Region:Europe

Author(s):Shubham

Product Code:KRAA1920

Pages:94

Published On:August 2025

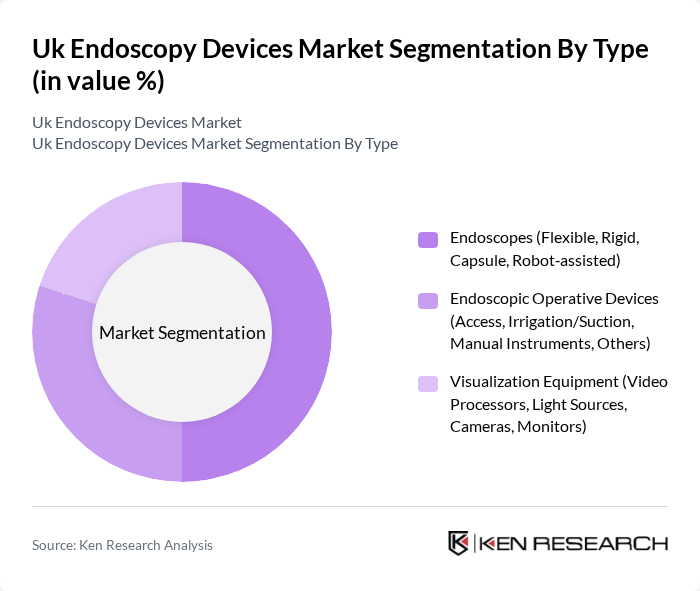

By Type:The market is segmented into three main categories: Endoscopes, Endoscopic Operative Devices, and Visualization Equipment. Each of these categories includes various subsegments that cater to different medical needs and applications. The Endoscopes segment, which includes flexible, rigid, capsule, and robot-assisted types, is particularly dominant due to the increasing demand for minimally invasive procedures. Endoscopic Operative Devices, which encompass access, irrigation/suction, and manual instruments, are also gaining traction as they enhance procedural efficiency. Visualization Equipment, including video processors, light sources, cameras, and monitors, plays a crucial role in improving diagnostic accuracy and procedural outcomes.

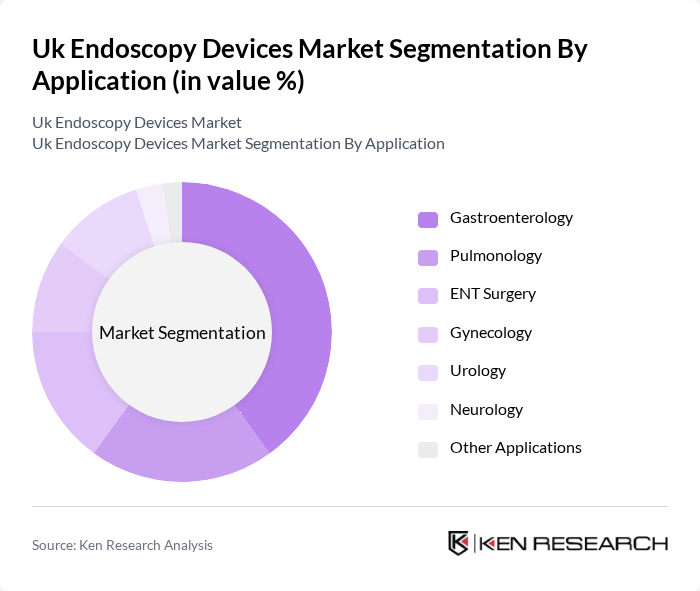

By Application:The applications of endoscopy devices are diverse, including Gastroenterology, Pulmonology, ENT Surgery, Gynecology, Urology, Neurology, and other applications. Gastroenterology is the leading application area, driven by the high prevalence of gastrointestinal disorders and the increasing adoption of screening programs. Pulmonology and ENT Surgery are also significant segments, reflecting the growing need for diagnostic and therapeutic procedures in respiratory and ear, nose, and throat conditions. The demand for endoscopic solutions in Gynecology and Urology is on the rise, as these specialties increasingly utilize minimally invasive techniques for diagnosis and treatment.

The Uk Endoscopy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, FUJIFILM Holdings Corporation, Karl Storz SE & Co. KG, Boston Scientific Corporation, Medtronic plc, Stryker Corporation, Ethicon, Inc. (Johnson & Johnson MedTech), Cook Medical Incorporated, CONMED Corporation, Ambu A/S, Richard Wolf GmbH, HOYA Group (PENTAX Medical), B. Braun Melsungen AG (Aesculap), Teleflex Incorporated, Medline Industries, LP contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK endoscopy devices market appears promising, driven by technological innovations and an increasing focus on patient-centered care. As healthcare providers adopt artificial intelligence and telemedicine solutions, the efficiency and effectiveness of endoscopic procedures are expected to improve significantly. Additionally, the expansion of outpatient surgical centers will facilitate greater access to endoscopic services, ultimately enhancing patient outcomes and satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Endoscopes (Flexible, Rigid, Capsule, Robot?assisted) Endoscopic Operative Devices (Access, Irrigation/Suction, Manual Instruments, Others) Visualization Equipment (Video Processors, Light Sources, Cameras, Monitors) |

| By Application | Gastroenterology Pulmonology ENT Surgery Gynecology Urology Neurology Other Applications |

| By End-User | Hospitals Outpatient Facilities/Ambulatory Surgical Centers Specialty Clinics Research & Academic Institutions |

| By Component | Capital Equipment (Scopes, Towers, Processors) Single?use/Disposable Devices (Biopsy, Polypectomy, ESD/EMR accessories) Reusable Accessories (Forceps, Snares, Energy Devices) Reprocessing Equipment & Consumables |

| By Sales Channel | Direct Sales Authorized Distributors Group Purchasing/Framework Agreements |

| By Distribution Mode | Hospital Procurement (NHS Trusts) Private Sector Procurement E?procurement/Online Tenders |

| By Price Range | Entry?Level Mid?Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 90 | Gastroenterologists, Clinic Managers |

| Hospitals with Endoscopy Units | 120 | Surgeons, Medical Directors |

| Medical Device Distributors | 80 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Economists, Policy Analysts |

| Clinical Research Organizations | 60 | Clinical Researchers, Project Managers |

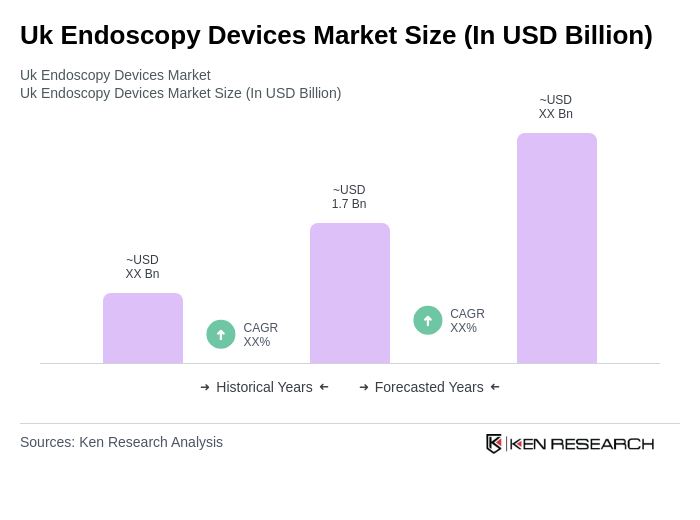

The UK Endoscopy Devices Market is valued at approximately USD 1.7 billion, reflecting a significant growth driven by the rising prevalence of gastrointestinal diseases and advancements in endoscopic technology.