Region:Asia

Author(s):Rebecca

Product Code:KRAB6385

Pages:95

Published On:October 2025

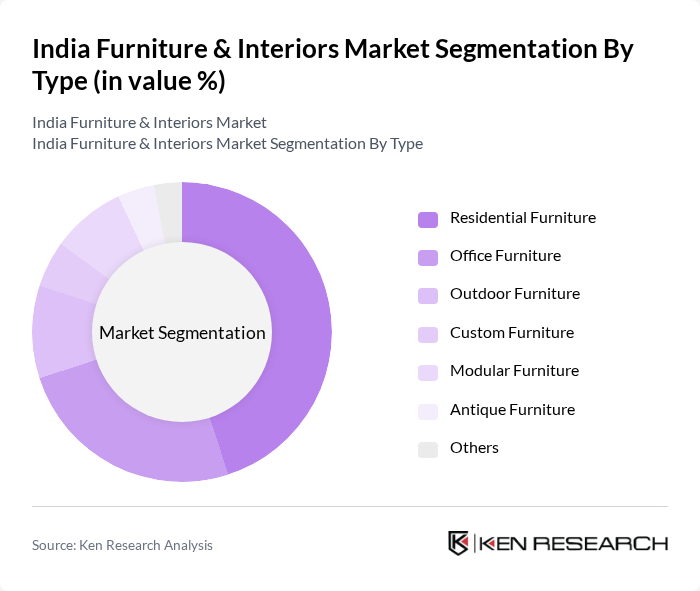

By Type:The furniture market can be segmented into various types, including Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Modular Furniture, Antique Furniture, and Others. Among these, Residential Furniture is the most dominant segment, driven by the increasing trend of home renovations and the growing middle-class population seeking stylish and functional home furnishings. Office Furniture is also significant, reflecting the expansion of corporate offices and co-working spaces.

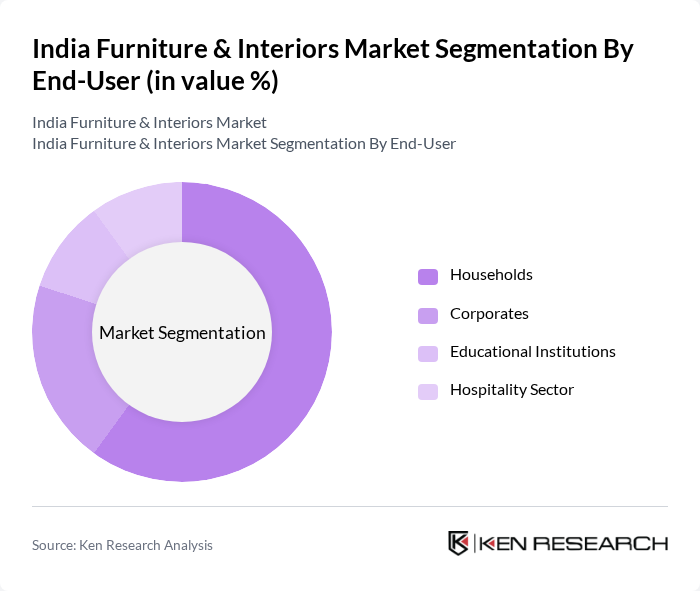

By End-User:The end-user segmentation includes Households, Corporates, Educational Institutions, and the Hospitality Sector. Households represent the largest segment, driven by the increasing demand for home furnishings as more people invest in their living spaces. Corporates follow closely, reflecting the growth in office spaces and the need for ergonomic and stylish office furniture.

The India Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godrej Interio, IKEA India, Durian Industries Ltd., Nilkamal Ltd., Featherlite Furniture, Urban Ladder, Pepperfry, Hometown, Wipro Furniture, Spacewood Furnishers, Royal Oak, Evok, Cosh Living, Duroflex, The Furniture Republic contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India furniture and interiors market appears promising, driven by ongoing urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics and functionality, the demand for innovative and sustainable furniture solutions is expected to grow. Additionally, the integration of technology in furniture design will likely enhance user experience, making smart furniture a significant trend. Companies that adapt to these evolving consumer preferences will be well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Modular Furniture Antique Furniture Others |

| By End-User | Households Corporates Educational Institutions Hospitality Sector |

| By Region | North India South India East India West India |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Material | Wood Metal Plastic Fabric |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Contemporary Traditional Industrial Rustic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Decorators |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Custom Furniture Design Preferences | 80 | Interior Designers, Architects |

| Online Furniture Shopping Behavior | 120 | eCommerce Shoppers, Digital Marketing Experts |

| Sustainable Furniture Trends | 70 | Sustainability Advocates, Eco-conscious Consumers |

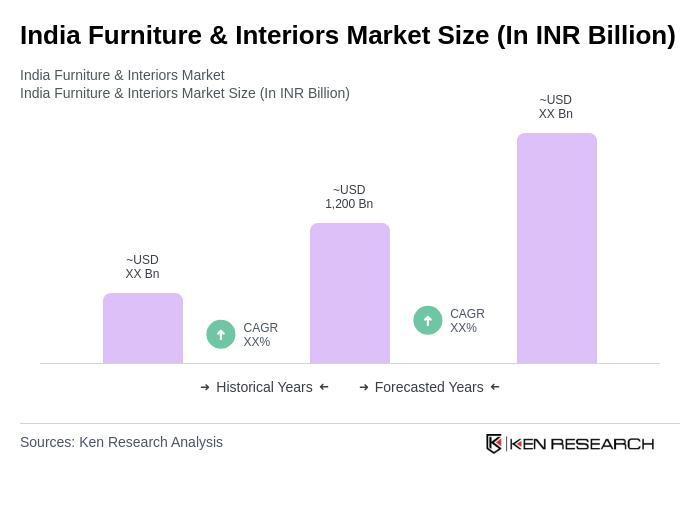

The India Furniture & Interiors Market is valued at approximately INR 1,200 billion. This valuation reflects a five-year historical analysis, highlighting significant growth driven by urbanization, increasing disposable incomes, and a trend towards home improvement.