Region:Middle East

Author(s):Dev

Product Code:KRAB7051

Pages:84

Published On:October 2025

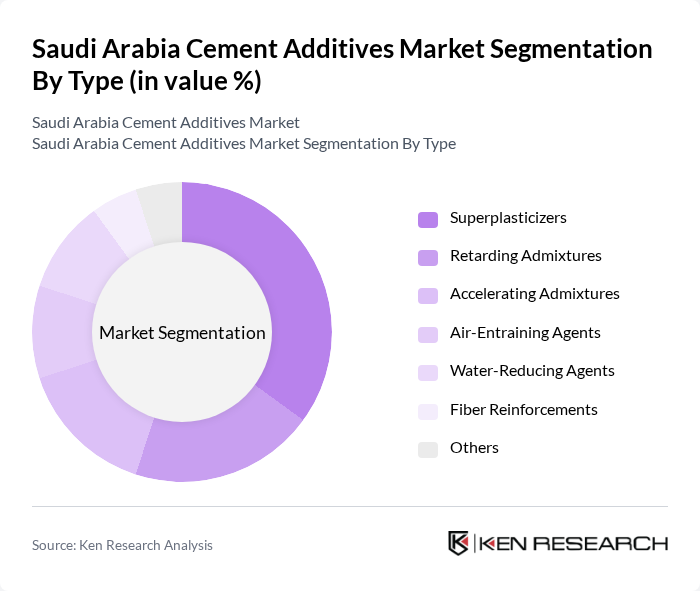

By Type:The market is segmented into various types of cement additives, including Superplasticizers, Retarding Admixtures, Accelerating Admixtures, Air-Entraining Agents, Water-Reducing Agents, Fiber Reinforcements, and Others. Among these, Superplasticizers are gaining traction due to their ability to enhance the workability of concrete while reducing water content, making them a preferred choice in high-performance concrete applications.

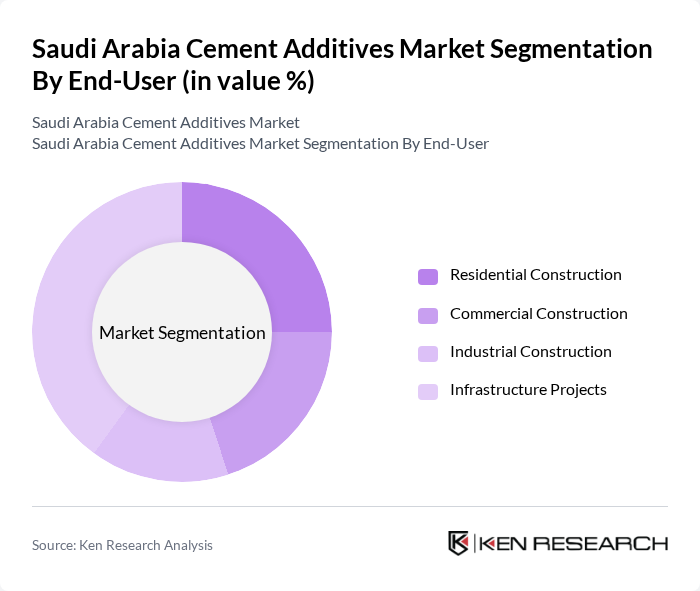

By End-User:The cement additives market is segmented by end-user into Residential Construction, Commercial Construction, Industrial Construction, and Infrastructure Projects. The Infrastructure Projects segment is currently leading the market due to the government's focus on large-scale infrastructure development, including roads, bridges, and public transport systems, which require high-quality cement additives for enhanced durability and performance.

The Saudi Arabia Cement Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, GCP Applied Technologies Inc., Mapei S.p.A., Fosroc International Limited, RPM International Inc., CEMEX S.A.B. de C.V., Saint-Gobain S.A., Admixture Systems, CHRYSO Group, Dow Chemical Company, HeidelbergCement AG, Boral Limited, Ashland Global Holdings Inc., Ceres Media contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia cement additives market is poised for significant transformation, driven by a combination of technological advancements and a strong focus on sustainability. As the construction sector expands, the demand for high-performance and eco-friendly additives will likely increase. Additionally, the integration of digital technologies in production processes will enhance efficiency and reduce costs. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Superplasticizers Retarding Admixtures Accelerating Admixtures Air-Entraining Agents Water-Reducing Agents Fiber Reinforcements Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure Projects |

| By Application | Ready-Mix Concrete Precast Concrete Shotcrete Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cement Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Construction Project Management | 80 | Project Managers, Site Engineers |

| Cement Additive Suppliers | 60 | Sales Managers, Product Development Specialists |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

| Research and Development in Construction Materials | 70 | R&D Managers, Technical Consultants |

The Saudi Arabia Cement Additives Market is valued at approximately USD 1.2 billion, driven by the booming construction sector and government initiatives focused on infrastructure development and urbanization.