Region:Asia

Author(s):Rebecca

Product Code:KRAA2146

Pages:96

Published On:August 2025

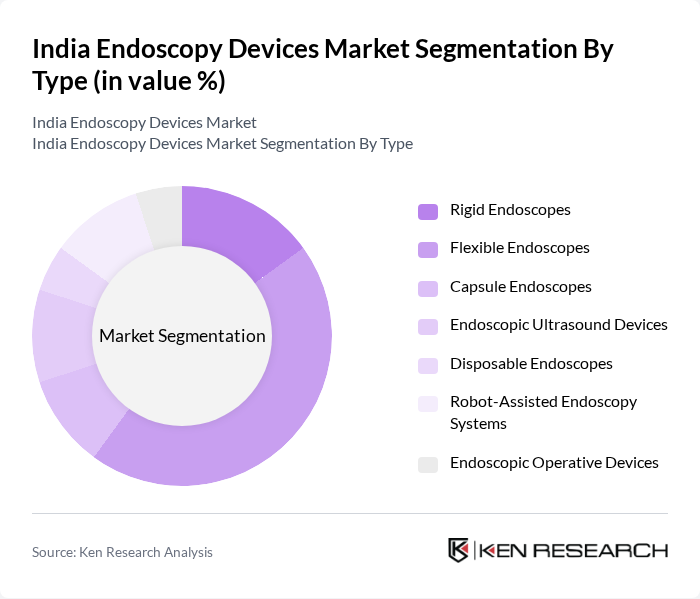

By Type:The endoscopy devices market can be segmented into Rigid Endoscopes, Flexible Endoscopes, Capsule Endoscopes, Endoscopic Ultrasound Devices, Disposable Endoscopes, Robot-Assisted Endoscopy Systems, and Endoscopic Operative Devices. Among these,Flexible Endoscopesare currently dominating the market due to their versatility, superior imaging capabilities, and ability to navigate complex anatomical structures. The increasing demand for minimally invasive procedures and technological advancements in maneuverability and visualization have led to a surge in the adoption of flexible endoscopes, making them the preferred choice for healthcare providers and patients.

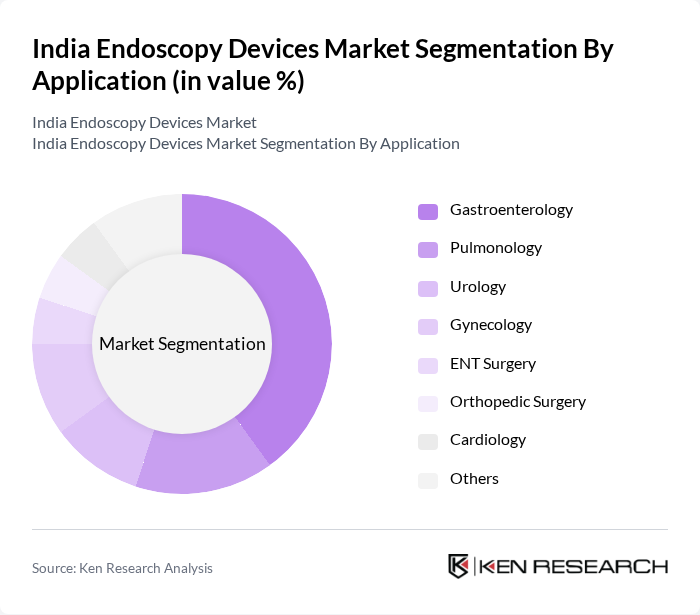

By Application:The applications of endoscopy devices span across various medical fields, including Gastroenterology, Pulmonology, Urology, Gynecology, ENT Surgery, Orthopedic Surgery, Cardiology, and others.Gastroenterologyremains the leading application area, driven by the rising incidence of gastrointestinal diseases and cancers, as well as the growing preference for endoscopic procedures over traditional surgeries. Increased awareness of preventive healthcare and early diagnosis continues to fuel growth in this segment.

The India Endoscopy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Olympus Corporation, Stryker Corporation, KARL STORZ SE & Co. KG, FUJIFILM Holdings Corporation, HOYA Corporation (PENTAX Medical), CONMED Corporation, EndoChoice Holdings, Inc., Ambu A/S, Cook Medical LLC, B. Braun Melsungen AG, Richard Wolf GmbH, Teleflex Incorporated, Merit Medical Systems, Inc., Jindal Medical & Scientific Instruments Company Pvt. Ltd., Boston India Private Limited, Vygon India Pvt. Ltd., Smith & Nephew plc, Steris Healthcare Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the India endoscopy devices market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The government’s focus on enhancing healthcare infrastructure, particularly in rural areas, is expected to improve access to endoscopic procedures. Additionally, the integration of artificial intelligence in diagnostics and treatment planning is anticipated to revolutionize the field, making procedures more efficient and accurate, thus fostering market growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Endoscopes Flexible Endoscopes Capsule Endoscopes Endoscopic Ultrasound Devices Disposable Endoscopes Robot-Assisted Endoscopy Systems Endoscopic Operative Devices |

| By Application | Gastroenterology Pulmonology Urology Gynecology ENT Surgery Orthopedic Surgery Cardiology Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Institutions |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North India South India East India West India Urban Centers (e.g., Mumbai, Delhi, Bangalore) |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Product Type | Endoscopic Accessories Visualization Systems (HD, 4K, 3D) Endoscopic Imaging Systems AI-Integrated Endoscopy Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 60 | Gastroenterologists, Clinic Managers |

| General Hospitals | 100 | Surgeons, Procurement Officers |

| Specialized Surgical Centers | 50 | Surgeons, Anesthesiologists |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Managers, Policy Analysts |

The India Endoscopy Devices Market is valued at approximately USD 1.5 billion, driven by the increasing prevalence of gastrointestinal diseases, demand for minimally invasive surgeries, and advancements in endoscopic technologies.