Region:Global

Author(s):Dev

Product Code:KRAA3068

Pages:89

Published On:August 2025

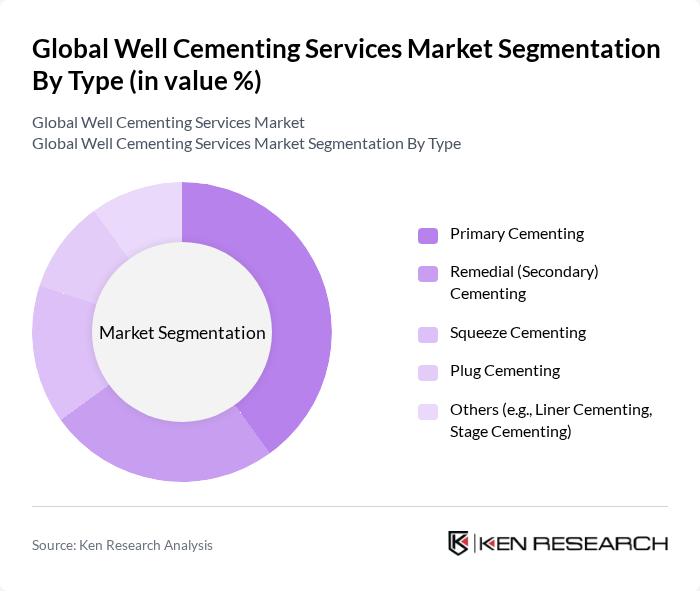

By Type:The market is segmented into various types of cementing services, including Primary Cementing, Remedial (Secondary) Cementing, Squeeze Cementing, Plug Cementing, and Others (e.g., Liner Cementing, Stage Cementing). Each type serves a specific purpose in the well construction and maintenance process, catering to different operational needs. Primary cementing is the most widely used, ensuring zonal isolation and casing support, while remedial cementing addresses issues such as leaks or well integrity failures. Squeeze and plug cementing are specialized techniques for targeted repairs or well abandonment, and liner/stage cementing supports complex well architectures .

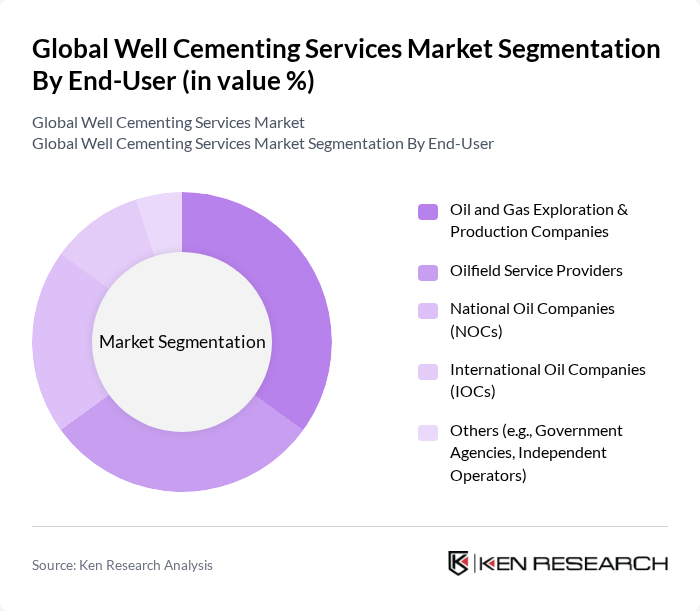

By End-User:The end-user segmentation includes Oil and Gas Exploration & Production Companies, Oilfield Service Providers, National Oil Companies (NOCs), International Oil Companies (IOCs), and Others (e.g., Government Agencies, Independent Operators). Each segment plays a crucial role in the demand for cementing services based on their operational requirements. Oil and gas E&P companies and oilfield service providers are the primary consumers, driven by ongoing drilling and well maintenance activities. NOCs and IOCs contribute significantly due to their large-scale, long-term projects, while government agencies and independent operators account for niche and regulatory-driven demand .

The Global Well Cementing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., Ciment Québec Inc., Superior Energy Services, Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., Aker Solutions ASA, Nabors Industries Ltd., Saipem S.p.A., Petrofac Limited, China Oilfield Services Limited (COSL), TETRA Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the well cementing services market is poised for growth, driven by technological advancements and a focus on sustainability. As companies increasingly adopt automation and digital technologies, operational efficiencies are expected to improve significantly. Furthermore, the shift towards integrated service offerings will enhance collaboration between service providers and drilling companies, fostering innovation. These trends indicate a robust market landscape, with opportunities for growth in emerging markets and the development of eco-friendly cementing solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Primary Cementing Remedial (Secondary) Cementing Squeeze Cementing Plug Cementing Others (e.g., Liner Cementing, Stage Cementing) |

| By End-User | Oil and Gas Exploration & Production Companies Oilfield Service Providers National Oil Companies (NOCs) International Oil Companies (IOCs) Others (e.g., Government Agencies, Independent Operators) |

| By Application | Onshore Wells Offshore Wells Deepwater & Ultra-Deepwater Wells Unconventional Wells (e.g., Shale, Tight Gas) Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Service Type | Conventional Cementing Services Advanced Cementing Services (e.g., Foam, Lightweight, Resin-based) Specialty Cementing Services (e.g., High-Temperature, High-Pressure) Others |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing Others |

| By Customer Type | Independent Operators National Oil Companies International Oil Companies Oilfield Service Companies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Well Cementing Services | 100 | Drilling Engineers, Operations Managers |

| Offshore Well Cementing Services | 80 | Project Managers, Safety Officers |

| Specialty Cementing Solutions | 50 | Technical Directors, R&D Managers |

| Market Trends in Emerging Economies | 60 | Market Analysts, Business Development Managers |

| Environmental Regulations Impact | 40 | Compliance Officers, Environmental Engineers |

The Global Well Cementing Services Market is valued at approximately USD 10 billion, driven by increasing oil and gas exploration activities, offshore drilling expansion, and the need for effective well integrity and safety measures.