Region:Asia

Author(s):Rebecca

Product Code:KRAB5960

Pages:85

Published On:October 2025

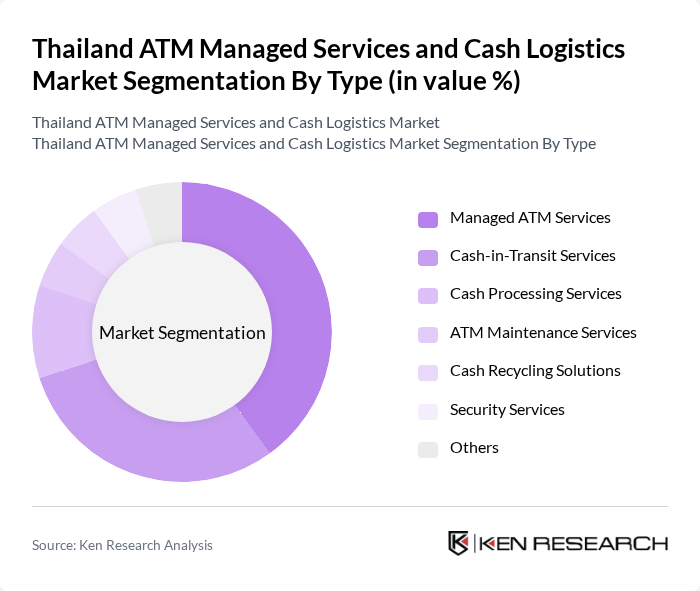

By Type:The market is segmented into various types, including Managed ATM Services, Cash-in-Transit Services, Cash Processing Services, ATM Maintenance Services, Cash Recycling Solutions, Security Services, and Others. Among these, Managed ATM Services and Cash-in-Transit Services are the most prominent, driven by the increasing reliance on automated cash handling and the need for secure cash transportation.

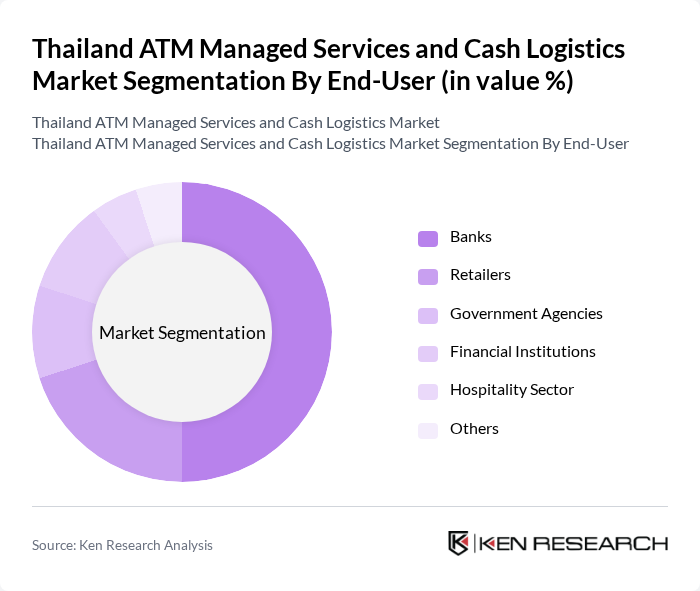

By End-User:The end-user segmentation includes Banks, Retailers, Government Agencies, Financial Institutions, Hospitality Sector, and Others. Banks are the leading end-users, as they require comprehensive ATM management and cash logistics solutions to ensure efficient cash flow and customer service.

The Thailand ATM Managed Services and Cash Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siam Commercial Bank, Kasikornbank, Bangkok Bank, Krung Thai Bank, TMBThanachart Bank, G4S Cash Solutions (Thailand) Ltd., Prosegur Cash, Securitas Thailand, ACI Worldwide, Diebold Nixdorf, NCR Corporation, Thales Group, Hitachi-Omron Terminal Solutions, ACI Worldwide, Cash Connect contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's ATM managed services and cash logistics market appears promising, driven by technological advancements and evolving consumer preferences. As automation in cash logistics increases, operational efficiencies are expected to improve, reducing costs and enhancing service delivery. Additionally, the integration of digital payment solutions with traditional cash services will likely create a more seamless customer experience, positioning companies to adapt to changing market dynamics and consumer behaviors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash-in-Transit Services Cash Processing Services ATM Maintenance Services Cash Recycling Solutions Security Services Others |

| By End-User | Banks Retailers Government Agencies Financial Institutions Hospitality Sector Others |

| By Service Model | Full-Service Model Hybrid Model Self-Service Model Others |

| By Payment Method | Cash Payments Digital Payments Mobile Payments Others |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas Others |

| By Customer Segment | Individual Customers Small and Medium Enterprises Large Corporations Others |

| By Frequency of Use | Daily Users Weekly Users Monthly Users Occasional Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 150 | ATM Managers, Operations Directors |

| Cash Logistics Providers | 100 | Logistics Coordinators, Fleet Managers |

| Retail ATM Deployment | 80 | Retail Managers, Financial Officers |

| Regulatory Compliance in Cash Handling | 70 | Compliance Officers, Risk Managers |

| Technological Innovations in ATM Services | 90 | IT Managers, Product Development Leads |

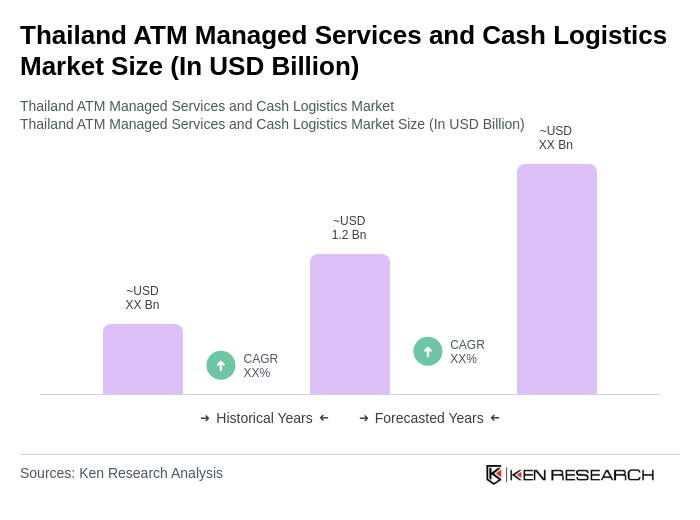

The Thailand ATM Managed Services and Cash Logistics Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for efficient cash management solutions and the rise in ATM installations across the country.