Region:Asia

Author(s):Shubham

Product Code:KRAB5663

Pages:87

Published On:October 2025

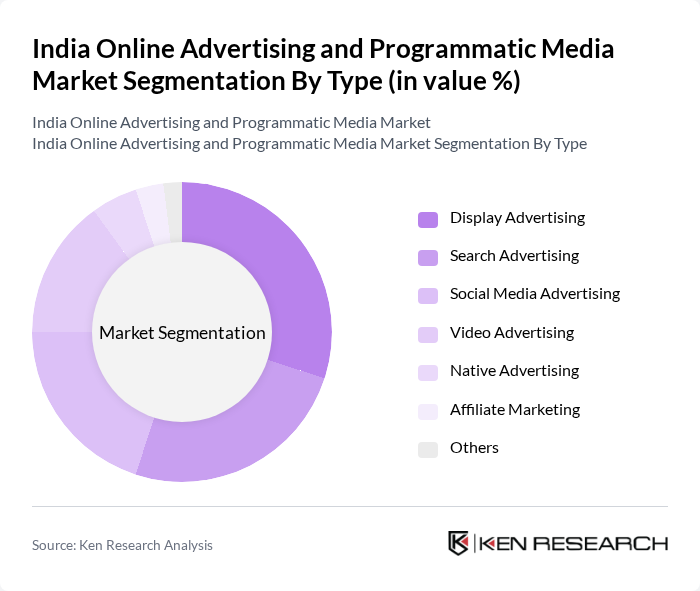

By Type:The online advertising market is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, and Others. Among these, Display Advertising has emerged as a dominant force due to its visual appeal and effectiveness in brand awareness campaigns. Social Media Advertising is also gaining traction as platforms like Facebook and Instagram continue to evolve, offering targeted advertising solutions that resonate with users.

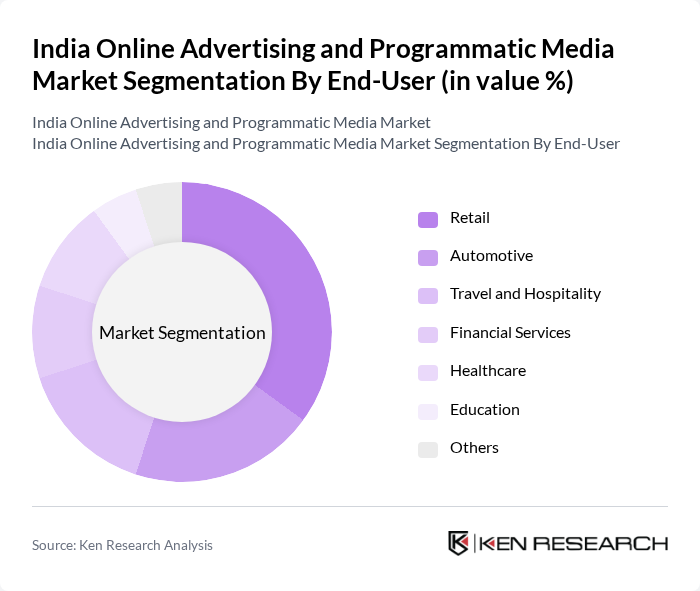

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Hospitality, Financial Services, Healthcare, Education, and Others. The Retail sector is the leading end-user, driven by the increasing trend of e-commerce and online shopping. Companies are leveraging online advertising to reach consumers directly, enhancing their visibility and sales through targeted campaigns.

The India Online Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google India Pvt. Ltd., Facebook India Pvt. Ltd., Amazon Advertising India, Aditya Birla Group, Times Internet Ltd., Zomato Media Pvt. Ltd., Paytm Ads, InMobi, Flipkart Ads, Snapdeal, Cleartrip, Quikr, MakeMyTrip, BookMyShow, Nykaa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India online advertising and programmatic media market appears promising, driven by technological advancements and changing consumer behaviors. As brands increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the rise of video content and influencer marketing will reshape advertising strategies, allowing for more personalized and engaging consumer experiences. This dynamic environment will foster innovation and competition among advertisers, ultimately benefiting consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Hospitality Financial Services Healthcare Education Others |

| By Region | North India South India East India West India |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms |

| By Advertising Format | Banner Ads Interstitial Ads Sponsored Content Email Marketing |

| By Sales Channel | Direct Sales Programmatic Sales Agency Sales Reseller Sales |

| By Policy Support | Subsidies for Digital Advertising Tax Incentives for Startups Grants for Innovative Advertising Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 150 | Account Managers, Media Planners |

| Brand Marketing Teams | 100 | Brand Managers, Marketing Directors |

| Programmatic Ad Platforms | 80 | Product Managers, Data Analysts |

| E-commerce Marketing Departments | 90 | Digital Marketing Specialists, SEO Managers |

| Media Buying Agencies | 70 | Media Buyers, Campaign Strategists |

The India Online Advertising and Programmatic Media Market is valued at approximately INR 1,200 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards digital consumption among consumers.