Region:Middle East

Author(s):Dev

Product Code:KRAB5428

Pages:86

Published On:October 2025

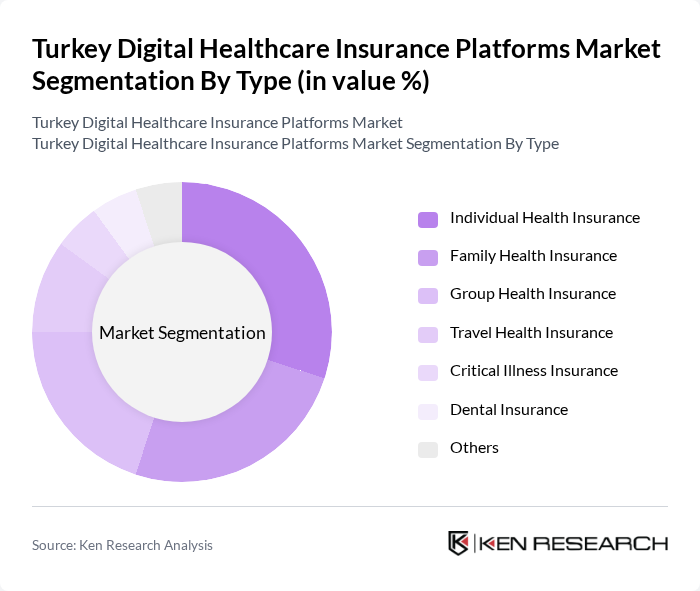

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of healthcare coverage in Turkey.

The Individual Health Insurance segment is currently dominating the market due to the increasing awareness among consumers about personal health management and the rising trend of personalized healthcare solutions. This segment appeals to individuals seeking tailored coverage options that meet their specific health needs. Additionally, the growing number of freelancers and self-employed individuals in Turkey has contributed to the demand for individual health insurance products, as they often lack employer-sponsored coverage.

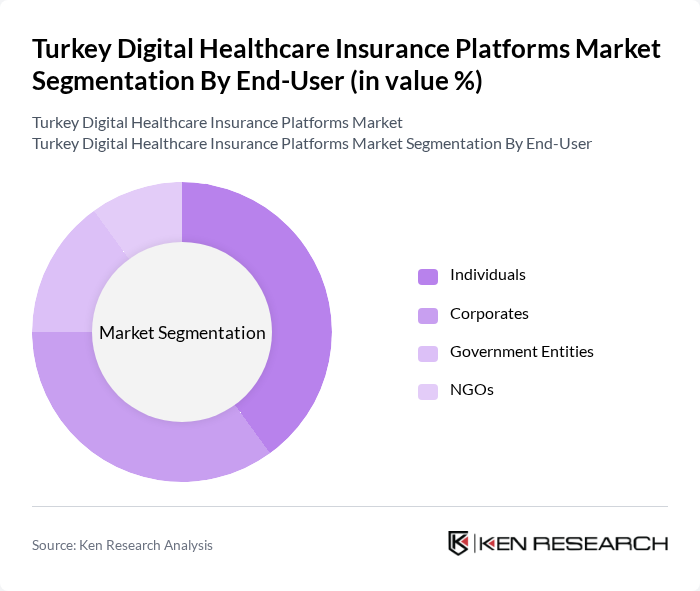

By End-User:The market is segmented by end-users, including Individuals, Corporates, Government Entities, and NGOs. Each segment plays a crucial role in shaping the demand for digital healthcare insurance platforms, with varying needs and preferences.

The Individuals segment is leading the market, driven by the increasing focus on personal health and wellness. As more people recognize the importance of having health insurance, the demand for individual policies has surged. Additionally, the rise of digital platforms has made it easier for individuals to access and manage their health insurance, further boosting this segment's growth. Corporates also contribute significantly to the market, as many companies are now offering health insurance benefits to attract and retain talent.

The Turkey Digital Healthcare Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Turkey, Anadolu Sigorta, Axa Sigorta, Mapfre Sigorta, QNB Finansinvest, Sompo Japan Sigorta, Generali Sigorta, Zurich Sigorta, Türkiye Sigorta, Aegon Emeklilik ve Hayat, Metlife Emeklilik ve Hayat, Groupama Sigorta, Ergo Sigorta, HDI Sigorta, Türkiye ?? Bankas? contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital healthcare insurance platforms appears promising, driven by technological advancements and changing consumer preferences. As the market evolves, platforms are likely to integrate more AI-driven solutions, enhancing user experience and operational efficiency. Additionally, the increasing focus on preventive healthcare will encourage insurers to develop innovative products that cater to health-conscious consumers. Overall, the sector is poised for significant growth, supported by favorable government policies and rising consumer demand for digital health solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities NGOs |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Coverage Type | Comprehensive Coverage Basic Coverage Supplemental Coverage |

| By Payment Model | Pay-Per-Use Subscription-Based One-Time Payment |

| By Customer Segment | Young Adults Families Seniors |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 150 | Policyholders, Digital Platform Users |

| Healthcare Providers | 100 | Doctors, Clinic Administrators |

| Insurance Brokers | 80 | Insurance Agents, Financial Advisors |

| Regulatory Bodies | 50 | Health Policy Makers, Regulatory Officials |

| Technology Providers in Healthcare | 70 | IT Managers, Software Developers |

The Turkey Digital Healthcare Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital health solutions, rising healthcare costs, and a focus on preventive care.