India Online Travel and OTA Platforms Market Overview

- The India Online Travel and OTA Platforms Market is valued at approximately USD 51 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile applications, and a growing middle class with disposable income. The convenience of online booking and the availability of diverse travel options have further fueled this market's expansion. Recent trends include hyper-personalization through AI-driven recommendations, flexible bookings, digital payments, and app-based convenience, all of which are shaping consumer behavior and intensifying platform competition. Platforms are increasingly leveraging machine learning to offer real-time, tailored suggestions, and integrating user-generated content and social media inputs to refine recommendations and boost engagement.

- Key cities such as Delhi, Mumbai, and Bangalore dominate the market due to their high population density, economic activity, and connectivity. These urban centers serve as major hubs for both domestic and international travel, attracting a significant number of travelers and fostering a competitive environment for online travel agencies and platforms.

- The Indian government’s Digital India initiative, launched in 2015 by the Ministry of Electronics and Information Technology, continues to enhance digital infrastructure and promote online services, including travel and tourism. This initiative focuses on expanding broadband connectivity, improving digital literacy, and enabling seamless online transactions, which collectively streamline processes, improve accessibility, and encourage more users to engage with online travel platforms. Compliance with the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, issued by the same ministry, is mandatory for online platforms, ensuring data privacy, grievance redressal, and adherence to content standards.

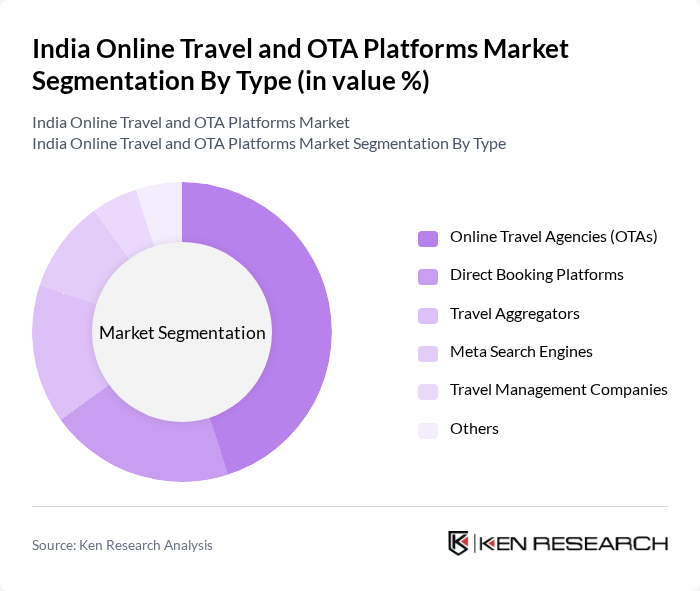

India Online Travel and OTA Platforms Market Segmentation

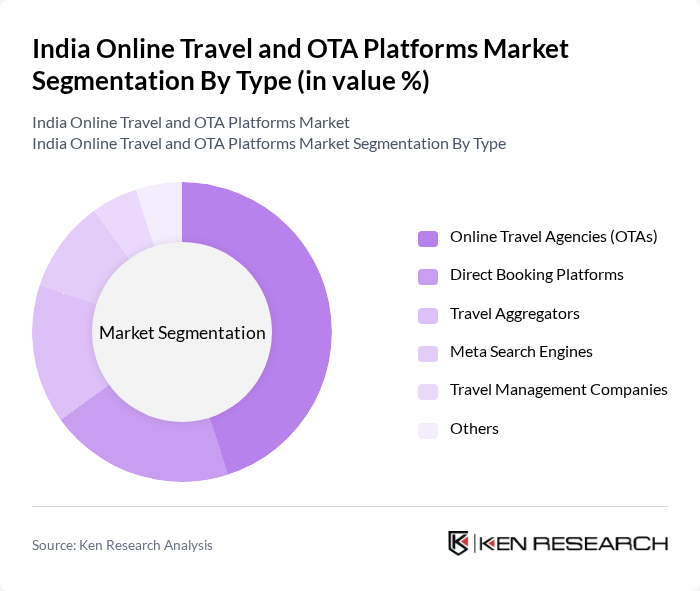

By Type:The market can be segmented into various types, including Online Travel Agencies (OTAs), Direct Booking Platforms, Travel Aggregators, Meta Search Engines, Travel Management Companies, and Others. Each of these segments plays a crucial role in catering to different consumer needs and preferences. Among these, Online Travel Agencies (OTAs) have emerged as the dominant segment due to their extensive offerings, user-friendly interfaces, and ability to aggregate multiple services. OTAs accounted for approximately 65 percent of the online gross booking value in the Indian market. The market is also seeing a rise in direct bookings through airline and hotel websites, as well as the growing influence of meta-search engines that compare prices across platforms.

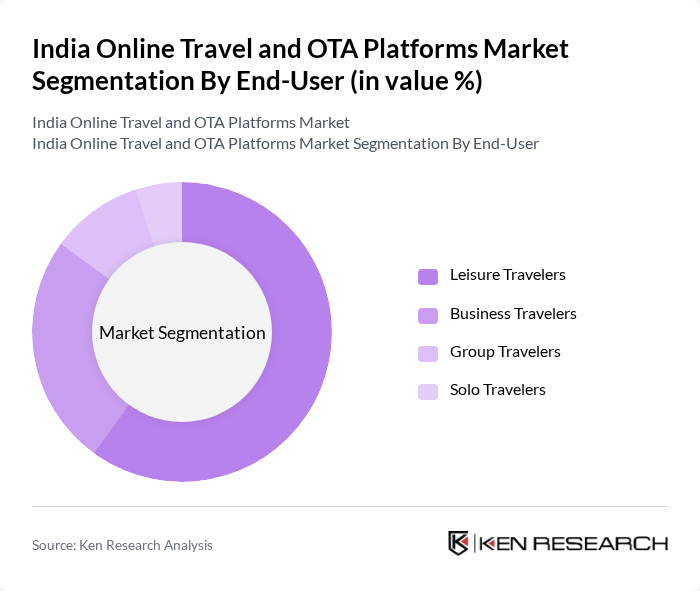

By End-User:The end-user segmentation includes Leisure Travelers, Business Travelers, Group Travelers, and Solo Travelers. Leisure Travelers dominate the market, driven by the increasing trend of domestic tourism and the growing interest in experiential travel. This segment's growth is supported by the rise of social media, which influences travel decisions and encourages exploration. Business travel remains significant, supported by corporate expansion and the return of in-person meetings post-pandemic. The market is also witnessing a gradual increase in solo and group travel, reflecting broader lifestyle shifts and the desire for personalized experiences.

India Online Travel and OTA Platforms Market Competitive Landscape

The India Online Travel and OTA Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as MakeMyTrip Limited, Yatra Online, Inc., Cleartrip Pvt. Ltd., Goibibo, OYO Rooms, Thomas Cook India Ltd., Cox & Kings Ltd., Expedia Group, Booking.com, TravelTriangle, Ixigo, SOTC Travel Ltd., Akbar Travels, TripAdvisor, Inc., RedBus, Via.com contribute to innovation, geographic expansion, and service delivery in this space.

India Online Travel and OTA Platforms Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:In future, India is projected to have over 850 million internet users, a significant increase from 800 million. This growth is driven by affordable data plans and expanding mobile networks, particularly in rural areas. The rise in internet accessibility facilitates online travel bookings, with approximately 70% of travelers preferring digital platforms for planning and purchasing travel services. This trend is expected to enhance the overall online travel market significantly.

- Rise in Disposable Income:The average disposable income in India is expected to reach ?1,15,000 per capita, up from ?1,30,000. This increase allows consumers to allocate more funds towards travel and leisure activities. As more individuals enter the middle class, the demand for travel experiences is anticipated to surge, leading to a higher volume of transactions on online travel platforms. This trend is crucial for the growth of the OTA market.

- Growth of Mobile Commerce:Mobile commerce in India is projected to reach ?5 trillion, up from ?5 trillion. With over 650 million smartphone users, mobile devices are becoming the primary means for travel bookings. The convenience of mobile apps and the integration of payment gateways enhance user experience, driving more consumers to utilize online travel agencies. This shift towards mobile commerce is a key growth driver for the online travel market.

Market Challenges

- Intense Competition:The Indian online travel market is characterized by fierce competition, with over 100 OTAs vying for market share. Major players like MakeMyTrip and Yatra dominate, but new entrants continuously disrupt the market. This saturation leads to price wars and reduced profit margins, making it challenging for smaller players to sustain operations. The competitive landscape necessitates innovation and differentiation to capture consumer attention effectively.

- Cybersecurity Threats:With the rise of online transactions, cybersecurity threats have become a significant concern for OTAs. In future, over 60% of travel companies reported experiencing cyberattacks, leading to data breaches and loss of customer trust. The financial implications of these breaches can be severe, with costs averaging ?1 crore per incident. Ensuring robust cybersecurity measures is essential for maintaining consumer confidence and protecting sensitive information.

India Online Travel and OTA Platforms Market Future Outlook

The future of the India online travel and OTA platforms market appears promising, driven by technological advancements and changing consumer preferences. As more travelers seek personalized experiences, OTAs are likely to leverage data analytics and AI to enhance service offerings. Additionally, the growing emphasis on sustainable travel practices will shape market strategies, encouraging companies to adopt eco-friendly initiatives. Overall, the market is poised for significant evolution, adapting to emerging trends and consumer demands.

Market Opportunities

- Emergence of Niche Travel Segments:The rise of niche travel segments, such as wellness tourism and adventure travel, presents significant opportunities for OTAs. With an estimated market size of ?50,000 crore, these segments cater to specific consumer interests, allowing OTAs to tailor their offerings and attract targeted audiences. This focus on niche markets can enhance customer engagement and loyalty.

- Partnerships with Local Businesses:Collaborating with local businesses can create unique travel experiences and enhance service offerings. By forming partnerships with local guides, hotels, and restaurants, OTAs can provide authentic experiences that appeal to travelers. This strategy not only supports local economies but also differentiates OTAs in a competitive market, potentially increasing customer satisfaction and retention.