Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB6379

Pages:90

Published On:October 2025

By Type:The furniture market in Peru is segmented into various types, including Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-friendly Furniture, Luxury Furniture, and Others. Among these, Residential Furniture is the leading segment, driven by the increasing number of households and a growing trend towards home decoration. The demand for Office Furniture is also significant, fueled by the expansion of businesses and the need for modern workspaces. The Eco-friendly Furniture segment is gaining traction as consumers become more environmentally conscious.

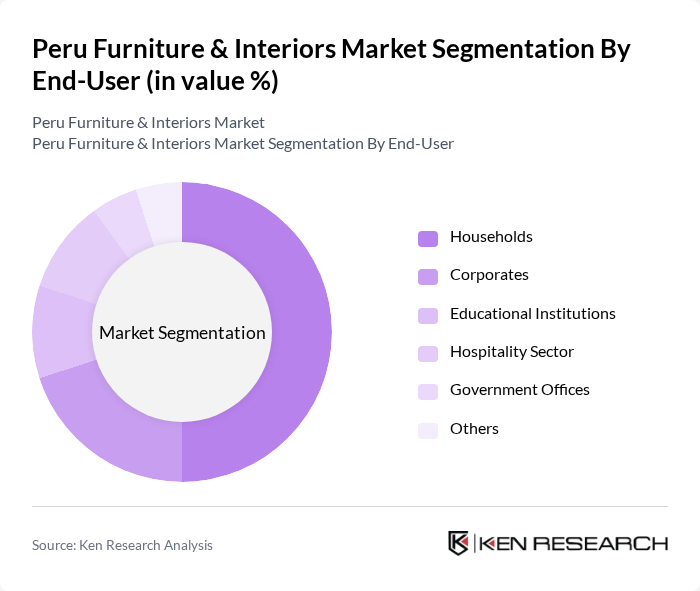

By End-User:The end-user segmentation includes Households, Corporates, Educational Institutions, Hospitality Sector, Government Offices, and Others. Households represent the largest segment, driven by the increasing number of residential properties and a focus on home aesthetics. The Corporates segment is also significant, as businesses invest in modern office spaces. The Hospitality Sector is witnessing growth due to the rise in tourism and the need for quality furnishings in hotels and restaurants.

The Peru Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Casa Andina, Muebles Dico, La Curacao, Oechsle, Promart, Sodimac, Tottus, IKEA Peru, Muebles Jamar, Muebles Montalvo, Muebles El Dorado, Muebles Tava, Muebles Tumi, Muebles Cama, Muebles Lima contribute to innovation, geographic expansion, and service delivery in this space.

The Peru furniture market is poised for growth, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics and functionality, trends such as minimalist designs and eco-friendly products are expected to gain traction. Additionally, the integration of technology in furniture design will likely enhance user experience. However, challenges such as economic instability and supply chain issues may temper growth. Overall, the market is set to evolve, reflecting changing consumer preferences and economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-friendly Furniture Luxury Furniture Others |

| By End-User | Households Corporates Educational Institutions Hospitality Sector Government Offices Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Material | Wood Metal Plastic Fabric Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Design Style | Modern Traditional Contemporary Rustic Others |

| By Functionality | Multi-functional Space-saving Ergonomic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Custom Furniture Orders | 80 | Architects, Custom Furniture Designers |

| Online Furniture Retail Trends | 120 | eCommerce Managers, Digital Marketing Specialists |

| Sustainable Furniture Preferences | 90 | Eco-conscious Consumers, Sustainability Advocates |

The Peru Furniture & Interiors Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a trend towards home improvement and interior design.