Mexico Online Advertising and Programmatic Media Market Overview

- The Mexico Online Advertising and Programmatic Media Market is valued at USD 10.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and mobile devices, along with the rising adoption of digital marketing strategies by businesses. The shift from traditional advertising to online platforms has significantly contributed to the market's expansion, as companies seek to engage consumers more effectively through targeted advertising. With 83.3% of Mexico's population using the internet and mobile traffic accounting for 57.4% of total digital activity, the market continues to experience robust growth driven by digital transformation.

- Key cities dominating this market include Mexico City, Guadalajara, and Monterrey. Mexico City, as the capital, serves as a hub for digital innovation and advertising agencies, while Guadalajara is known for its tech ecosystem. Monterrey, with its strong industrial base, has also seen a surge in digital marketing investments, making these cities pivotal in shaping the online advertising landscape in Mexico.

- The Federal Telecommunications and Broadcasting Law reforms, 2025 issued by the Ministry of the Interior (SEGOB) established comprehensive regulatory oversight for digital advertising content. These reforms transfer regulatory authority from the Federal Telecommunications Institute (IFT) to the new Agency for Digital Transformation (ATD), while imposing fines up to 5% of broadcasters' revenues for airing foreign government propaganda. The legislation includes mandatory compliance requirements for content oversight, licensing standards for digital platforms, and transparency thresholds for programmatic ad placements to protect consumer interests and ensure fair competition within the online advertising sector.

Mexico Online Advertising and Programmatic Media Market Segmentation

By Advertising Type:The advertising type segmentation includes various methods through which businesses reach their target audiences online. The subsegments include Search Engine Advertising, Social Media Advertising, Display Advertising, Video Advertising, Mobile Advertising, Native Advertising, Programmatic Advertising, and Email Marketing. Among these, Social Media Advertising has emerged as a dominant force due to the widespread use of platforms like Facebook, Instagram, and TikTok, which allow for highly targeted campaigns and direct consumer engagement. Programmatic advertising accounts for 79.5% of total digital ad spend, demonstrating the market's shift toward automated, data-driven advertising solutions.

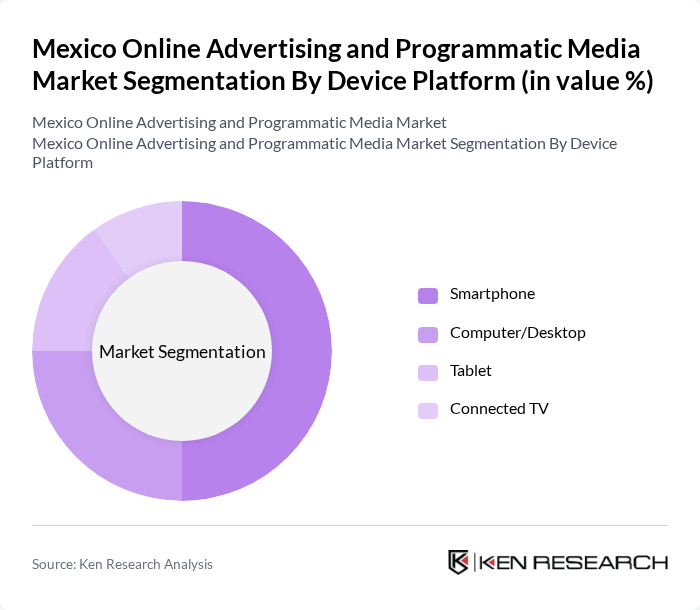

By Device Platform:The device platform segmentation categorizes the market based on the devices used for online advertising. This includes Smartphones, Computers/Desktop, Tablets, and Connected TVs. Smartphones have become the leading platform due to their ubiquitous presence and the increasing time consumers spend on mobile applications and social media, making them a critical channel for advertisers. Mobile usage dominates in Mexico with users spending an average of 7 hours and 32 minutes online daily, with smartphones being the largest revenue-generating component in the digital advertising market.

Mexico Online Advertising and Programmatic Media Market Competitive Landscape

The Mexico Online Advertising and Programmatic Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms Inc, Alphabet Inc (Google), Amazon.com Inc, Microsoft Corporation, ByteDance (TikTok), X (formerly Twitter), Adobe Inc, Dentsu Aegis Network, Grupo Televisa, TV Azteca, Grupo Imagen, Mercado Libre, Verizon Media (Yahoo), Baidu Inc, Tencent Holdings Ltd contribute to innovation, geographic expansion, and service delivery in this space.

Mexico Online Advertising and Programmatic Media Market Industry Analysis

Growth Drivers

- Increased Internet Penetration:As of future, Mexico's internet penetration rate is projected to reach78%, with approximately98 millionusers accessing online platforms. This growth is driven by improved infrastructure and affordable data plans, enabling more consumers to engage with digital content. The World Bank reports that increased connectivity correlates with higher online advertising expenditures, which are expected to exceedUSD 3 billion, reflecting a robust demand for digital marketing strategies.

- Rise of Mobile Advertising:Mobile advertising in Mexico is anticipated to account for over60%of total digital ad spending in future, driven by the widespread use of smartphones, which reachedover 90 millionunits sold. According to the OECD, mobile ad revenue is projected to surpassUSD 1.8 billion, as brands increasingly target consumers through mobile-optimized campaigns. This shift is further supported by the growing trend of mobile commerce, with e-commerce sales expected to hitUSD 30 billion, enhancing the effectiveness of mobile advertising strategies.

- Growth of E-commerce:The e-commerce sector in Mexico is set to grow significantly, with sales projected to reachUSD 30 billion, up fromUSD 25 billion. This growth is fueled by changing consumer behaviors, withabout 70%of internet users engaging in online shopping. The increase in e-commerce activity drives demand for targeted online advertising, as businesses seek to capture the attention of potential customers through personalized marketing efforts, thereby enhancing overall advertising effectiveness.

Market Challenges

- Ad Fraud Concerns:Ad fraud remains a significant challenge in Mexico's online advertising landscape, with losses estimated atUSD 1.5 billionin future. This issue is exacerbated by the lack of robust verification systems, leading to distrust among advertisers. The Interactive Advertising Bureau (IAB) highlights that30%of digital ad impressions may be fraudulent, prompting advertisers to invest in more secure and transparent advertising solutions to mitigate these risks and protect their investments.

- Regulatory Compliance Issues:Navigating the complex regulatory environment poses challenges for advertisers in Mexico. The implementation of data protection laws, such as the Federal Law on Protection of Personal Data, requires companies to adapt their advertising strategies to comply with stringent regulations. Non-compliance can result in fines exceedingUSD 1 million, creating a barrier for smaller businesses that may lack the resources to ensure adherence to these evolving legal standards, thus impacting their advertising capabilities.

Mexico Online Advertising and Programmatic Media Market Future Outlook

The future of Mexico's online advertising and programmatic media market appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the rise of localized content will cater to diverse consumer segments, fostering deeper engagement. With a focus on sustainability, advertisers will likely prioritize eco-friendly practices, aligning their campaigns with the values of socially conscious consumers, thereby driving growth in this dynamic market.

Market Opportunities

- Expansion of Social Media Platforms:The growth of social media platforms presents a significant opportunity for advertisers, with user engagement projected to reachover 80 millionin future. Brands can leverage these platforms for targeted advertising, capitalizing on the high interaction rates. This trend is expected to drive ad spending on social media to overUSD 1.2 billion, as businesses seek to connect with consumers in innovative ways that resonate with their interests and preferences.

- Growth in Video Advertising:Video advertising is set to become a dominant force in Mexico's digital landscape, with revenues expected to exceedUSD 600 millionin future. The increasing consumption of video content, particularly on mobile devices, creates a fertile ground for advertisers. Brands can utilize engaging video formats to capture audience attention, enhancing brand recall and driving conversions, making this a critical area for investment in the coming years.