Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6376

Pages:98

Published On:October 2025

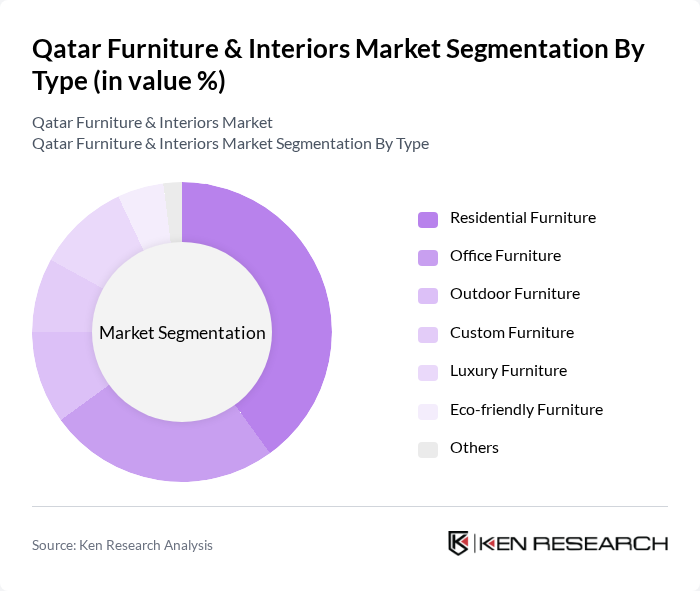

By Type:The market is segmented into various types of furniture, including Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Luxury Furniture, Eco-friendly Furniture, and Others. Among these, Residential Furniture is the leading segment, driven by the increasing number of households and the growing trend of home decoration. Office Furniture follows closely, fueled by the expansion of businesses and the need for modern workspaces.

By End-User:The market is categorized into Residential, Commercial, Hospitality, and Government segments. The Residential segment dominates the market, driven by the increasing number of households and the trend towards home improvement. The Commercial segment is also significant, as businesses invest in modern office spaces and furniture to enhance productivity and employee satisfaction.

The Qatar Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Al Ameen Furniture, Royal Furniture, The One, Midas Furniture, Damas Furniture, Al-Futtaim Group, Landmark Group, Al-Mana Group, Al-Hokair Group, Al-Suwaidi Group, Al-Mansoori Group, Al-Jazeera Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar furniture and interiors market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly seek quality and sustainable options, businesses must adapt to these preferences. The integration of technology in furniture design and retail, alongside government initiatives to boost local manufacturing, will likely shape the market landscape. Additionally, the anticipated growth in e-commerce will provide new avenues for reaching consumers, enhancing overall market dynamics and opportunities for innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Luxury Furniture Eco-friendly Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Price Range | Budget Mid-Range Premium |

| By Brand Preference | Local Brands International Brands Custom Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Interior Design Projects | 100 | Architects, Project Managers |

| Luxury Furniture Market Insights | 80 | High-end Retailers, Luxury Brand Managers |

| Sustainable Furniture Trends | 70 | Sustainability Consultants, Eco-conscious Consumers |

| Online Furniture Shopping Behavior | 90 | eCommerce Managers, Digital Marketing Specialists |

The Qatar Furniture & Interiors Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for modern and luxury furniture among consumers.