Region:Asia

Author(s):Rebecca

Product Code:KRAB3464

Pages:93

Published On:October 2025

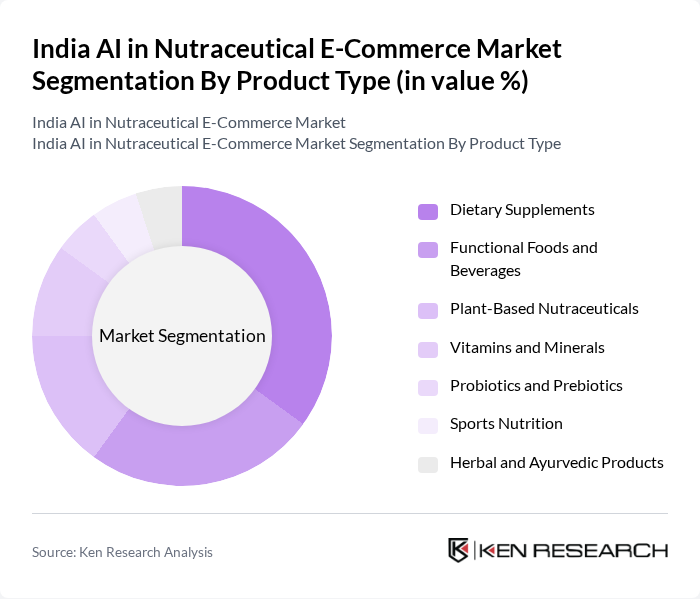

By Product Type:The product type segmentation includes various categories such as Dietary Supplements, Functional Foods and Beverages, Plant-Based Nutraceuticals, Vitamins and Minerals, Probiotics and Prebiotics, Sports Nutrition, and Herbal and Ayurvedic Products. Among these, Dietary Supplements are currently leading the market due to their increasing popularity among health-conscious consumers seeking preventive healthcare solutions. The trend towards personalized nutrition is also driving demand for these products, as consumers are more inclined to invest in supplements that cater to their specific health needs.

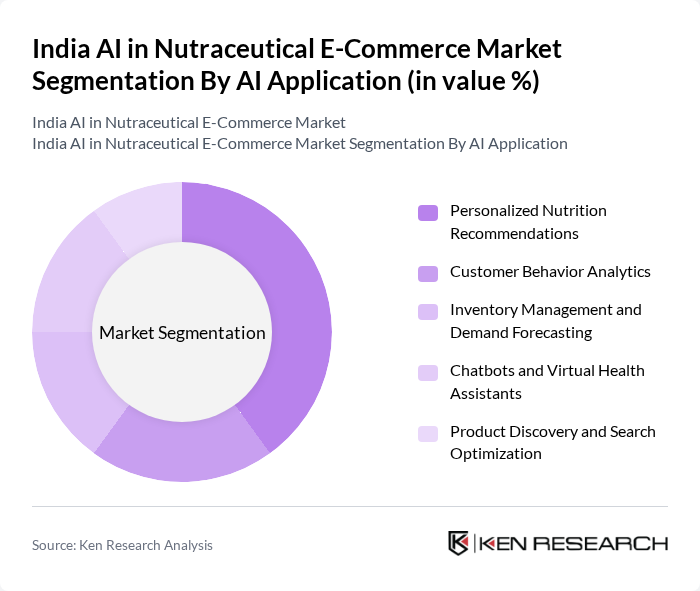

By AI Application:The AI application segmentation encompasses Personalized Nutrition Recommendations, Customer Behavior Analytics, Inventory Management and Demand Forecasting, Chatbots and Virtual Health Assistants, and Product Discovery and Search Optimization. Personalized Nutrition Recommendations are leading this segment, as they allow consumers to receive tailored advice based on their health profiles and preferences. This customization enhances user engagement and satisfaction, driving higher sales and loyalty in the nutraceutical e-commerce space.

The India AI in Nutraceutical E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as HealthKart, 1mg (Tata Digital), Netmeds (Reliance Retail), Pharmeasy, Nykaa (FSN E-Commerce Ventures), Wellbeing Nutrition, OZiva, True Elements, Kapiva Ayurveda, Himalaya Wellness Company, Dabur India Ltd., Patanjali Ayurved Ltd., Organic India Pvt. Ltd., Zandu Pharmaceuticals Works Ltd., MuscleBlaze (Bright Lifecare) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India AI in nutraceutical e-commerce market appears promising, driven by technological advancements and changing consumer preferences. As health consciousness continues to rise, companies are expected to invest in AI-driven solutions for personalized nutrition. Additionally, the increasing penetration of smartphones and internet access will facilitate the growth of online platforms, enabling consumers to access a wider range of nutraceutical products conveniently. This evolving landscape presents significant opportunities for innovation and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dietary Supplements Functional Foods and Beverages Plant-Based Nutraceuticals Vitamins and Minerals Probiotics and Prebiotics Sports Nutrition Herbal and Ayurvedic Products |

| By AI Application | Personalized Nutrition Recommendations Customer Behavior Analytics Inventory Management and Demand Forecasting Chatbots and Virtual Health Assistants Product Discovery and Search Optimization |

| By End-User Demographics | Millennials (25-40 years) Generation X (41-56 years) Athletes and Fitness Enthusiasts Elderly Population (60+ years) Health-Conscious Urban Consumers |

| By E-Commerce Platform Type | Marketplace Platforms (Amazon, Flipkart) Direct-to-Consumer Websites Specialized Health E-Commerce Platforms Social Commerce Platforms |

| By Geographic Region | North India West India South India East India Tier-II and Tier-III Cities |

| By Price Segment | Budget (Under ?500) Mid-Range (?500-?2000) Premium (Above ?2000) |

| By Distribution Model | Subscription-Based Services One-Time Purchase Bulk Orders |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical E-commerce Retailers | 100 | eCommerce Managers, Marketing Directors |

| Health and Wellness Consumers | 120 | Regular Nutraceutical Users, Health Enthusiasts |

| AI Technology Providers | 80 | Product Development Managers, Sales Executives |

| Healthcare Professionals | 60 | Nutritionists, Dieticians, General Practitioners |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The India AI in Nutraceutical E-Commerce Market is valued at approximately USD 32 billion, reflecting significant growth driven by increasing health consciousness, the rise in online shopping, and the integration of AI technologies for enhanced customer experiences.