Region:Global

Author(s):Shubham

Product Code:KRAA2679

Pages:80

Published On:August 2025

By Type:The market is segmented into diverse winter sports equipment categories, including skis, snowboards, ice hockey equipment, winter sports apparel, protective gear, sleds, figure skating equipment, and others. Skis and snowboards remain the most popular segments, driven by the rising number of winter sports enthusiasts and the growing trend of snowboarding and skiing as leisure activities. Demand for high-performance gear continues to rise, fueled by innovations in lightweight materials, aerodynamic designs, and integrated smart technologies that enhance user experience and safety on the slopes.

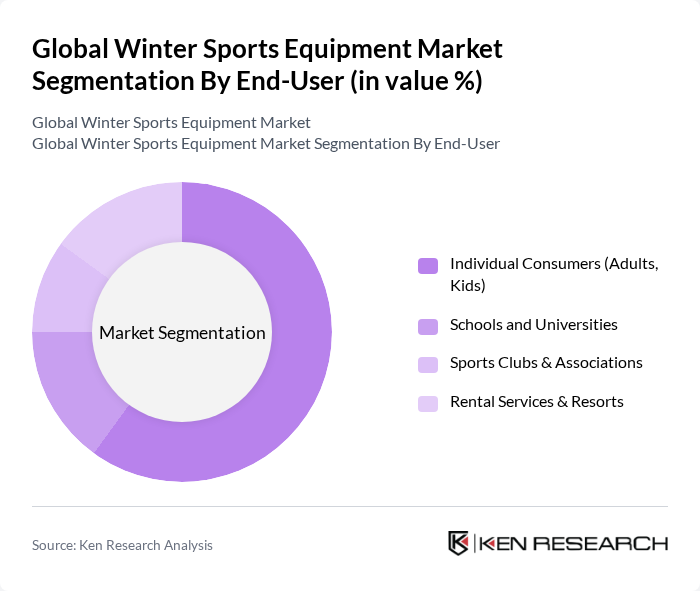

By End-User:The end-user segmentation comprises individual consumers, schools and universities, sports clubs and associations, and rental services and resorts. Individual consumers, including adults and kids, represent the largest segment, propelled by the increasing popularity of winter sports as recreational activities and the influence of global sporting events. Schools and universities are expanding their investment in winter sports programs, while rental services and resorts are leveraging the growth in winter tourism to drive equipment demand.

The Global Winter Sports Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amer Sports (Salomon, Atomic, Arc'teryx, Suunto), Rossignol Group, Völkl (Marker, Dalbello), Burton Snowboards, K2 Sports (K2, Ride, Line, Full Tilt), Salomon, Head (Head, Tyrolia, Penn), Fischer Sports, Atomic, Black Diamond Equipment, Elan, Nordica, Tecnica Group (Tecnica, Nordica, Blizzard, Moon Boot), Spyder Active Sports, The North Face (VF Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the winter sports equipment market appears promising, driven by increasing health consciousness and a growing interest in outdoor activities. As more consumers prioritize fitness, participation in winter sports is expected to rise, particularly among younger demographics. Additionally, the integration of technology in equipment design will likely enhance user experience and safety, attracting new participants. The market is also anticipated to benefit from strategic partnerships with tourism boards, promoting winter sports as a key attraction in various regions, thereby expanding the consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Skis (Alpine, Nordic, Freeride) Snowboards Ice Hockey Equipment (Sticks, Skates, Pads) Winter Sports Apparel (Jackets, Pants, Base Layers) Protective Gear & Accessories (Helmets, Goggles, Gloves, Poles) Sleds, Toboggans & Snowshoes Figure Skating Equipment Others (e.g., Curling Equipment, Luge) |

| By End-User | Individual Consumers (Adults, Kids) Schools and Universities Sports Clubs & Associations Rental Services & Resorts |

| By Distribution Channel | Online Retail Stores Specialty Sports Stores Supermarkets/Hypermarkets Department Stores Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, Switzerland, Austria, Nordics, UK, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, Australia, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Usage | Recreational Competitive Professional Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Winter Sports Retailers | 100 | Store Managers, Sales Representatives |

| Manufacturers of Winter Sports Equipment | 80 | Product Managers, Marketing Directors |

| Professional Athletes and Coaches | 60 | Professional Skiers, Snowboarders, Coaches |

| Winter Sports Event Organizers | 40 | Event Managers, Sponsorship Coordinators |

| Winter Sports Enthusiasts | 90 | Amateur Athletes, Club Members |

The Global Winter Sports Equipment Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by increased participation in winter sports, rising disposable incomes, and the popularity of winter tourism.