Region:Central and South America

Author(s):Shubham

Product Code:KRAB3235

Pages:83

Published On:October 2025

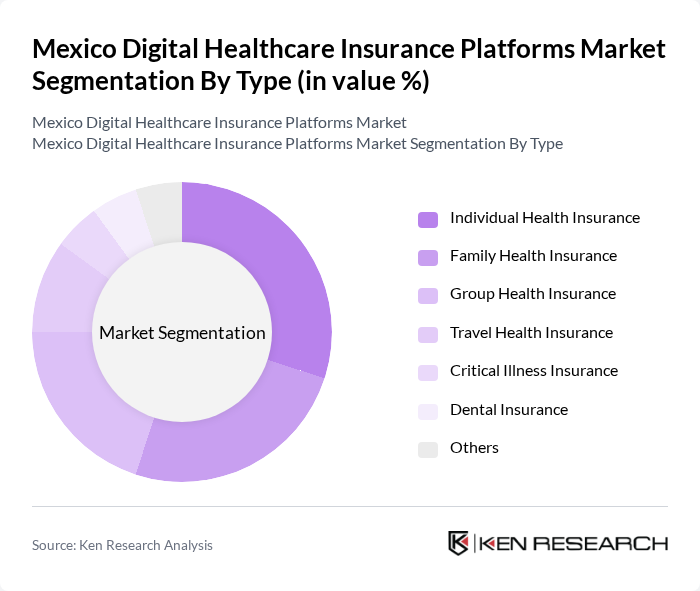

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of healthcare coverage in Mexico.

The Individual Health Insurance segment is currently dominating the market due to the increasing awareness among consumers about personal health management and the rising trend of personalized healthcare solutions. This segment appeals to individuals seeking tailored coverage options that fit their specific health needs. The growing number of self-employed individuals and freelancers in Mexico is also contributing to the demand for individual health insurance, as they often lack employer-sponsored coverage. As a result, this segment is expected to maintain its leadership position in the market.

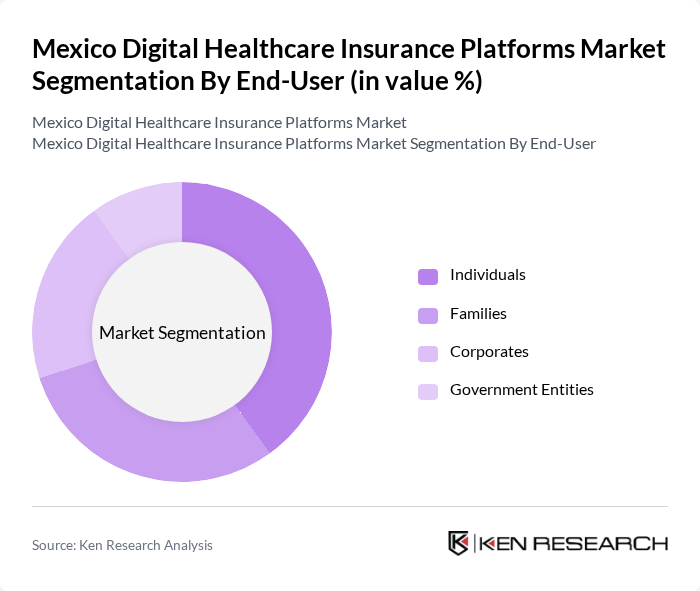

By End-User:The market is segmented by end-users into Individuals, Families, Corporates, and Government Entities. Each segment has unique requirements and preferences, influencing the types of digital healthcare insurance products they seek.

The Individuals segment is leading the market, driven by a growing awareness of health issues and the need for personal health management. As more people recognize the importance of having health insurance, this segment is expanding rapidly. The rise of digital platforms has made it easier for individuals to access and compare various insurance options, further boosting this segment's growth. Additionally, the increasing trend of self-employment and gig economy jobs has led to a higher demand for individual health insurance products.

The Mexico Digital Healthcare Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Nacional Provincial S.A.B. de C.V., MetLife México, S.A. de C.V., Seguros Monterrey New York Life, Allianz México, S.A. de C.V., Axa Seguros, S.A. de C.V., GNP Seguros, Zurich México, S.A. de C.V., Bupa México, Aseguradora Interacciones, S.A. de C.V., Qualitas Controladora, S.A.B. de C.V., Seguros Inbursa, S.A. de C.V., Banorte-IXE, S.A.B. de C.V., Aseguradora de Vida Suramericana, S.A., Aseguradora de Salud de México, S.A., Grupo Financiero Banorte contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital healthcare insurance market in Mexico appears promising, driven by technological advancements and evolving consumer preferences. As the demand for personalized healthcare solutions increases, platforms that leverage AI and machine learning will likely gain traction. Additionally, the growth of subscription-based insurance models is expected to reshape the market landscape, providing consumers with flexible and affordable options. These trends indicate a shift towards more integrated and user-friendly digital health services, enhancing overall market potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Families Corporates Government Entities |

| By Distribution Channel | Online Platforms Insurance Agents Brokers Direct Sales |

| By Coverage Type | Comprehensive Coverage Basic Coverage Supplemental Coverage |

| By Payment Model | Pay-Per-Use Subscription-Based One-Time Payment |

| By Customer Segment | Young Adults Middle-Aged Adults Seniors |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Platform Users | 150 | Consumers aged 25-45, Tech-savvy Individuals |

| Healthcare Providers | 100 | Doctors, Clinic Administrators, Health Insurance Agents |

| Insurance Company Executives | 80 | CEOs, CTOs, Product Development Managers |

| Regulatory Bodies | 50 | Policy Makers, Healthcare Regulators |

| Technology Providers in Healthcare | 70 | IT Managers, Software Developers, System Integrators |

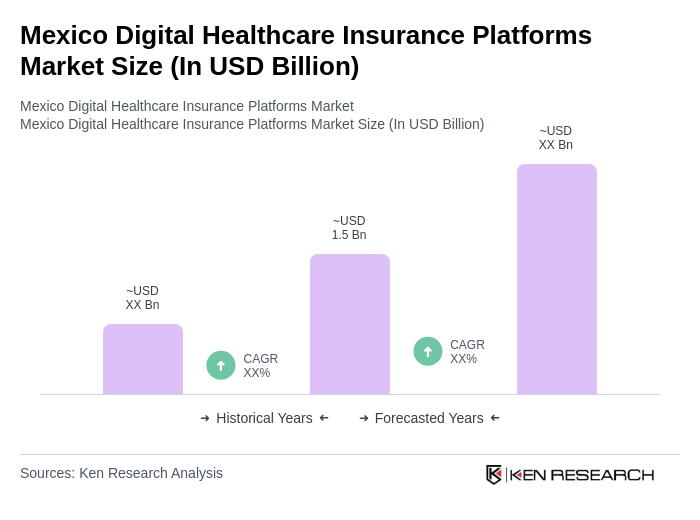

The Mexico Digital Healthcare Insurance Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of digital health solutions, rising healthcare costs, and a focus on preventive care.