Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2024

Pages:82

Published On:August 2025

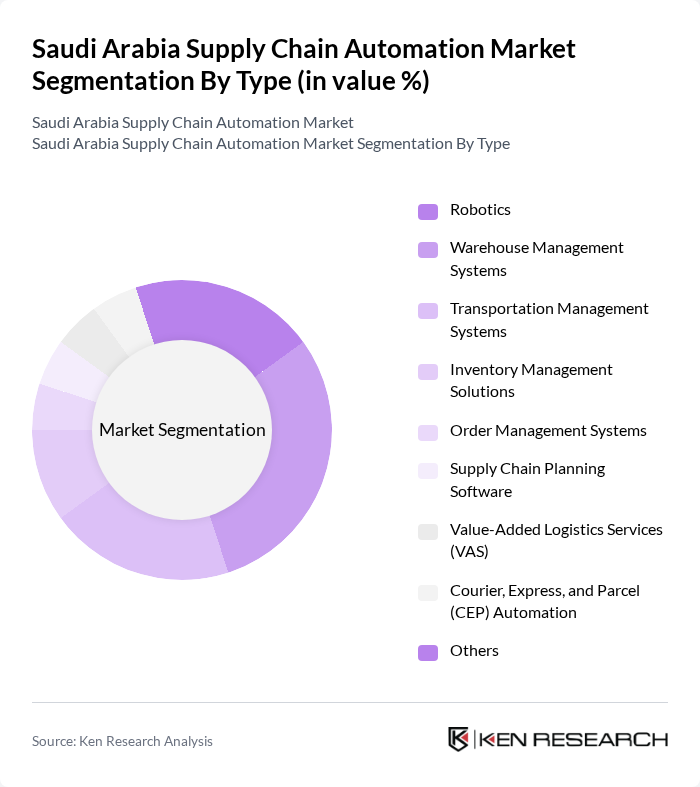

By Type:The market is segmented into various types, including Robotics, Warehouse Management Systems, Transportation Management Systems, Inventory Management Solutions, Order Management Systems, Supply Chain Planning Software, Value-Added Logistics Services (VAS), Courier, Express, and Parcel (CEP) Automation, and Others. Among these, Warehouse Management Systems are currently leading the market due to the increasing need for efficient inventory management and order fulfillment processes. The rise of e-commerce and the expansion of automated warehouses have accelerated demand for these systems, as businesses seek to optimize operations and improve delivery speed .

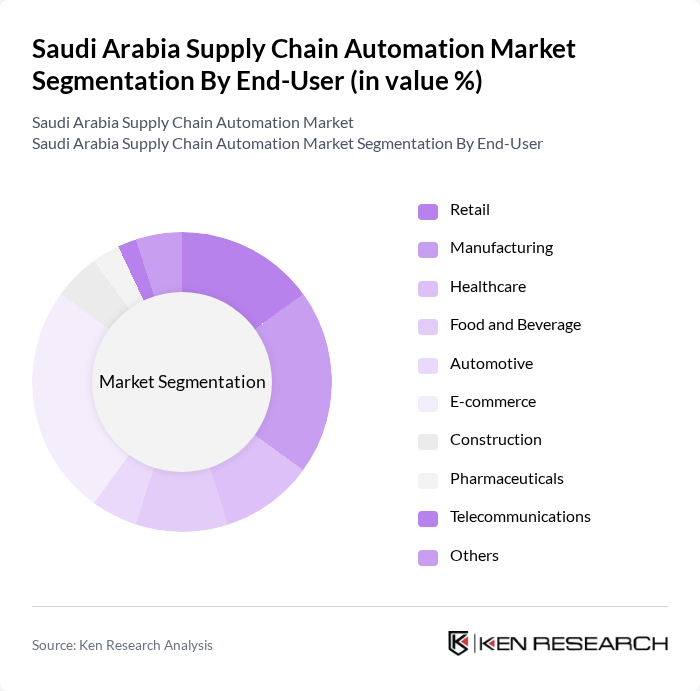

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare, Food and Beverage, Automotive, E-commerce, Construction, Pharmaceuticals, Telecommunications, and Others. The E-commerce sector is currently the dominant end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions. As consumer preferences shift towards digital platforms, businesses are increasingly investing in automation technologies to enhance their supply chain capabilities. The expansion of retail and e-commerce, along with government support for logistics infrastructure, is further boosting automation adoption across sectors .

The Saudi Arabia Supply Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder, Manhattan Associates, IBM Corporation, Kinaxis Inc., Infor, Siemens AG, Honeywell International Inc., Zebra Technologies Corporation, C.H. Robinson Worldwide Inc., DHL Supply Chain, Kuehne + Nagel International AG, Geodis, Almajdouie Logistics, Agility Logistics, Bahri (The National Shipping Company of Saudi Arabia), Aramex, Saudi Post, Saudi Global Ports contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia supply chain automation market appears promising, driven by ongoing technological advancements and government support. As businesses increasingly recognize the importance of automation for operational efficiency, investments in AI, IoT, and robotics are expected to rise significantly. Additionally, the integration of sustainability practices into supply chains will likely become a priority, aligning with global trends. This evolving landscape will create a dynamic environment for innovation and growth in the sector, fostering competitive advantages for early adopters.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotics Warehouse Management Systems Transportation Management Systems Inventory Management Solutions Order Management Systems Supply Chain Planning Software Value-Added Logistics Services (VAS) Courier, Express, and Parcel (CEP) Automation Others |

| By End-User | Retail Manufacturing Healthcare Food and Beverage Automotive E-commerce Construction Pharmaceuticals Telecommunications Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | B2B B2C |

| By Industry Vertical | Consumer Goods Pharmaceuticals Electronics Apparel FMCG Others |

| By Policy Support | Subsidies for technology adoption Tax incentives for automation Grants for research and development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Automation | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Process Automation | 90 | Operations Managers, Production Supervisors |

| Healthcare Logistics Automation | 70 | Logistics Coordinators, Compliance Officers |

| Food and Beverage Supply Chain | 60 | Procurement Managers, Quality Assurance Heads |

| Technology Adoption in Logistics | 50 | Logistics Technology Managers, Innovation Managers |

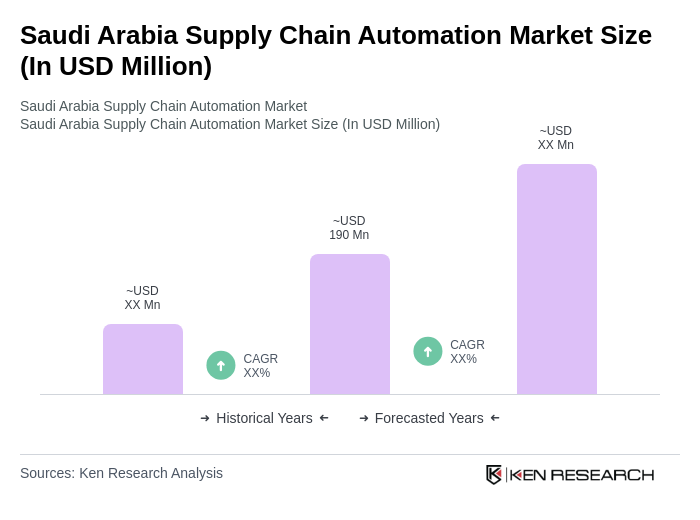

The Saudi Arabia Supply Chain Automation Market is valued at approximately USD 190 million, reflecting a significant growth trend driven by the adoption of advanced technologies like AI, IoT, and robotics, which enhance operational efficiency and reduce costs.