Region:Europe

Author(s):Shubham

Product Code:KRAB1072

Pages:80

Published On:October 2025

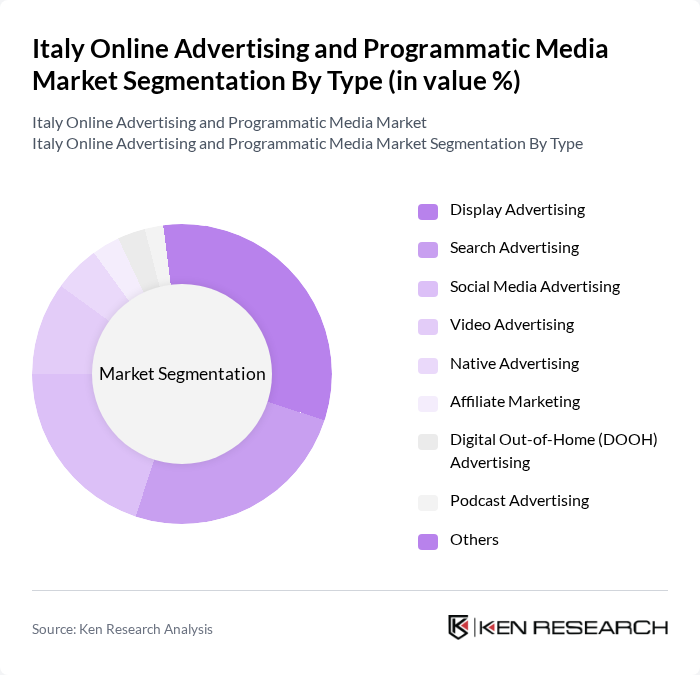

By Type:The market is segmented into various types of online advertising, each catering to different consumer behaviors and preferences. Display advertising, search advertising, and social media advertising are among the most prominent types, with video advertising gaining significant traction due to the increasing consumption of video content and interactive advertising formats. Native advertising and affiliate marketing also play significant roles, while digital out-of-home (DOOH) and podcast advertising are emerging segments that leverage innovative technologies. Programmatic advertising has gained momentum with precision targeting and real-time optimization capabilities.

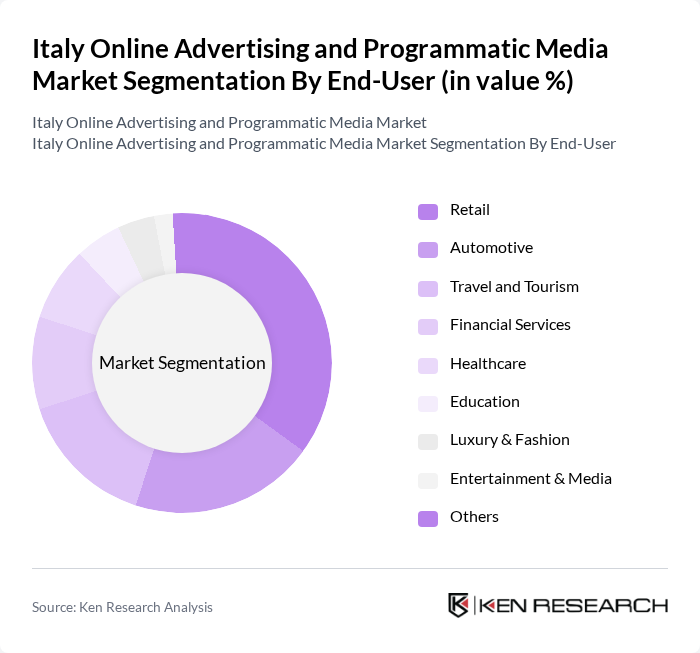

By End-User:The end-user segmentation highlights the diverse industries leveraging online advertising. Retail, automotive, and travel and tourism sectors are the largest contributors, driven by their need to reach consumers effectively and optimize their digital marketing efforts to address economic challenges while maintaining competitiveness. Financial services and healthcare also utilize online advertising to promote their services, with healthcare showing particularly strong growth in digital advertising adoption. Education, luxury & fashion, and entertainment & media sectors are increasingly adopting digital strategies to engage their audiences through personalized content and immersive consumer interactions.

The Italy Online Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook, Instagram), Amazon Advertising, Adform A/S, Criteo S.A., The Trade Desk, Inc., Verizon Media (now Yahoo Inc.), Taboola.com Ltd., Outbrain Inc., MediaMath, Inc., Sizmek Inc. (an Amazon Company), AdRoll, Inc. (NextRoll), Xandr (Microsoft Advertising), Quantcast Corporation, AdColony, Inc., Dentsu Italia S.p.A., GroupM Italy (WPP), Publicis Groupe Italia, Havas Media Group Italy, Digital Angels S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online advertising and programmatic media market in Italy appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt programmatic buying, the efficiency and effectiveness of ad placements are expected to improve. Additionally, the integration of artificial intelligence and machine learning will enhance targeting capabilities, allowing for more personalized advertising experiences. This evolution will likely lead to increased investments in digital channels, fostering a competitive landscape that prioritizes innovation and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Digital Out-of-Home (DOOH) Advertising Podcast Advertising Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Luxury & Fashion Entertainment & Media Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Podcast Platforms Others |

| By Advertising Format | Banner Ads Interstitial Ads Sponsored Content Rich Media Ads Shoppable Ads Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| By Geographic Focus | National Campaigns Regional Campaigns Local Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 60 | Account Managers, Digital Strategists |

| Programmatic Media Buyers | 50 | Media Buyers, Campaign Managers |

| Brand Advertisers | 40 | Marketing Directors, Brand Managers |

| Consumer Insights Specialists | 40 | Market Researchers, Data Analysts |

| Technology Providers in Ad Tech | 40 | Product Managers, Technical Leads |

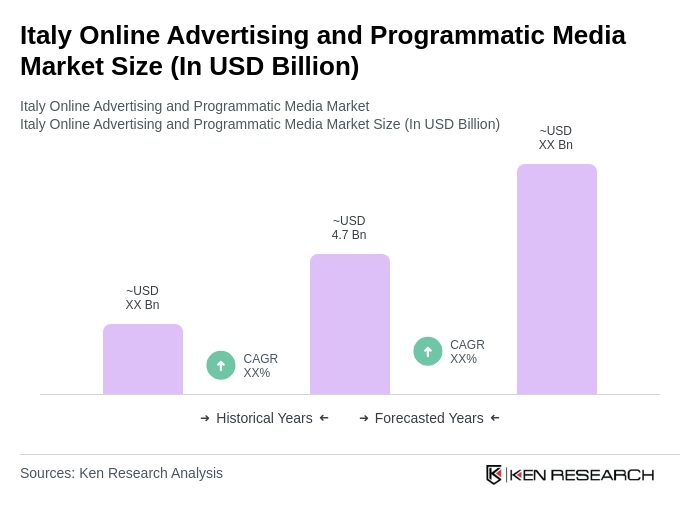

The Italy Online Advertising and Programmatic Media Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by digitalization, e-commerce, and consumer preferences for online content consumption.