Region:Asia

Author(s):Dev

Product Code:KRAB6499

Pages:99

Published On:October 2025

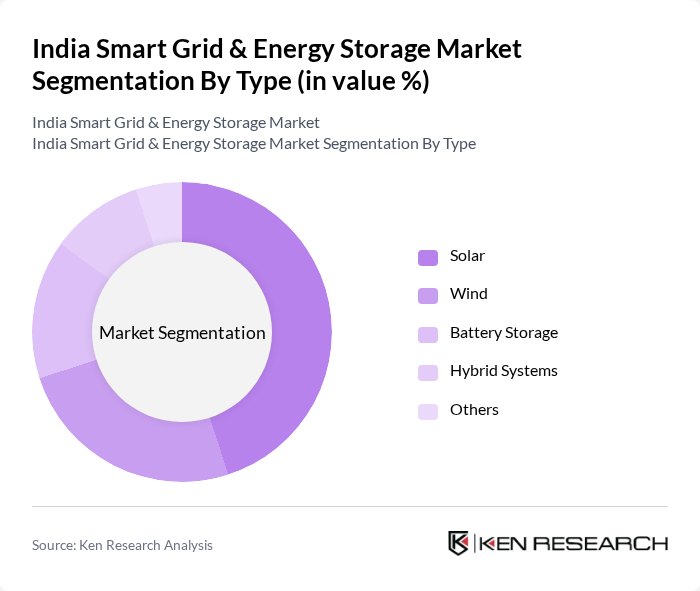

By Type:The market is segmented into various types, including Solar, Wind, Battery Storage, Hybrid Systems, and Others. Among these, Solar energy has emerged as the leading sub-segment due to its abundant availability and decreasing costs, making it a preferred choice for both residential and commercial applications. The growing awareness of environmental sustainability and government incentives further bolster the adoption of solar technologies.

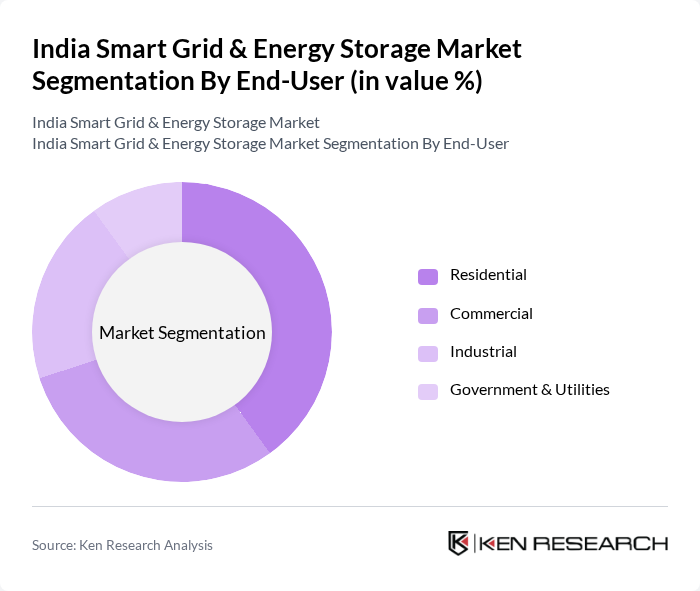

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the most significant, driven by the increasing adoption of smart home technologies and energy-efficient solutions. Consumers are increasingly investing in energy storage systems to reduce electricity bills and enhance energy independence, contributing to the segment's growth.

The India Smart Grid & Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Power, Adani Green Energy Limited, NTPC Limited, Siemens India, ABB India, Schneider Electric India, L&T Power, Bharat Heavy Electricals Limited (BHEL), ReNew Power, Greenko Energy Holdings, Hero Future Energies, JSW Energy, Power Grid Corporation of India, Gensol Engineering, Sterling and Wilson Solar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Smart Grid and Energy Storage Market appears promising, driven by increasing investments in renewable energy and technological innovations. In future, the integration of artificial intelligence and big data analytics is expected to enhance grid management and operational efficiency. Additionally, the expansion of smart cities will create a conducive environment for smart grid solutions, fostering sustainable urban development and energy resilience across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Battery Storage Hybrid Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North India South India East India West India |

| By Technology | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 100 | Energy Managers, Grid Operations Directors |

| Energy Storage Providers | 80 | Product Managers, Business Development Executives |

| Smart Grid Technology Vendors | 70 | Sales Directors, Technical Consultants |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Managers |

| Research Institutions | 60 | Energy Researchers, Academic Professors |

The India Smart Grid & Energy Storage Market is valued at approximately USD 20 billion, driven by the increasing demand for reliable energy systems and government initiatives aimed at enhancing energy security and sustainability.