Region:Asia

Author(s):Dev

Product Code:KRAB4339

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Floater Plans, Critical Illness Insurance, Top-Up Plans, Group Health Insurance, Travel Health Insurance, and Others. Among these, Individual Health Insurance is currently the most dominant segment, driven by the increasing number of individuals seeking personalized health coverage. The growing awareness of health risks and the need for financial protection against medical expenses have led to a surge in demand for individual plans.

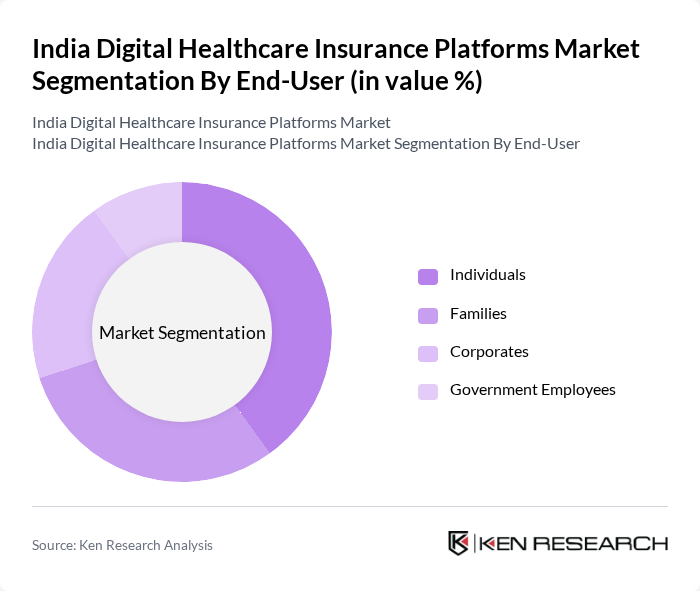

By End-User:The end-user segmentation includes Individuals, Families, Corporates, and Government Employees. The Individual segment is leading the market, as more people are recognizing the importance of personal health insurance. The rise in lifestyle diseases and the increasing cost of healthcare have prompted individuals to seek insurance coverage tailored to their specific health needs.

The India Digital Healthcare Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as HDFC ERGO Health Insurance, Star Health and Allied Insurance, ICICI Lombard General Insurance, Max Bupa Health Insurance, Aditya Birla Health Insurance, Religare Health Insurance, Bajaj Allianz General Insurance, SBI Health Insurance, Kotak Mahindra General Insurance, Future Generali India Insurance, ManipalCigna Health Insurance, New India Assurance, Oriental Insurance, United India Insurance, Reliance General Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Digital Healthcare Insurance Platforms market appears promising, driven by technological advancements and increasing consumer awareness. The integration of artificial intelligence and machine learning is expected to enhance user experiences, enabling personalized healthcare solutions. Additionally, the expansion of telemedicine services will likely facilitate greater access to healthcare, particularly in rural areas. As the market evolves, companies that prioritize data security and regulatory compliance will be better positioned to thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Floater Plans Critical Illness Insurance Top-Up Plans Group Health Insurance Travel Health Insurance Others |

| By End-User | Individuals Families Corporates Government Employees |

| By Region | North India South India East India West India |

| By Distribution Channel | Online Platforms Insurance Agents Brokers Direct Sales |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium Plans Medium Premium Plans High Premium Plans |

| By Customer Segment | Urban Customers Rural Customers Senior Citizens Young Adults |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 150 | Policyholders, Healthcare Consumers |

| Insurance Agents and Brokers | 100 | Insurance Agents, Financial Advisors |

| Healthcare Providers | 80 | Doctors, Hospital Administrators |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Officials |

| Technology Providers in Healthcare | 70 | IT Managers, Product Development Leads |

The India Digital Healthcare Insurance Platforms Market is valued at approximately INR 155 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and rising healthcare costs among the population.