporation, Mitsubishi Heavy Industries, Ltd., FCC Environment (part of FCC Group), Ramboll Group A/S, EQT AB (owner of Covanta), A2A S.p.A., Bioenergy Infrastructure Group, Plasco Energy Group Inc., Enerkem Inc.** contribute to innovation, geographic expansion, and service delivery in this space.

The future of the waste-to-energy sector appears promising, driven by increasing energy demands and a global shift towards sustainable practices. In future, the integration of smart technologies in WtE facilities is expected to enhance operational efficiencies, while the focus on circular economy principles will further promote resource recovery. As governments continue to prioritize renewable energy, the WtE market is likely to see increased investments and innovative partnerships, paving the way for sustainable energy solutions and waste management strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Incineration Anaerobic Digestion Gasification Pyrolysis Landfill Gas Recovery Plasma Arc Gasification Mechanical-Biological Treatment (MBT) |

| By Feedstock | Municipal Solid Waste (MSW) Industrial Waste Agricultural Waste Others |

| By End-User | Municipalities Industrial Sector Commercial Sector Energy Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Thermal Technologies (Incineration, Gasification, Pyrolysis, Plasma Arc) Biological Technologies (Anaerobic Digestion, Fermentation) Mechanical-Biological Treatment (MBT) |

| By Application | Electricity Generation Heat Generation Transport Fuels (Bio-SNG, Bio-LNG, Ethanol) Waste Management Resource Recovery |

| By Investment Source | Private Investments Government Funding International Aid |

| By Policy Support | Government Subsidies Tax Incentives Renewable Energy Certificates (RECs) Landfill Bans & Carbon Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Policy Makers |

| Industrial Waste-to-Energy Projects | 80 | Plant Managers, Operations Directors |

| Energy Recovery Technology Providers | 60 | Product Development Engineers, Sales Executives |

| Regulatory Bodies and Environmental Agencies | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions and Academia | 40 | Research Scientists, Environmental Economists |

The Global Waste to Energy Market is valued at approximately USD 48 billion, driven by factors such as increasing urbanization, stringent waste management regulations, and a rising demand for renewable energy sources.