Region:Asia

Author(s):Dev

Product Code:KRAA3536

Pages:81

Published On:September 2025

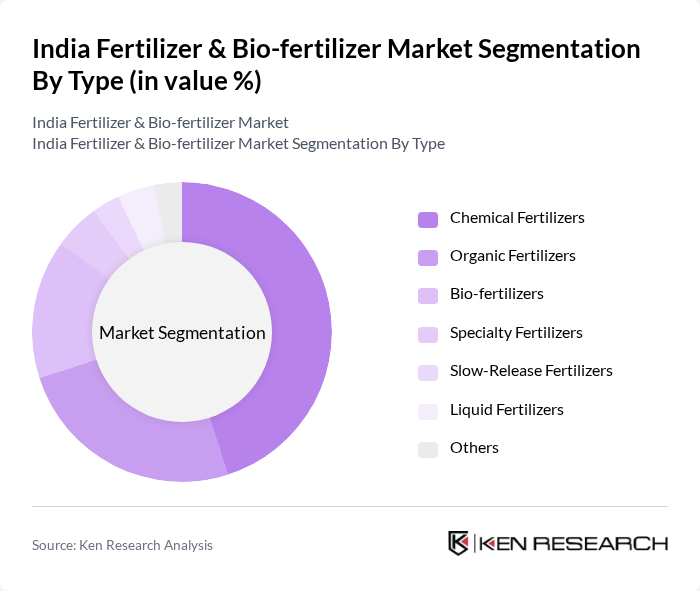

By Type:The market can be segmented into various types, including Chemical Fertilizers, Organic Fertilizers, Bio-fertilizers, Specialty Fertilizers, Slow-Release Fertilizers, Liquid Fertilizers, and Others. Among these, Chemical Fertilizers dominate the market due to their widespread use and effectiveness in enhancing crop yields. Organic Fertilizers and Bio-fertilizers are gaining traction as farmers increasingly seek sustainable alternatives to chemical inputs, driven by rising health awareness, government support, and the growing popularity of organic food products .

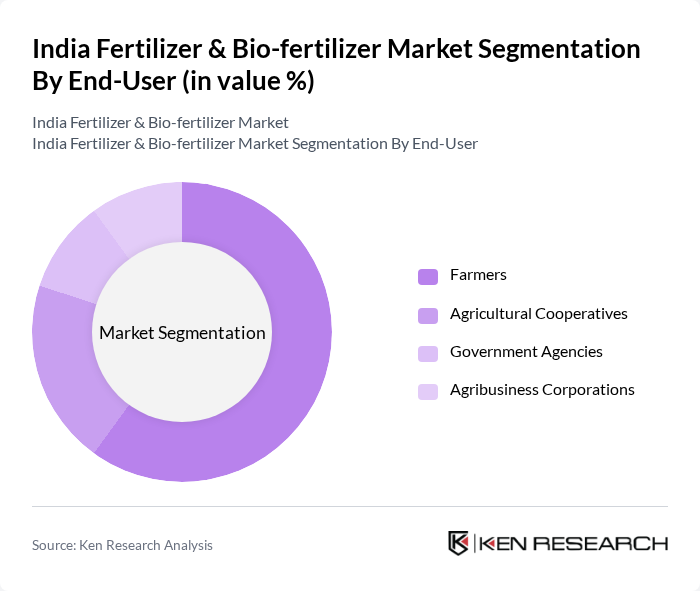

By End-User:The end-user segmentation includes Farmers, Agricultural Cooperatives, Government Agencies, and Agribusiness Corporations. Farmers represent the largest segment, driven by the need for increased productivity and crop quality. Agricultural Cooperatives also play a significant role by providing access to fertilizers and bio-fertilizers, while Government Agencies focus on policy implementation and support for sustainable practices. Agribusiness Corporations are increasingly involved in supply chain innovation and distribution efficiency .

The India Fertilizer & Bio-fertilizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Indian Farmers Fertiliser Cooperative Limited (IFFCO), National Fertilizers Limited (NFL), Rashtriya Chemicals and Fertilizers Limited (RCF), Coromandel International Limited, Zuari Agro Chemicals Limited, Chambal Fertilisers and Chemicals Limited, Tata Chemicals Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), Deepak Fertilisers and Petrochemicals Corporation Limited, Krishak Bharati Cooperative Limited (KRIBHCO), Nagarjuna Fertilizers and Chemicals Limited, GrowTech Agri Science Private Limited, BioCare India Pvt. Ltd., Green Planet Bio-Tech, Sardar Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Fertilizer & Bio-fertilizer market appears promising, driven by technological advancements and a shift towards sustainable practices. The integration of precision agriculture technologies is expected to enhance fertilizer efficiency, reducing waste and environmental impact. Additionally, the increasing focus on organic farming will likely spur innovation in bio-fertilizer development, creating new market segments. As government policies continue to support agricultural growth, the sector is poised for significant transformation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Fertilizers Organic Fertilizers Bio-fertilizers Specialty Fertilizers Slow-Release Fertilizers Liquid Fertilizers Others |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Agribusiness Corporations |

| By Region | North India South India East India West India |

| By Application | Crop Production Horticulture Landscaping Turf Management |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Containers |

| By Price Range | Low Price Mid Price High Price |

| By Product Type (Bio-fertilizer Specific) | Nitrogen-Fixing Biofertilizers Phosphate-Solubilizing Biofertilizers Potassium-Solubilizing Biofertilizers Others (e.g., Zinc, Sulphur, etc.) |

| By Crop Type (Bio-fertilizer Specific) | Cereals and Grains Pulses and Oilseeds Fruits and Vegetables Plantation Crops Others |

| By Mode of Application (Bio-fertilizer Specific) | Seed Treatment Soil Treatment Foliar Application Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retailers | 150 | Store Managers, Sales Representatives |

| Farmers Using Bio-fertilizers | 150 | Smallholder Farmers, Cooperative Members |

| Agricultural Extension Officers | 100 | Field Officers, Agricultural Advisors |

| Fertilizer Manufacturers | 80 | Production Managers, R&D Heads |

| Environmental NGOs | 50 | Sustainability Advocates, Policy Analysts |

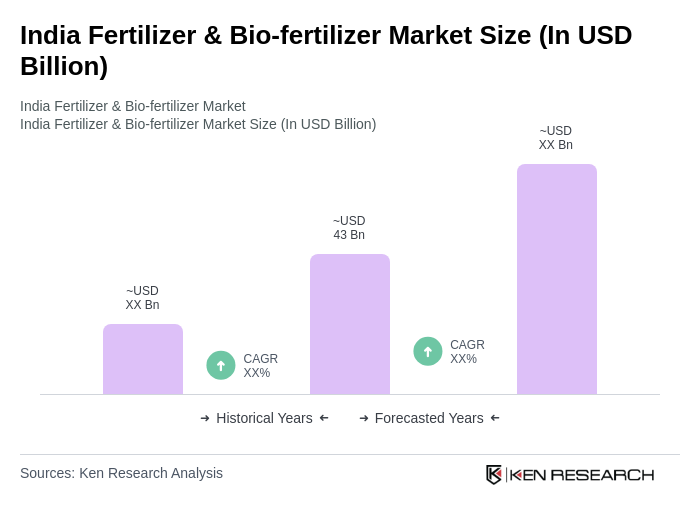

The India Fertilizer & Bio-fertilizer Market is valued at approximately USD 43 billion, driven by increasing food production demands and government initiatives promoting sustainable agriculture and soil health.