Region:Asia

Author(s):Shubham

Product Code:KRAB4993

Pages:80

Published On:October 2025

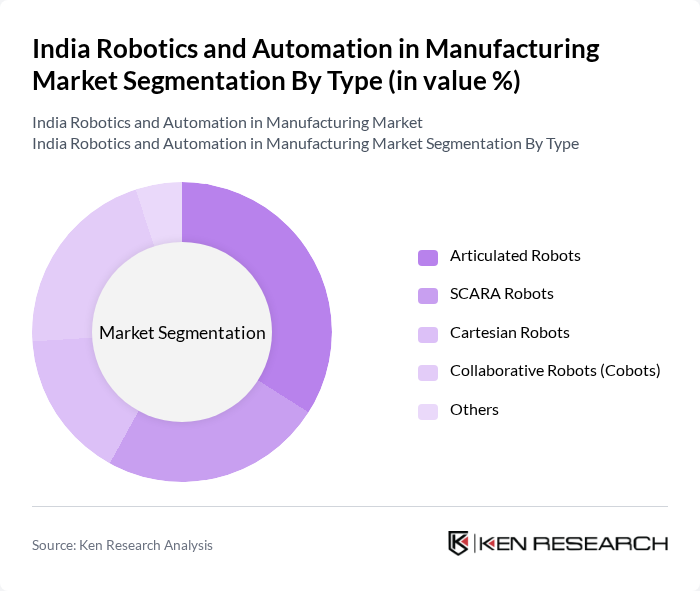

By Type:The market is segmented into various types of robots, including articulated robots, SCARA robots, Cartesian robots, collaborative robots (cobots), and others. Articulated robots are widely used due to their flexibility and range of motion, making them suitable for complex tasks such as welding and material handling. SCARA robots are preferred for assembly and pick-and-place operations, while collaborative robots are gaining traction for their ability to work safely alongside human operators, particularly in small and medium-sized enterprises .

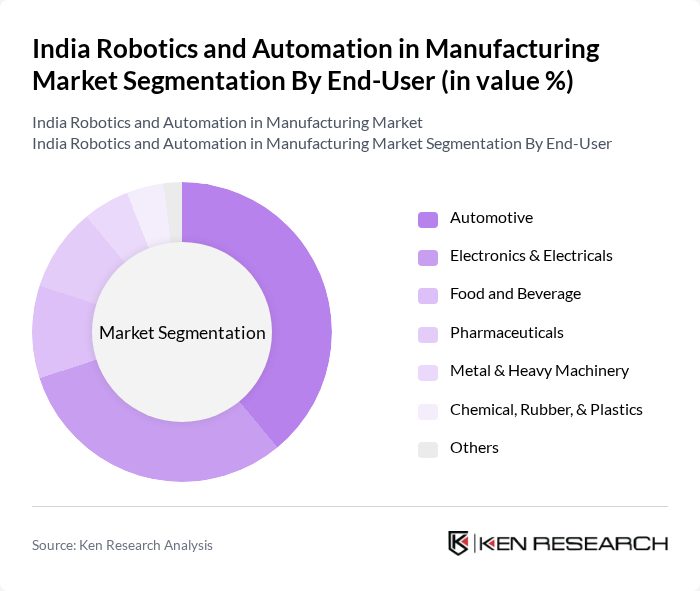

By End-User:The end-user segmentation includes automotive, electronics & electricals, food and beverage, pharmaceuticals, metal & heavy machinery, chemical, rubber & plastics, and others. The automotive sector remains the largest consumer of robotics and automation solutions, driven by the need for precision, efficiency, and high-volume production. The electronics sector follows closely, with increasing automation in assembly lines and component manufacturing. The chemical, rubber, and plastics segment is experiencing rapid growth due to the adoption of robotics for hazardous material handling and quality control .

The India Robotics and Automation in Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB India Ltd., KUKA Robotics (India) Pvt. Ltd., FANUC India Pvt. Ltd., Yaskawa India Pvt. Ltd., Siemens Ltd. (India), Mitsubishi Electric India Pvt. Ltd., Omron Automation Pvt. Ltd. (India), Bosch Rexroth (India) Ltd., Schneider Electric India Pvt. Ltd., Rockwell Automation India Pvt. Ltd., Hyundai Robotics India Pvt. Ltd., Universal Robots (India) Pvt. Ltd., Cognex Sensors India Pvt. Ltd., Denso Robotics India Pvt. Ltd., GreyOrange Robotics Pvt. Ltd., TAL Manufacturing Solutions Ltd., Panasonic Smart Factory Solutions India, Bharat Fritz Werner Ltd. (BFW) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotics and automation market in India appears promising, driven by ongoing technological advancements and increasing government support. As manufacturers seek to enhance productivity and reduce costs, the adoption of automation technologies is expected to accelerate. Furthermore, the integration of AI and IoT into manufacturing processes will likely lead to smarter, more efficient operations. This trend will create a robust environment for innovation and investment in the robotics sector, positioning India as a key player in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Cartesian Robots Collaborative Robots (Cobots) Others |

| By End-User | Automotive Electronics & Electricals Food and Beverage Pharmaceuticals Metal & Heavy Machinery Chemical, Rubber, & Plastics Others |

| By Region | North India West and Central India South India East and Northeast India |

| By Application | Material Handling Welding and Soldering Assembly Painting and Coating Packaging Quality Control Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Research and Development Grants Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Automation | 100 | Production Managers, Automation Engineers |

| Electronics Assembly Robotics | 80 | Operations Directors, Quality Control Managers |

| Consumer Goods Robotics Integration | 70 | Supply Chain Managers, Product Line Managers |

| Pharmaceutical Manufacturing Automation | 50 | Regulatory Affairs Managers, Process Engineers |

| Food Processing Robotics | 60 | Plant Managers, Food Safety Officers |

The India Robotics and Automation in Manufacturing Market is valued at approximately USD 1.4 billion, driven by the increasing adoption of automation technologies across various sectors, including automotive, electronics, and pharmaceuticals.