Region:Asia

Author(s):Dev

Product Code:KRAB3078

Pages:89

Published On:October 2025

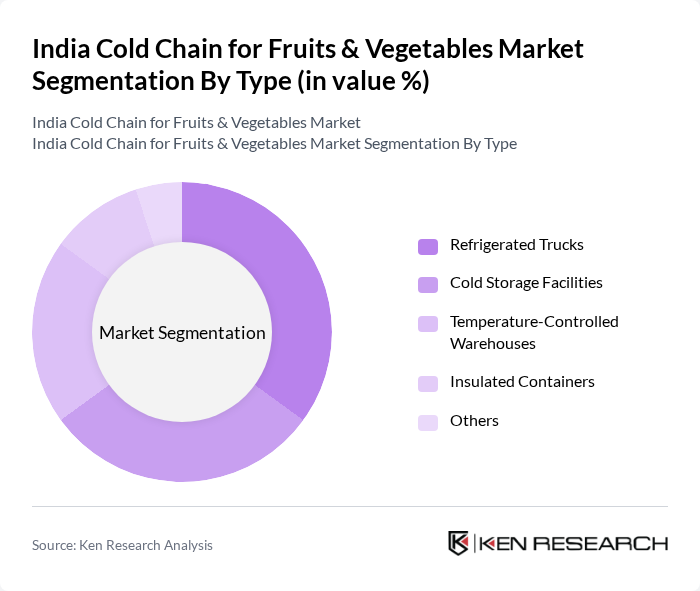

By Type:The cold chain market is segmented into various types, including refrigerated trucks, cold storage facilities, temperature-controlled warehouses, insulated containers, and others. Each of these segments plays a crucial role in ensuring the effective transportation and storage of perishable goods. Among these, refrigerated trucks and cold storage facilities are particularly significant due to their direct impact on maintaining the quality and freshness of fruits and vegetables during transit and storage.

By End-User:The end-user segmentation includes retail chains, food processing companies, wholesalers, exporters, and others. Retail chains and food processing companies are the leading segments, driven by the increasing demand for fresh produce and processed food products. The growing trend of organized retailing and the need for efficient supply chain solutions in food processing are key factors contributing to their dominance in the market.

The India Cold Chain for Fruits & Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Snowman Logistics Ltd., ColdEX Logistics Pvt. Ltd., Gati Ltd., Mahindra Logistics Ltd., TCI Cold Chain Solutions, Future Supply Chain Solutions Ltd., J. B. Boda Group, SRS Logistics, Aegis Logistics Ltd., Blue Star Ltd., APL Logistics, Xpressbees Logistics, Delhivery Ltd., Rhenus Logistics, APL India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain market for fruits and vegetables in India appears promising, driven by increasing urbanization and a growing emphasis on food safety. As consumer preferences shift towards fresh and organic produce, the demand for efficient cold chain solutions will intensify. Additionally, advancements in technology, such as AI for demand forecasting, will enhance operational efficiencies, enabling stakeholders to better manage supply chain dynamics and reduce waste, ultimately supporting market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Trucks Cold Storage Facilities Temperature-Controlled Warehouses Insulated Containers Others |

| By End-User | Retail Chains Food Processing Companies Wholesalers Exporters Others |

| By Region | North India South India East India West India |

| By Application | Fresh Fruits Fresh Vegetables Processed Fruits and Vegetables Organic Produce Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facility Operators | 100 | Facility Managers, Operations Directors |

| Farmers and Producers | 150 | Farm Owners, Agricultural Managers |

| Logistics and Distribution Companies | 80 | Logistics Coordinators, Supply Chain Managers |

| Retailers and Wholesalers | 70 | Procurement Managers, Category Managers |

| Government and Regulatory Bodies | 50 | Policy Makers, Regulatory Officers |

The India Cold Chain for Fruits & Vegetables Market is valued at approximately USD 15 billion, driven by increasing demand for fresh produce, consumer awareness regarding food safety, and the growth of organized retail.