Italy ATM Managed Services and Cash Logistics Market Overview

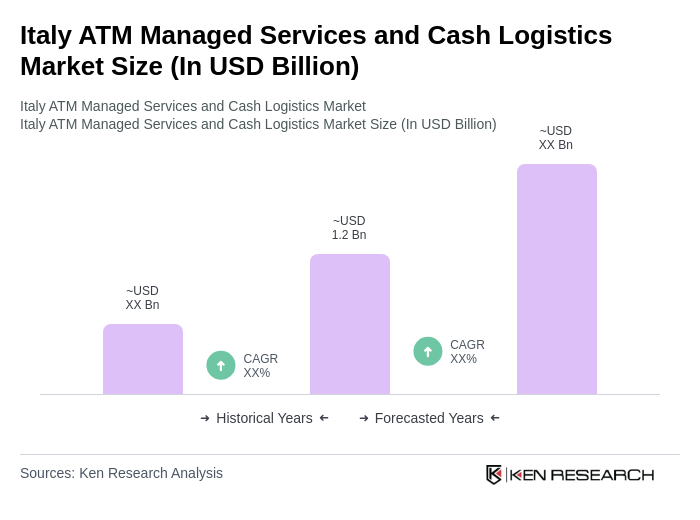

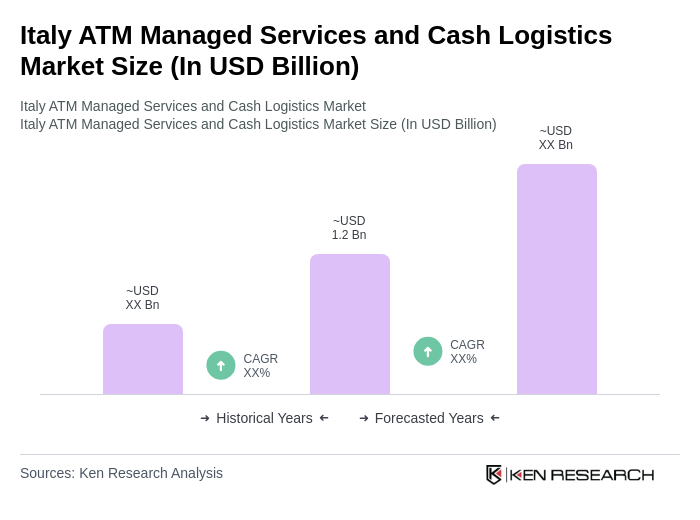

- The Italy ATM Managed Services and Cash Logistics Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient cash management solutions, the rise in ATM installations, and the need for enhanced security measures in cash handling. The market is also supported by technological advancements in cash logistics and ATM services, which have improved operational efficiency and customer satisfaction.

- Key cities such as Milan, Rome, and Turin dominate the market due to their high population density, significant financial activities, and the presence of major banking institutions. These urban centers are characterized by a robust infrastructure that supports the deployment of ATMs and cash logistics services, making them critical hubs for financial transactions and cash management solutions.

- In 2023, the Italian government implemented regulations aimed at enhancing the security of cash logistics operations. This includes mandatory compliance with stringent security protocols for cash-in-transit services, requiring companies to adopt advanced tracking technologies and ensure the safety of personnel involved in cash handling. Such regulations are designed to mitigate risks associated with cash transportation and improve overall service reliability.

Italy ATM Managed Services and Cash Logistics Market Segmentation

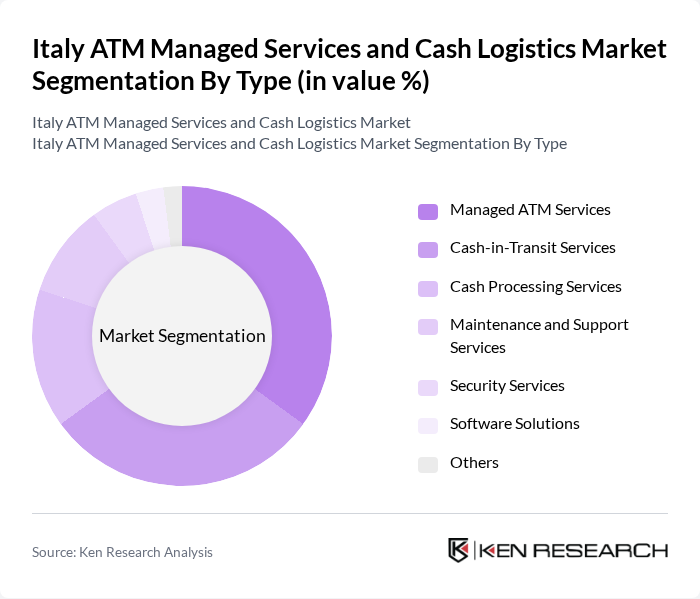

By Type:The market is segmented into various types, including Managed ATM Services, Cash-in-Transit Services, Cash Processing Services, Maintenance and Support Services, Security Services, Software Solutions, and Others. Among these, Managed ATM Services and Cash-in-Transit Services are the most prominent, driven by the increasing reliance on ATMs for cash withdrawals and the need for secure cash transportation.

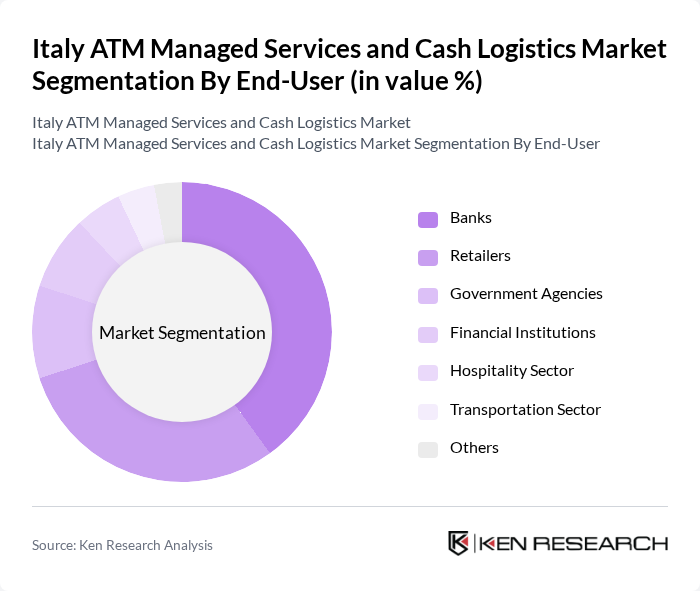

By End-User:The end-user segmentation includes Banks, Retailers, Government Agencies, Financial Institutions, Hospitality Sector, Transportation Sector, and Others. Banks and Retailers are the leading end-users, as they require reliable cash management solutions to facilitate transactions and ensure customer satisfaction.

Italy ATM Managed Services and Cash Logistics Market Competitive Landscape

The Italy ATM Managed Services and Cash Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ATM Italia S.p.A., SIA S.p.A., G4S Cash Solutions S.p.A., Loomis S.p.A., CCL Secure S.p.A., CashLogistics S.r.l., Prosegur Cash S.A., Euronet Worldwide, Inc., Diebold Nixdorf, Inc., NCR Corporation, Verifone Systems, Inc., ACI Worldwide, Inc., Fiserv, Inc., Ingenico Group S.A., Worldline S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Italy ATM Managed Services and Cash Logistics Market Industry Analysis

Growth Drivers

- Increasing Demand for Cash Management Solutions:The demand for cash management solutions in Italy is projected to rise significantly, driven by a cash circulation of approximately €200 billion in the future. This increase is attributed to the growing need for efficient cash handling and management systems among businesses and financial institutions. The Italian banking sector, with over 600 banks, is focusing on optimizing cash flow, thereby enhancing the demand for managed services and logistics solutions tailored to cash management.

- Rise in ATM Installations Across Urban Areas:Urban areas in Italy are witnessing a surge in ATM installations, with an estimated 50,000 ATMs operational in the future. This growth is fueled by the increasing population in cities and the need for accessible cash withdrawal points. The Italian government’s initiatives to promote financial inclusion further support this trend, as more ATMs are installed in underserved urban neighborhoods, enhancing the overall cash logistics framework in the country.

- Technological Advancements in Cash Logistics:The cash logistics sector in Italy is experiencing rapid technological advancements, with investments exceeding €150 million in the future. Innovations such as real-time cash tracking systems and automated cash handling solutions are becoming prevalent. These technologies not only improve operational efficiency but also reduce the risk of theft and fraud, making cash logistics services more attractive to banks and retailers seeking to enhance their cash management processes.

Market Challenges

- High Operational Costs:The operational costs associated with ATM managed services and cash logistics in Italy are significant, averaging around €1.2 billion annually. Factors contributing to these costs include maintenance, security, and transportation of cash. As service providers strive to maintain profitability, these high costs can deter investment in new technologies and expansion efforts, ultimately impacting service quality and availability in the market.

- Regulatory Compliance Complexities:The regulatory landscape for cash logistics in Italy is complex, with over 30 regulations governing cash handling and transportation. Compliance with anti-money laundering (AML) laws and data protection regulations requires substantial resources and expertise. This complexity can hinder the ability of smaller service providers to compete effectively, as they may lack the necessary infrastructure to meet stringent regulatory requirements, limiting market participation.

Italy ATM Managed Services and Cash Logistics Market Future Outlook

The future of the ATM managed services and cash logistics market in Italy appears promising, driven by ongoing technological innovations and a shift towards integrated cash management systems. As urbanization continues, the demand for efficient cash handling solutions will likely increase, prompting service providers to adopt advanced technologies. Additionally, the focus on sustainability and eco-friendly practices in cash logistics will shape the market, encouraging companies to develop greener solutions that align with consumer preferences and regulatory expectations.

Market Opportunities

- Expansion into Rural Areas:There is a significant opportunity for ATM managed services to expand into rural areas, where cash access remains limited. With approximately 30% of Italy's population residing in these regions, enhancing cash availability can drive demand for services, creating a new revenue stream for providers while promoting financial inclusion.

- Partnerships with Fintech Companies:Collaborating with fintech companies presents a lucrative opportunity for cash logistics providers. By integrating digital payment solutions with traditional cash services, companies can offer comprehensive financial solutions, catering to a broader customer base and enhancing service efficiency, ultimately driving growth in the sector.