India Digital Gold and WealthTech Platforms Market Overview

- The India Digital Gold and WealthTech Platforms Market is valued at INR 155 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital payment systems, rising consumer interest in gold as an investment, and the proliferation of mobile applications that facilitate easy access to wealth management services.

- Key cities such as Mumbai, Delhi, and Bengaluru dominate the market due to their status as financial hubs, high population density, and a growing number of tech-savvy consumers. These cities have a robust infrastructure for digital transactions and a significant presence of financial institutions, which further enhances market growth.

- In 2023, the Indian government introduced the Digital Gold Scheme, which allows individuals to invest in gold digitally through regulated platforms. This initiative aims to promote transparency and security in gold investments, making it easier for consumers to buy and sell gold without the need for physical storage.

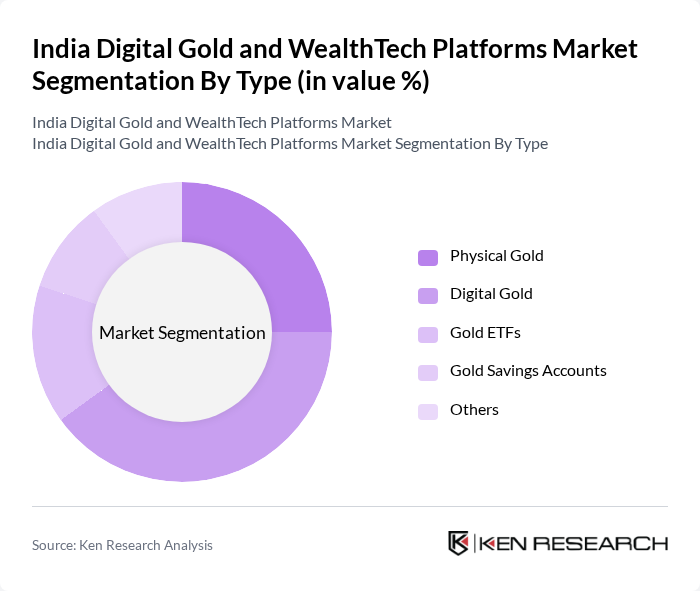

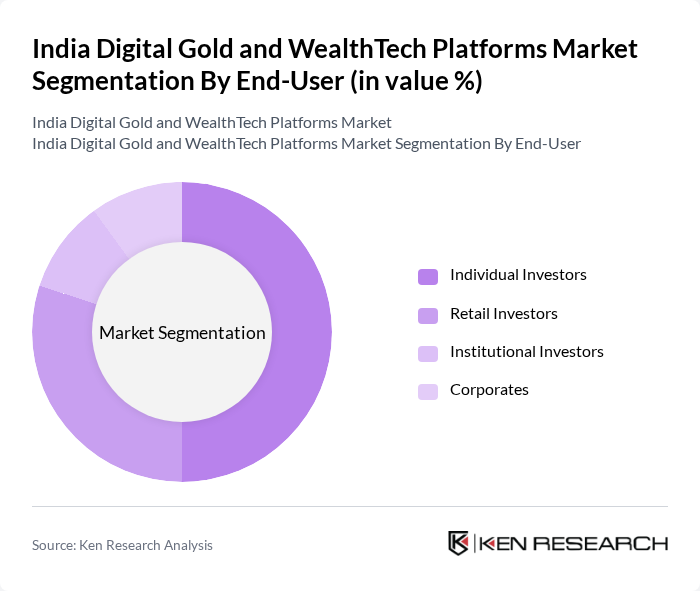

India Digital Gold and WealthTech Platforms Market Segmentation

By Type:The market is segmented into various types, including Physical Gold, Digital Gold, Gold ETFs, Gold Savings Accounts, and Others. Among these, Digital Gold has gained significant traction due to its convenience and accessibility, appealing to a younger demographic that prefers online transactions. Physical Gold remains popular for traditional investors, while Gold ETFs and Savings Accounts cater to those looking for more structured investment options.

By End-User:The end-user segmentation includes Individual Investors, Retail Investors, Institutional Investors, and Corporates. Individual Investors dominate the market, driven by the increasing trend of personal wealth management and the desire for gold as a hedge against inflation. Retail Investors are also significant, as they seek diversified portfolios, while Institutional Investors and Corporates contribute to the market through larger investments in gold-backed securities.

India Digital Gold and WealthTech Platforms Market Competitive Landscape

The India Digital Gold and WealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Paytm Money, PhonePe, Goldmoney Inc., KYC Gold, SafeGold, Augmont, Zerodha, Groww, Kuvera, Scripbox, ClearTax, HDFC Securities, ICICI Direct, Axis Direct, Upstox contribute to innovation, geographic expansion, and service delivery in this space.

India Digital Gold and WealthTech Platforms Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital penetration in India has surged, with internet users reaching approximately 1,200 million in future, according to the Telecom Regulatory Authority of India (TRAI). This growth facilitates access to digital gold and WealthTech platforms, enabling more individuals to invest in gold and manage their wealth online. The rise of smartphone usage, projected to exceed 1.5 billion devices, further supports this trend, making digital financial services more accessible to the masses.

- Rising Gold Prices:Gold prices in India have shown a significant upward trend, with the average price per gram reaching ?6,500 in future, up from ?4,800 in 2023. This increase has heightened consumer interest in gold investments, as individuals seek to hedge against inflation and economic uncertainty. The historical performance of gold as a safe-haven asset continues to attract both retail and institutional investors, driving demand for digital gold platforms.

- Enhanced Financial Literacy:Financial literacy initiatives have gained momentum, with the Reserve Bank of India reporting that over 60% of the population is now aware of investment options beyond traditional savings. This shift is crucial as more individuals are educated about wealth management and investment strategies, leading to increased participation in digital gold and WealthTech platforms. The government's focus on financial inclusion is expected to further bolster this trend, encouraging responsible investment behaviors.

Market Challenges

- Regulatory Uncertainty:The regulatory landscape for digital gold and WealthTech platforms remains ambiguous, with the Securities and Exchange Board of India (SEBI) continuously updating guidelines. This uncertainty can deter potential investors, as companies may hesitate to innovate or expand their offerings. The lack of clear regulations can also lead to compliance challenges, impacting the overall growth of the digital gold market in India.

- Consumer Trust Issues:Trust remains a significant barrier in the digital gold market, with many consumers wary of online transactions. A survey by the Indian Market Research Bureau indicated that 35% of potential investors express concerns about the security of their investments. Building consumer confidence through transparent practices and robust security measures is essential for platforms to attract and retain users in this competitive landscape.

India Digital Gold and WealthTech Platforms Market Future Outlook

The future of the India Digital Gold and WealthTech platforms market appears promising, driven by technological advancements and increasing consumer awareness. As digital literacy improves, more individuals are expected to engage with these platforms, leading to a broader acceptance of digital investments. Additionally, the integration of advanced technologies like AI and blockchain will enhance user experience and security, fostering innovation. The market is likely to witness a surge in tailored financial products catering to diverse consumer needs, further solidifying its growth trajectory.

Market Opportunities

- Expansion of Digital Platforms:The proliferation of digital platforms presents a significant opportunity for growth. With over 400 million potential new users in the next few years, companies can leverage this demographic to introduce innovative services, enhancing user engagement and investment in digital gold.

- Strategic Partnerships:Collaborations between fintech companies and traditional banks can create synergies that enhance service offerings. By combining resources, these partnerships can improve customer reach and trust, ultimately driving higher adoption rates of digital gold and WealthTech solutions across diverse consumer segments.