Region:Asia

Author(s):Rebecca

Product Code:KRAB2980

Pages:88

Published On:October 2025

By Type:The market is segmented into various types, including Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), Transactional Video on Demand (TVOD), Live Streaming Services, and Others. Among these, SVOD has emerged as the leading segment due to the increasing number of consumers willing to pay for premium content and ad-free experiences. The trend of binge-watching and the availability of exclusive content have further fueled the growth of this segment.

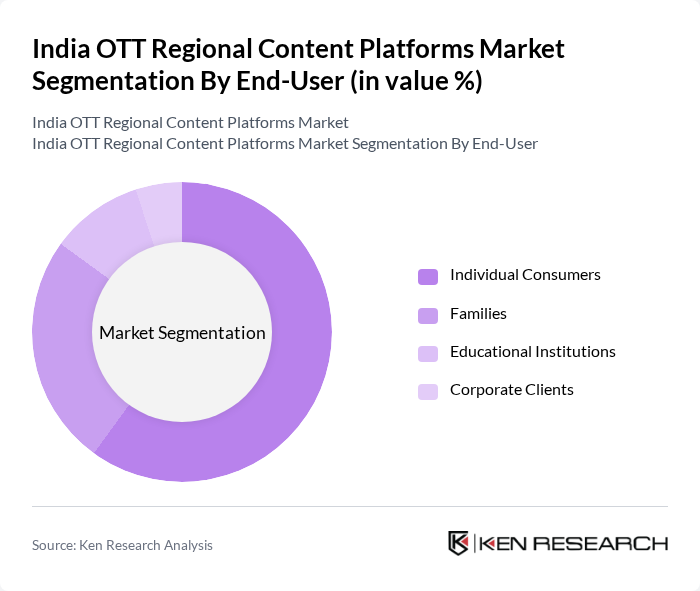

By End-User:The end-user segmentation includes Individual Consumers, Families, Educational Institutions, and Corporate Clients. Individual Consumers dominate the market, driven by the increasing trend of personalized content consumption and the convenience of accessing a wide range of content on various devices. Families also represent a significant segment, as they often subscribe to platforms that offer diverse content suitable for all age groups.

The India OTT Regional Content Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Amazon Prime Video, Disney+ Hotstar, Zee5, SonyLIV, Voot, MX Player, ALTBalaji, Eros Now, Aha, Hoichoi, JioCinema, Discovery+, Apple TV+, YouTube Premium contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India OTT regional content market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms are likely to enhance their offerings with more localized content. Additionally, the integration of AI and machine learning for personalized recommendations will improve user engagement. The focus on regional languages will further expand, catering to diverse demographics and fostering a more inclusive viewing experience across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription Video on Demand (SVOD) Advertising Video on Demand (AVOD) Transactional Video on Demand (TVOD) Live Streaming Services Others |

| By End-User | Individual Consumers Families Educational Institutions Corporate Clients |

| By Region | North India South India East India West India |

| By Content Genre | Drama Comedy Thriller Documentaries Others |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-Per-View |

| By Device Type | Mobile Devices Smart TVs Laptops and Desktops Streaming Devices |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Regional OTT Platform Executives | 100 | CEOs, Content Directors, Marketing Heads |

| Content Creators and Producers | 80 | Writers, Directors, Production Managers |

| Consumer Insights from Viewers | 150 | Regular OTT Users, Regional Language Speakers |

| Advertising and Marketing Professionals | 70 | Ad Agency Executives, Brand Managers |

| Technology and Platform Developers | 60 | Software Engineers, Product Managers |

The India OTT Regional Content Platforms Market is valued at approximately INR 155 billion, reflecting significant growth driven by increased internet penetration, smartphone usage, and a rising preference for on-demand content among consumers.