Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA8055

Pages:90

Published On:September 2025

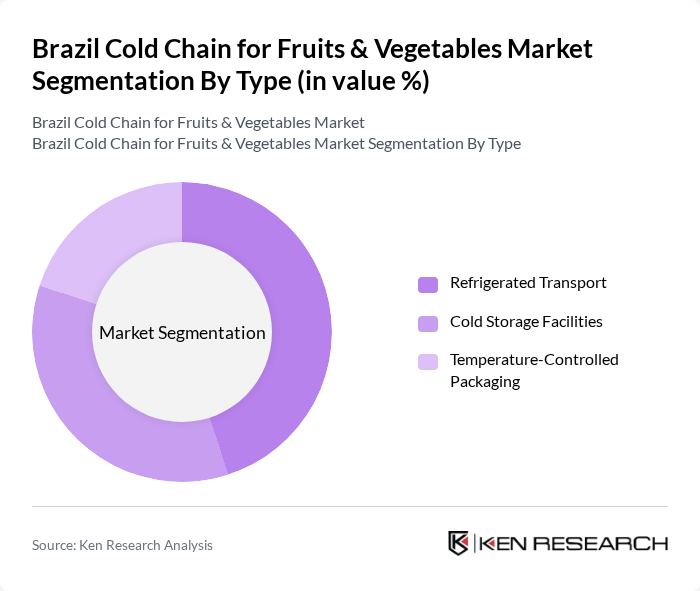

By Type:The cold chain market is segmented into three primary types: Refrigerated Transport, Cold Storage Facilities, and Temperature-Controlled Packaging. Refrigerated transport is crucial for maintaining the freshness of perishable goods during transit, while cold storage facilities provide the necessary environment for long-term storage. Temperature-controlled packaging ensures that products remain at optimal temperatures throughout the supply chain, thus preserving their quality.

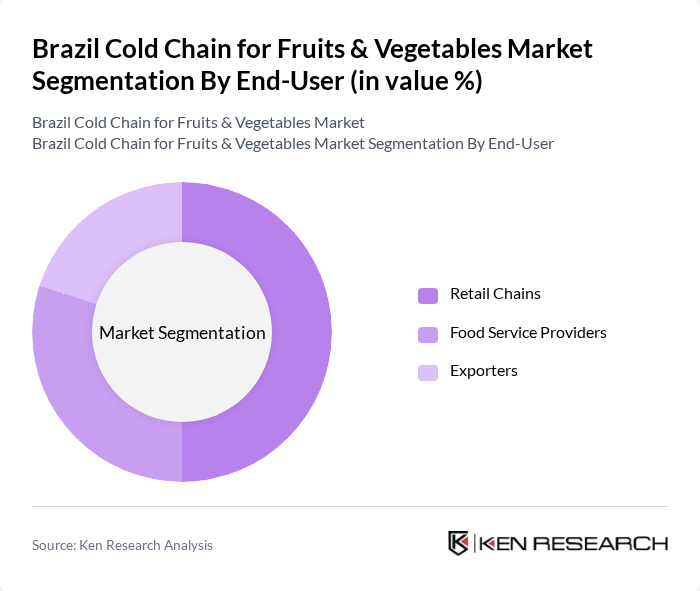

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, and Exporters. Retail chains are the largest consumers of cold chain services, driven by the need to maintain the quality of fresh produce. Food service providers, including restaurants and catering services, also rely heavily on cold chain logistics to ensure food safety. Exporters play a vital role in the market by requiring efficient cold chain solutions to meet international standards.

The Brazil Cold Chain for Fruits & Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Martins, Friozem, Logística Frigorificada, Frigobras, Cold Chain Solutions, JBS S.A., BRF S.A., Grupo Pão de Açúcar, Carrefour Brasil, Supermercados BH, Cargill Brasil, Agrosuper, Seara Alimentos, Aurora Alimentos, Unilever Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's cold chain for fruits and vegetables market appears promising, driven by technological advancements and increasing consumer awareness of food safety. The integration of IoT technologies is expected to enhance supply chain efficiency, while sustainable practices will likely gain traction. As the government continues to support agricultural exports, the demand for cold chain solutions will rise, creating a more robust infrastructure that can handle the growing volume of perishable goods in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging |

| By End-User | Retail Chains Food Service Providers Exporters |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms |

| By Product Category | Fresh Fruits Fresh Vegetables Processed Fruits & Vegetables |

| By Sales Channel | Online Sales Offline Sales |

| By Price Range | Premium Segment Mid-Range Segment Budget Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Fruit and Vegetable Distributors | 80 | Supply Chain Managers, Logistics Coordinators |

| Agricultural Producers | 70 | Farm Owners, Production Managers |

| Retail Sector Cold Chain Users | 90 | Store Managers, Procurement Officers |

| Cold Chain Technology Providers | 60 | Product Development Managers, Sales Executives |

The Brazil Cold Chain for Fruits & Vegetables Market is valued at approximately USD 5 billion, driven by increasing demand for fresh produce and heightened consumer awareness regarding food safety and quality.