Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9334

Pages:80

Published On:November 2025

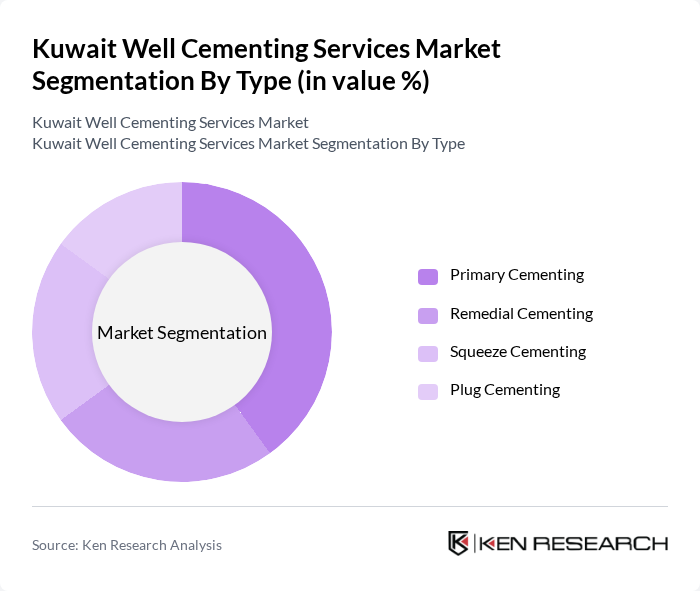

By Type:The well cementing services market is segmented into four main types: Primary Cementing, Remedial Cementing, Squeeze Cementing, and Plug Cementing. Each type serves a specific function in well construction and maintenance. Primary Cementing establishes a secure bond between the casing and the wellbore, ensuring zonal isolation and well integrity. Remedial Cementing addresses issues such as lost circulation or compromised well integrity. Squeeze Cementing is used to seal off unwanted zones, while Plug Cementing is employed for safe well abandonment .

Primary Cementing dominates the market due to its essential role in the initial well construction phase, ensuring the integrity and safety of the well. Operators favor this segment as it establishes a strong foundation for subsequent drilling and production activities. The growing number of new drilling projects in Kuwait continues to drive demand for primary cementing services, making it a critical focus area for service providers .

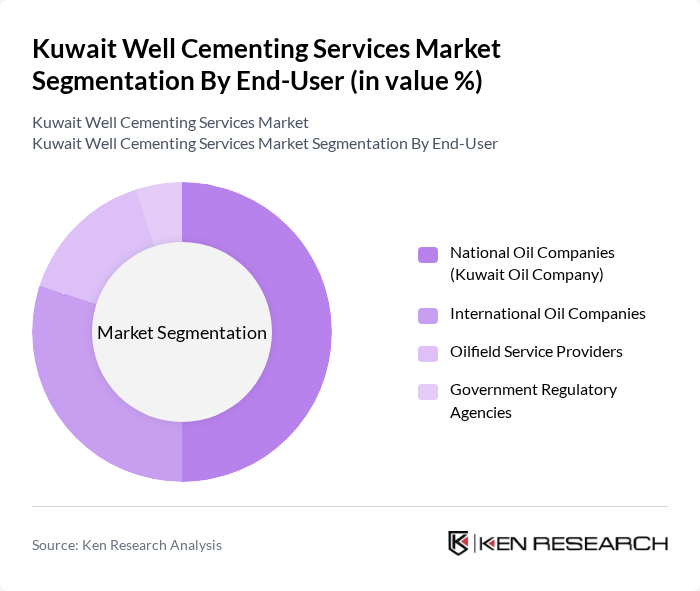

By End-User:End-user segmentation includes National Oil Companies (e.g., Kuwait Oil Company), International Oil Companies, Oilfield Service Providers, and Government Regulatory Agencies. National Oil Companies are the largest consumers due to their extensive operations and investments in the region .

National Oil Companies, particularly Kuwait Oil Company, lead the market due to their significant drilling and production activities. Their investments in oil exploration and production projects drive demand for well cementing services. Collaboration with international oil companies further enhances technological capabilities and service quality, reinforcing the dominance of this segment .

The Kuwait Well Cementing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Oil Company, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Petroleum Services (NPS), NESR (National Energy Services Reunited Corp.), Saipem S.p.A., Petrofac Limited, AlMansoori Specialized Engineering, Al-Khorayef Petroleum, Superior Energy Services, Trican Well Service Ltd., Ensign Energy Services Inc., and Precision Drilling Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait well cementing services market appears promising, driven by ongoing investments in oil exploration and production. As the government continues to prioritize oil output, the demand for innovative cementing solutions will likely increase. Additionally, the integration of digital technologies and sustainable practices will shape the industry's evolution. Companies that adapt to these trends and invest in advanced technologies will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Primary Cementing Remedial Cementing Squeeze Cementing Plug Cementing |

| By End-User | National Oil Companies (e.g., Kuwait Oil Company) International Oil Companies Oilfield Service Providers Government Regulatory Agencies |

| By Application | Onshore Operations Offshore Operations Well Rehabilitation Deepwater & Ultra-Deepwater Wells |

| By Region | Northern Kuwait Southern Kuwait Central Kuwait Western Kuwait |

| By Technology | Conventional Cementing Advanced Cementing Techniques (e.g., Foam, Lightweight, Nano-Enhanced) Automated Cementing Systems Real-Time Monitoring Solutions |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Joint Ventures |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Local Content Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Well Cementing Services | 100 | Project Managers, Operations Engineers |

| Offshore Well Cementing Services | 80 | Field Supervisors, Technical Directors |

| Cementing Material Suppliers | 50 | Sales Managers, Product Development Engineers |

| Regulatory Compliance in Cementing | 40 | Compliance Officers, Environmental Managers |

| Market Trends and Innovations | 60 | Industry Analysts, R&D Managers |

The Kuwait Well Cementing Services Market is valued at approximately USD 1.1 billion, driven by increased oil and gas exploration activities, the need for enhanced well integrity, and advancements in cementing technologies.