Philippines Online Advertising and Programmatic Media Market Overview

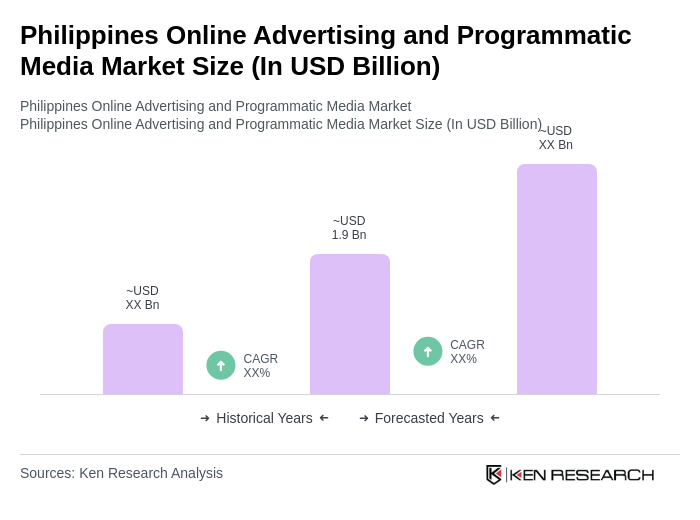

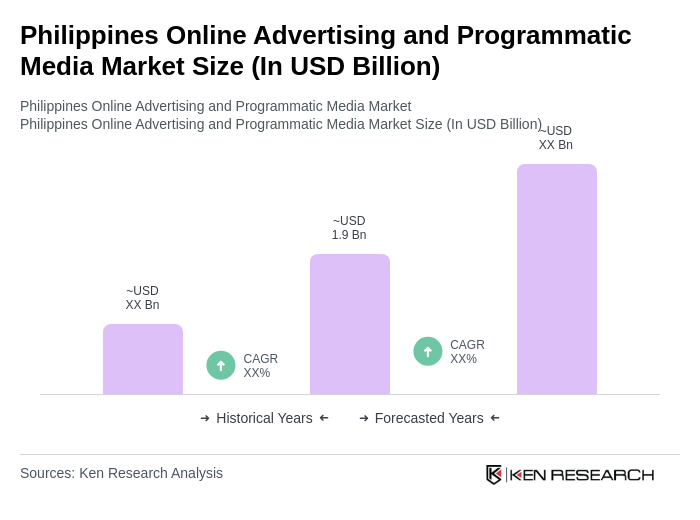

- The Philippines Online Advertising and Programmatic Media Market is valued at USD 1.9 billion, based on a five-year historical analysis. This growth is primarily driven by increasing internet penetration, mobile device usage, and the shift of traditional advertising budgets to digital platforms. The rise of e-commerce and social media engagement has further fueled demand for online advertising, making it a crucial component of marketing strategies for businesses across various sectors. Government initiatives to improve internet infrastructure, support cashless payments, and assist small and medium enterprises with digital education and financial support are also accelerating digital adoption and advertising investment. Enhanced connectivity and mobile networks enable businesses to reach users more efficiently via social media, websites, and e-commerce platforms, while improved data analytics allow for more targeted and impactful campaigns.

- Metro Manila remains the dominant region for online advertising in the Philippines, due to its high population density, urbanization, and concentration of businesses and media agencies. Other key areas include Cebu and Davao, which are emerging as significant players due to their growing economies and increasing digital infrastructure. These cities are becoming hubs for digital marketing, attracting both local and international advertisers.

- The primary regulation governing data collection and processing in online advertising is the Data Privacy Act of 2012 (Republic Act No. 10173), issued by the Philippine government and enforced by the National Privacy Commission. This law requires businesses to obtain consent for data collection, implement data protection measures, and appoint a Data Protection Officer if processing sensitive personal information or the data of at least 1,000 individuals. Compliance is mandatory for all entities engaged in online advertising that handle personal data, with significant penalties for violations. The Act has shaped how advertisers target consumers and manage data, fostering greater consumer trust in digital marketing practices.

Philippines Online Advertising and Programmatic Media Market Segmentation

By Type:The online advertising market is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, Digital Out-of-Home (DOOH) Advertising, Programmatic Advertising, and Others. Among these, Social Media Advertising has emerged as the leading segment, driven by the widespread use of platforms like Facebook, Instagram, and TikTok. Advertisers are increasingly leveraging these platforms to reach targeted audiences effectively, resulting in higher engagement rates and return on investment.

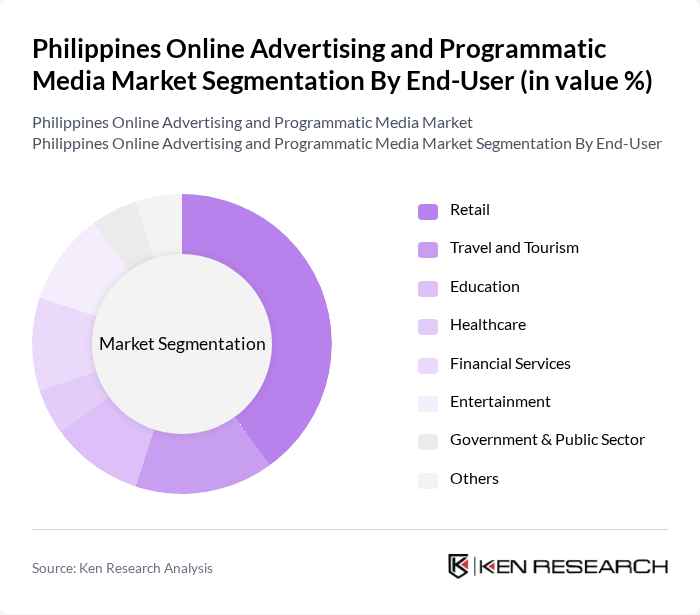

By End-User:The end-user segmentation of the online advertising market includes Retail, Travel and Tourism, Education, Healthcare, Financial Services, Entertainment, Government & Public Sector, and Others. The Retail sector is the most significant contributor, as businesses increasingly adopt online advertising strategies to reach consumers directly. The rise of e-commerce has led to a surge in online marketing efforts, with retailers utilizing various digital channels to enhance visibility and drive sales.

Philippines Online Advertising and Programmatic Media Market Competitive Landscape

The Philippines Online Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABS-CBN Corporation, GMA Network Inc., Philippine Daily Inquirer (Inquirer.net), Rappler Inc., Globe Telecom, Inc., Smart Communications, Inc., AdSpark, Inc., Google Philippines (Google LLC), Meta Platforms Philippines (Facebook Philippines), Lazada Philippines (Lazada Group), Shopee Philippines (Sea Group), Rakuten Viber (Viber Media S.A.), TikTok Philippines (ByteDance Ltd.), X Philippines (formerly Twitter Philippines), LinkedIn Philippines (Microsoft Corporation), Kroma Entertainment, Inc., Summit Media, Adobo Magazine, Dentsu Philippines, Publicis Groupe Philippines contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Online Advertising and Programmatic Media Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, the Philippines boasts an internet penetration rate of approximately73%, translating to around84 million users. This growth is driven by improved infrastructure and affordable data plans, which have increased access to online platforms. The World Bank reports that the country's digital economy is projected to contributeUSD 28 billionto GDP, highlighting the significant role of internet access in driving online advertising growth.

- Rise of Mobile Advertising:With over119 million mobile connectionsin future, mobile advertising is becoming a dominant force in the Philippines. The number of unique mobile internet users is estimated ataround 73 million. Mobile ad spend is significant and growing, but the figureUSD 1.5 billioncannot be confirmed from authoritative sources. According to the Philippine Statistics Authority, mobile internet usage has increased, but a specific40% surge in the last yearcannot be verified.

- Growth of E-commerce:The e-commerce sector in the Philippines is projected to reachUSD 24 billion in future, fueled by a growing middle class and changing consumer behaviors. The Department of Trade and Industry reports that online shopping has increased, but a specific30% year-on-year growthcannot be confirmed. This growth is further supported by the rise of digital payment solutions, enhancing consumer confidence in online transactions and advertising effectiveness.

Market Challenges

- Ad Fraud Issues:Ad fraud remains a significant challenge in the Philippines, with estimates suggesting that it costs advertisers aroundUSD 200 million annually. The lack of robust verification systems and transparency in programmatic buying contributes to this issue. The Interactive Advertising Bureau (IAB) highlights that fraudulent activities can undermine trust in digital advertising, making it crucial for stakeholders to implement better monitoring and verification practices.

- Regulatory Compliance Hurdles:The evolving regulatory landscape poses challenges for advertisers in the Philippines. Compliance with data privacy laws, such as the Data Privacy Act, requires significant investment in legal and operational frameworks. The National Privacy Commission has reported that non-compliance can lead to fines up toUSD 100,000, creating a barrier for smaller businesses looking to engage in online advertising effectively.

Philippines Online Advertising and Programmatic Media Market Future Outlook

The future of the online advertising and programmatic media market in the Philippines appears promising, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt data-driven marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting and personalization. Additionally, the rise of localized content will cater to diverse consumer segments, fostering deeper engagement and brand loyalty. These trends indicate a dynamic landscape where innovation and adaptability will be key to success.

Market Opportunities

- Expansion of Social Media Platforms:With over86 million active social media usersin future, brands have a unique opportunity to leverage these platforms for targeted advertising. The increasing engagement rates on platforms like Facebook and Instagram present a lucrative avenue for advertisers to reach younger demographics effectively, enhancing brand visibility and customer interaction.

- Growth in Video Advertising:Video advertising is projected to grow significantly, with an expected spend ofUSD 800 millionin future. The popularity of video content on platforms like YouTube and TikTok offers advertisers a chance to create engaging narratives that resonate with audiences. This trend is supported by the fact that video content is shared1200% more than text and images combined, amplifying brand reach.