Region:Africa

Author(s):Geetanshi

Product Code:KRAB6368

Pages:81

Published On:October 2025

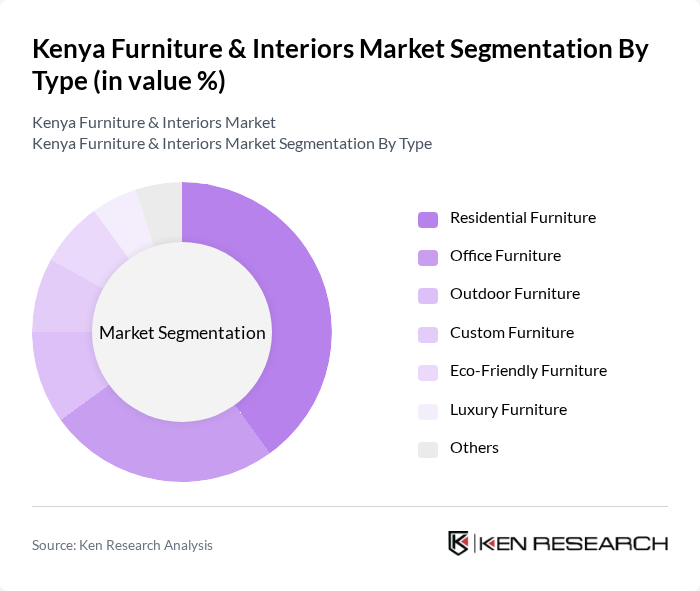

By Type:The furniture market can be segmented into various types, including Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-Friendly Furniture, Luxury Furniture, and Others. Among these, Residential Furniture is currently dominating the market due to the increasing demand for home furnishings driven by urbanization and a growing middle class. Consumers are increasingly investing in quality and stylish furniture for their homes, leading to a significant rise in this segment.

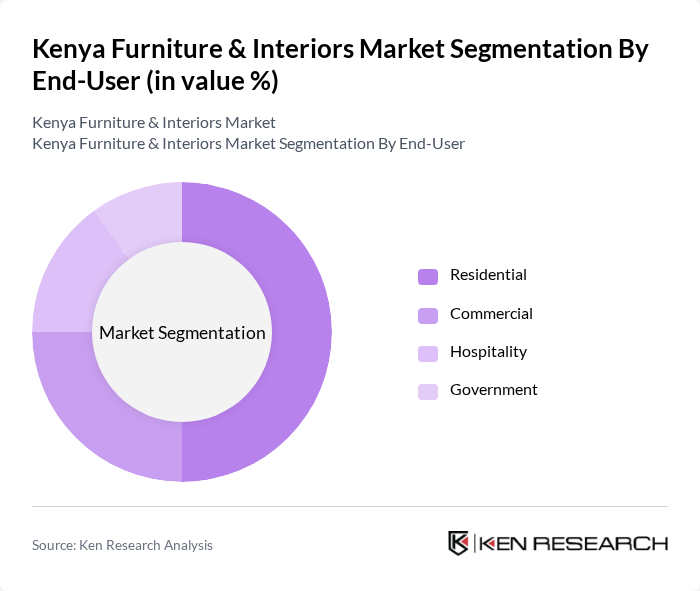

By End-User:The market can be segmented into Residential, Commercial, Hospitality, and Government end-users. The Residential segment is leading the market, driven by the increasing number of households and the demand for home improvement. Consumers are focusing on creating comfortable living spaces, which has led to a surge in the purchase of furniture for homes. The growing trend of home renovations and interior design is further propelling this segment's growth.

The Kenya Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Homewood Furniture, Moko Furniture, Victoria Courts, Nuru Furniture, Kikao Furniture, Kijani Furniture, Kaluworks, Kijiji Furniture, Kwanza Furniture, Kijani Living, Kijiji Creations, Kijiji Designs, Kijiji Interiors, Kijiji Home contribute to innovation, geographic expansion, and service delivery in this space.

The Kenya furniture market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative and sustainable furniture solutions will rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Local manufacturers are likely to enhance their capabilities, focusing on quality and customization to meet the growing expectations of the market, thereby fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-Friendly Furniture Luxury Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Material | Wood Metal Plastic Fabric |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Brand Positioning | Luxury Brands Value Brands Niche Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Custom Furniture Orders | 80 | Architects, Custom Furniture Designers |

| Online Furniture Retail Trends | 120 | eCommerce Managers, Digital Marketing Specialists |

| Sustainable Furniture Preferences | 90 | Eco-conscious Consumers, Sustainability Advocates |

The Kenya Furniture & Interiors Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and an expanding middle class seeking quality furniture and interior solutions.