Region:Africa

Author(s):Rebecca

Product Code:KRAA5620

Pages:96

Published On:September 2025

By Type:This segmentation includes various methods and technologies used in the cold chain process, which are essential for maintaining the quality and safety of fruits and vegetables during transportation and storage.

The Refrigerated Transport segment is the leading sub-segment in the cold chain market, driven by the increasing demand for fresh produce and the need for efficient logistics solutions. This segment is crucial for ensuring that fruits and vegetables reach their destination in optimal condition, minimizing spoilage and waste. The rise of e-commerce and online grocery shopping has further fueled the demand for refrigerated transport, as consumers expect fresh products delivered quickly and safely.

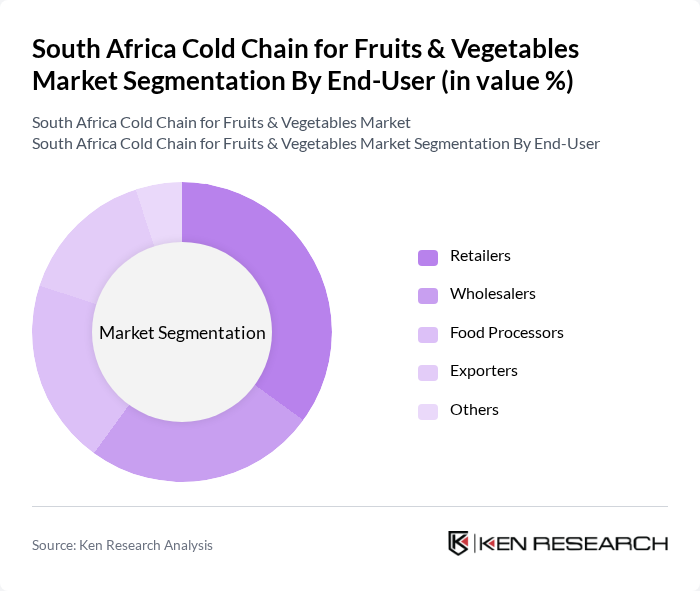

By End-User:This segmentation categorizes the market based on the various entities that utilize cold chain services for fruits and vegetables.

Retailers represent the largest end-user segment in the cold chain market, as they require reliable cold chain solutions to maintain the quality of perishable goods. The growing trend of health-conscious consumers seeking fresh produce has led retailers to invest in advanced cold chain technologies. Additionally, the expansion of supermarket chains and online grocery platforms has increased the demand for efficient cold storage and transportation solutions, solidifying the retailers' position as market leaders.

The South Africa Cold Chain for Fruits & Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Logistics, Imperial Logistics, Cold Chain Solutions, Africold, Kuehne + Nagel, DSV, Transnet, RCL Foods, A.P. Moller-Maersk, Bidvest Waltons, SAAFF, Freshmark, Food Logistics, SAAFF, TFG Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African cold chain for fruits and vegetables market appears promising, driven by technological advancements and increasing consumer demand for fresh produce. As the government continues to invest in infrastructure improvements, the efficiency of cold chain logistics is expected to enhance significantly. Additionally, the integration of IoT technologies will facilitate real-time monitoring of temperature-sensitive products, ensuring quality and safety throughout the supply chain, which is crucial for market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Retailers Wholesalers Food Processors Exporters Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Others |

| By Product Type | Fresh Fruits Fresh Vegetables Processed Fruits & Vegetables Others |

| By Temperature Range | Chilled (0-5°C) Frozen (-18°C and below) Ambient (5-20°C) Others |

| By Service Type | Transportation Services Storage Services Packaging Services Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Fruit Exporters | 80 | Export Managers, Supply Chain Coordinators |

| Vegetable Producers | 70 | Farm Owners, Production Managers |

| Logistics Providers | 90 | Logistics Managers, Business Development Executives |

| Retail Buyers | 60 | Category Managers, Procurement Officers |

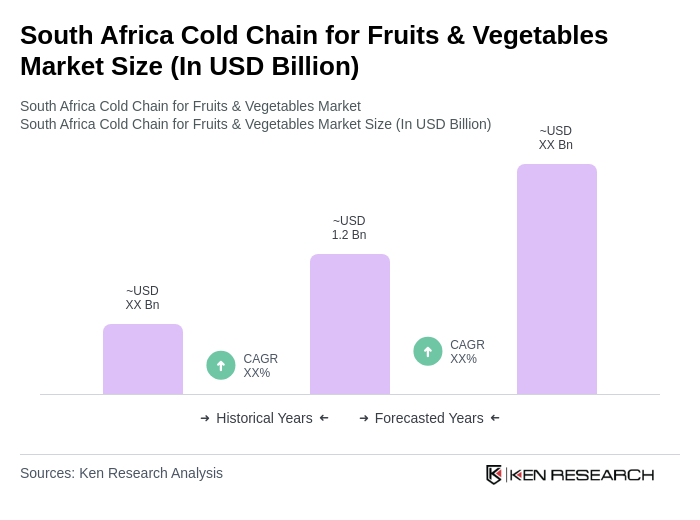

The South Africa Cold Chain for Fruits & Vegetables Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for fresh produce and enhanced food safety awareness among consumers.