Region:Asia

Author(s):Rebecca

Product Code:KRAB1859

Pages:97

Published On:October 2025

By Type:The market is segmented into Cash Dispensers, Cash Recyclers, Multi-Function ATMs, ATM Reconciliation, ATM Repair & Maintenance, Cash Management Services, Journal Management, and Others. Multi-Function ATMs are gaining significant traction due to their versatility in handling a wide range of transactions, including deposits, mobile wallet top-ups, QRIS Tap, and contactless transactions. The increasing consumer preference for convenience and the need for banks to deliver comprehensive digital and cash services are driving the demand for these advanced ATMs. The rise in cash recyclers is also notable, supporting efficient cash circulation and reducing operational costs for banks .

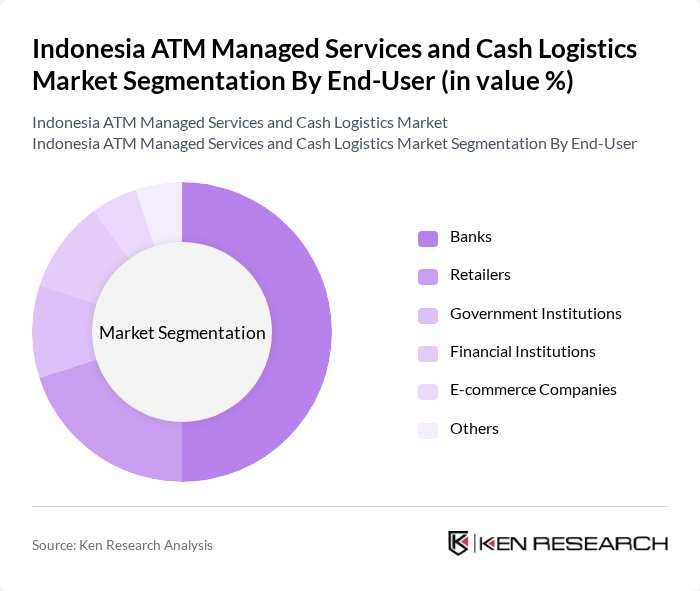

By End-User:The end-user segmentation includes Banks, Retailers, Government Institutions, Financial Institutions, E-commerce Companies, and Others. Banks remain the dominant end-users, requiring extensive ATM networks to facilitate cash withdrawals, deposits, and digital transactions for their customers. The increasing number of banking customers, expansion of branchless banking, and the push towards digital banking are further propelling the demand for ATM services among banks. Retailers and e-commerce companies are also expanding their use of ATM managed services to support cash logistics and payment solutions .

The Indonesia ATM Managed Services and Cash Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Astra Graphia Tbk, PT Bank Mandiri (Persero) Tbk, PT Bank Rakyat Indonesia (Persero) Tbk, PT Bank Central Asia Tbk (BCA), PT CIMB Niaga Tbk, PT Bank Danamon Indonesia Tbk, PT Mega Finance Indonesia, PT Bank Negara Indonesia (Persero) Tbk, PT Indosat Ooredoo Hutchison Tbk, PT Telkom Indonesia (Persero) Tbk, PT Bank Panin Dubai Syariah Tbk, PT Bank Permata Tbk, PT Bank Sinarmas Tbk, PT Bank Tabungan Negara (Persero) Tbk, PT Bank Muamalat Indonesia Tbk, Brinks Indonesia, G4S Cash Solutions Indonesia, Securitas Indonesia, JNE (Jalur Nugraha Ekakurir), PT Cash Logistics Indonesia, PT Sumber Daya Manunggal, PT Mitra Cash, PT Artha Cash, PT Trans Cash, Mandiri Cash Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATM managed services and cash logistics market in Indonesia appears promising, driven by ongoing technological innovations and a shift towards digital solutions. As the economy continues to grow, the integration of mobile banking with ATM services is expected to enhance customer convenience. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly practices in cash logistics, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cash Dispensers Cash Recyclers Multi-Function ATMs (deposit, withdrawal, mobile wallet top-up, QRIS Tap, contactless transactions) ATM Reconciliation ATM Repair & Maintenance Cash Management Services Journal Management Others |

| By End-User | Banks Retailers Government Institutions Financial Institutions E-commerce Companies Others |

| By Service Model | On-Site Management Remote Monitoring Maintenance Services Cash Management Services (cash forecasting, processing, replenishment, vaulting, cash-in-transit) |

| By Payment Method | Card-Based Transactions Mobile Payments (QRIS Tap, QRID, digital wallet integration) Contactless Payments (NFC-enabled) Others |

| By Geographic Coverage | Java Sumatra Bali and Nusa Tenggara Kalimantan Sulawesi Maluku and Papua Others |

| By Customer Segment | Individual Consumers Small Businesses Large Corporations Others |

| By Maintenance Type | Preventive Maintenance Corrective Maintenance Predictive Maintenance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 85 | ATM Managers, Operations Directors |

| Cash Logistics Providers | 75 | Logistics Managers, Service Delivery Heads |

| Retail ATM Usage | 65 | Store Managers, Financial Officers |

| Consumer Cash Withdrawal Behavior | 80 | End-users, Financial Service Customers |

| Regulatory Impact on Cash Services | 55 | Compliance Officers, Regulatory Affairs Managers |

The Indonesia ATM Managed Services and Cash Logistics Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of digital banking services and the demand for efficient cash management solutions.