Region:Africa

Author(s):Rebecca

Product Code:KRAB4136

Pages:92

Published On:October 2025

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of health insurance in Egypt.

TheIndividual Health Insurancesegment is currently dominating the market due to the increasing number of individuals seeking personalized health coverage. This trend is driven by rising healthcare costs and a growing awareness of the importance of health insurance. Consumers are increasingly opting for plans that offer tailored benefits, leading to a surge in demand for individual policies. Additionally, the flexibility and customization options available in individual health insurance plans make them appealing to a wide range of consumers. Digital platforms are facilitating this shift by providing transparent product information and streamlined purchasing experiences .

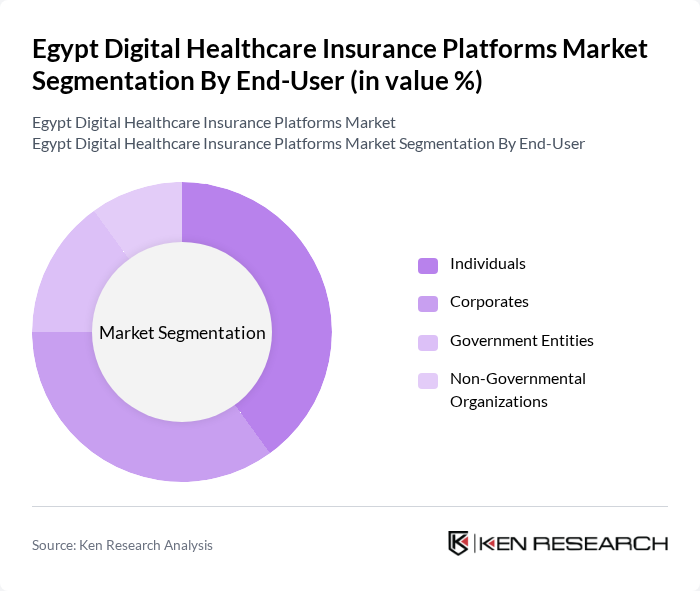

By End-User:The market is segmented by end-user into Individuals, Corporates, Government Entities, and Non-Governmental Organizations. Each segment has unique requirements and preferences, influencing the types of insurance products offered and the distribution channels used. Digital platforms are increasingly being adopted by all end-user segments for policy management, claims processing, and customer support, reflecting the broader shift toward digital-first insurance solutions .

TheIndividualssegment is leading the market, driven by a growing awareness of health insurance's importance and the increasing number of people seeking personal health coverage. This trend is further supported by the rise in healthcare costs and the desire for customized insurance solutions. As more individuals recognize the value of health insurance, the demand for tailored products continues to grow, solidifying the dominance of this segment. Digital platforms are making it easier for individuals to compare, purchase, and manage insurance policies online .

The Egypt Digital Healthcare Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Egypt, MetLife Egypt, AXA Egypt, Bupa Egypt, Nile Insurance Company, Misr Insurance Company, Arab Misr Insurance Group, Delta Insurance Company, GIG Egypt, Pharos Insurance, Suez Canal Insurance, Egyptian Takaful Insurance, National Insurance Company, Trust Insurance, United Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's digital healthcare insurance platforms appears promising, driven by technological advancements and changing consumer behaviors. As the market evolves, there will be a notable shift towards personalized healthcare solutions, enhancing user experience and satisfaction. Additionally, the integration of artificial intelligence and big data analytics will enable platforms to offer tailored insurance products, improving risk assessment and customer engagement. These trends indicate a dynamic landscape where innovation will play a crucial role in shaping the future of healthcare insurance in Egypt.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Payment Model | Pay-Per-Use Subscription-Based Fee-For-Service |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Technology Integration | Mobile Applications Web Portals Telehealth Services |

| By Customer Segment | Young Adults Families Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Platform Users | 120 | Policyholders, Digital Health App Users |

| Healthcare Providers | 100 | Doctors, Clinic Administrators |

| Insurance Agents | 80 | Insurance Brokers, Sales Representatives |

| Regulatory Bodies | 40 | Healthcare Regulators, Policy Makers |

| Technology Providers in Healthcare | 70 | IT Managers, Software Developers |

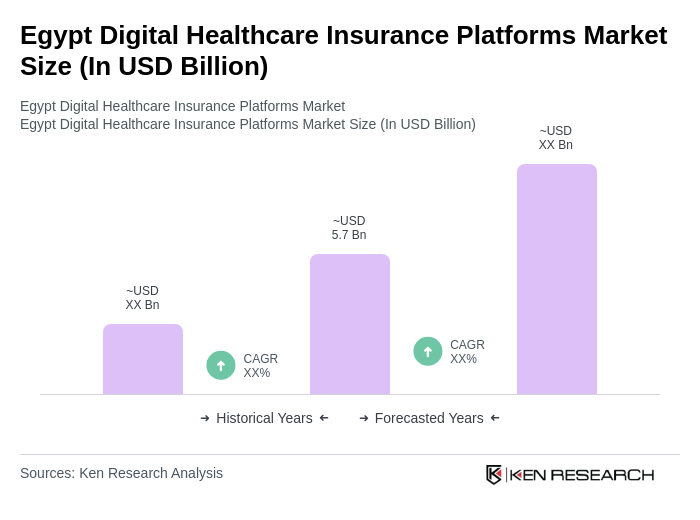

The Egypt Digital Healthcare Insurance Platforms Market is valued at approximately USD 5.7 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and rising healthcare costs among the population.