Region:Asia

Author(s):Geetanshi

Product Code:KRAA3236

Pages:85

Published On:September 2025

By Type:The market is segmented into various types of services that cater to the needs of financial institutions and businesses. The subsegments include Managed ATM Services, Cash Replenishment Services, Cash Processing Services, Maintenance and Support Services, Security Services, Software Solutions, and Cash Recycling & Video-enabled ATM Services. Among these, Managed ATM Services is the leading segment due to the increasing reliance on outsourcing ATM operations to enhance efficiency and reduce operational costs. The adoption of cash recyclers and video-enabled ATMs is also accelerating, driven by the need for enhanced customer experience and operational efficiency.

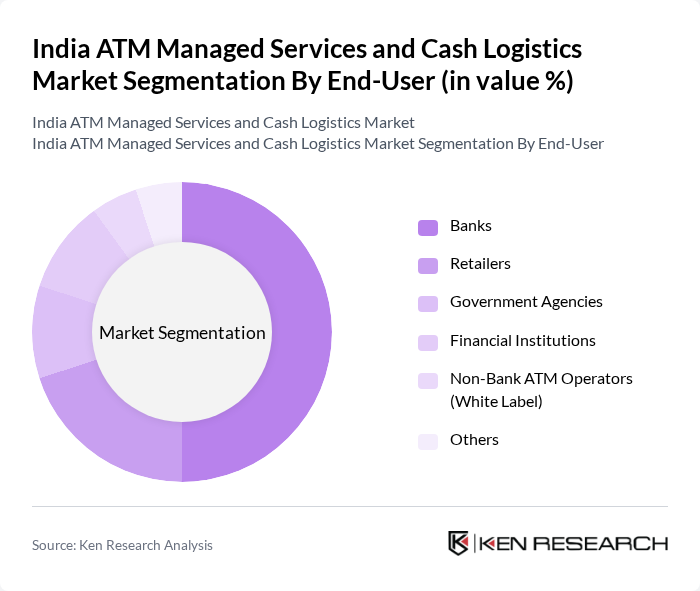

By End-User:The market is further segmented by end-users, which include Banks, Retailers, Government Agencies, Financial Institutions, Non-Bank ATM Operators (White Label), and Others. Banks are the dominant end-user segment, driven by their need for efficient cash management and customer service enhancement through ATMs. White label ATMs, managed by non-banking entities, have seen rapid growth in semi-urban and rural areas, expanding financial access and driving segmental demand.

The India ATM Managed Services and Cash Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, AGS Transact Technologies Ltd., Euronet Worldwide, Inc., Tata Communications Payment Solutions Ltd., CMS Info Systems Ltd., G4S Cash Solutions (India) Pvt. Ltd., Brinks India Pvt. Ltd., Fidelity National Information Services, Inc. (FIS), Hitachi-Omron Terminal Solutions, Corp., Muthoot Finance Ltd., Axis Bank Ltd., HDFC Bank Ltd., State Bank of India, ICICI Bank Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India ATM managed services and cash logistics market appears promising, driven by technological advancements and increasing cash demand. As urbanization accelerates, the need for efficient cash management solutions will grow. Additionally, the integration of AI and automation in cash logistics is expected to enhance operational efficiency. Companies that adapt to these trends will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Replenishment Services Cash Processing Services Maintenance and Support Services Security Services Software Solutions Cash Recycling & Video-enabled ATM Services |

| By End-User | Banks Retailers Government Agencies Financial Institutions Non-Bank ATM Operators (White Label) Others |

| By Region | North India South India East India West India |

| By Technology | Traditional ATMs Smart ATMs Mobile ATMs Biometric ATMs Cash Dispensers |

| By Application | Cash Withdrawal Cash Deposit Balance Inquiry Fund Transfer Bill Payment & Mobile Recharge |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies for ATM Deployment Tax Incentives Regulatory Support for Cash Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bank ATM Network Management | 60 | ATM Operations Managers, Risk Management Officers |

| Cash Logistics Services | 50 | Logistics Coordinators, Cash Handling Supervisors |

| ATM Maintenance and Support | 40 | Field Service Technicians, Technical Support Managers |

| Regulatory Compliance in Cash Management | 45 | Compliance Officers, Financial Analysts |

| Emerging Technologies in ATM Services | 45 | IT Managers, Innovation Leads |

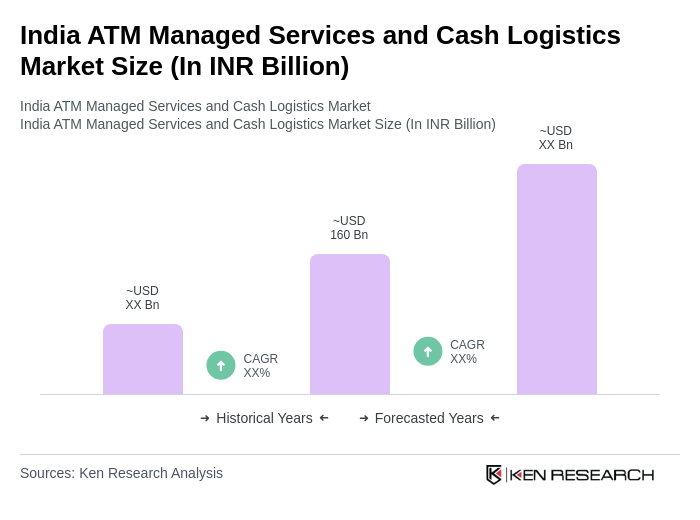

The India ATM Managed Services and Cash Logistics Market is valued at approximately INR 160 billion, reflecting the total addressable market for ATM outsourcing, cash replenishment, and managed services, driven by the increasing adoption of digital banking and cash transactions.