Region:Asia

Author(s):Dev

Product Code:KRAB6516

Pages:88

Published On:October 2025

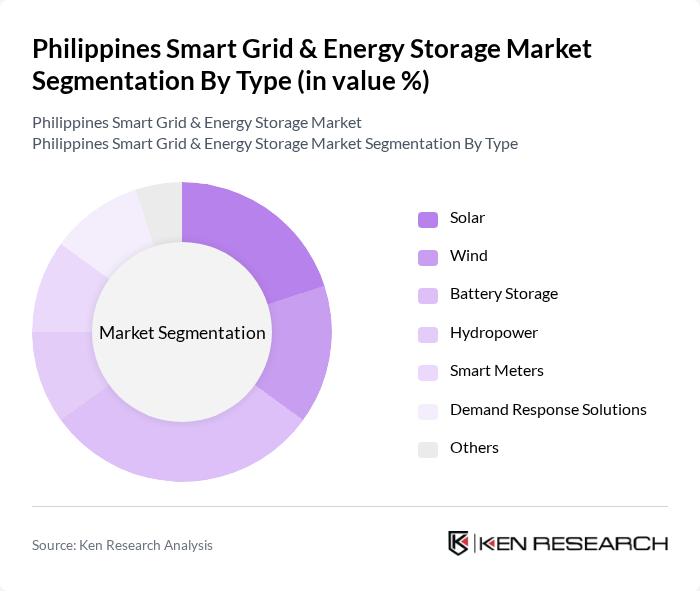

By Type:The market is segmented into various types, including Solar, Wind, Battery Storage, Hydropower, Smart Meters, Demand Response Solutions, and Others. Among these, Battery Storage is currently dominating the market due to its critical role in energy management and reliability. The increasing adoption of renewable energy sources necessitates efficient storage solutions to balance supply and demand, making Battery Storage a key focus for both consumers and utilities.

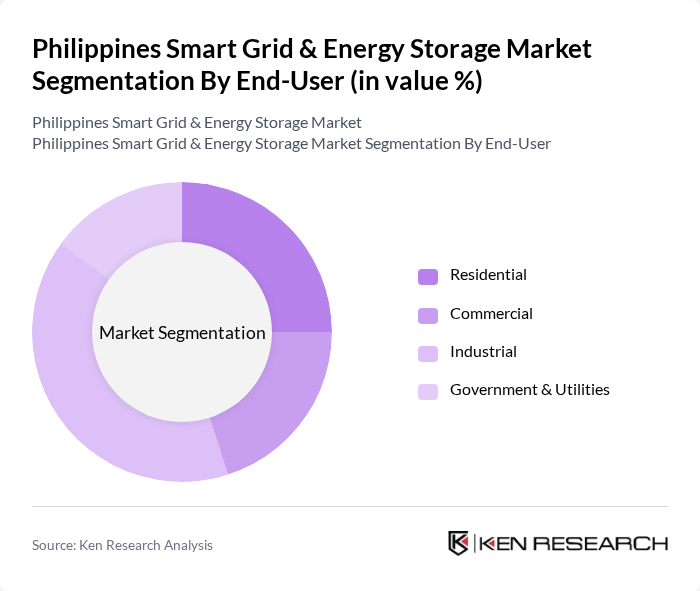

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Government & Utilities. The Industrial segment is currently leading the market due to the high energy consumption and the need for efficient energy management solutions in manufacturing and production processes. Industries are increasingly investing in smart grid technologies to optimize their energy usage and reduce operational costs.

The Philippines Smart Grid & Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meralco, Aboitiz Power Corporation, First Gen Corporation, Energy Development Corporation, Manila Electric Company, Solar Philippines, Enfinity Global, JGC Corporation, Siemens Philippines, Schneider Electric Philippines, ABB Philippines, GE Renewable Energy, Tesla Energy, LG Chem, SunPower Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines is poised for significant advancements in its smart grid and energy storage sectors, driven by increasing investments in renewable energy and supportive government policies. In the future, the integration of smart technologies is expected to enhance grid reliability and efficiency, addressing the challenges of energy distribution. As public-private partnerships grow, innovative financing models will emerge, facilitating the adoption of smart grid solutions. The focus on sustainability will further accelerate the transition towards a more resilient energy infrastructure, aligning with global trends in energy management.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Battery Storage Hydropower Smart Meters Demand Response Solutions Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Systems Off-Grid Solutions Microgrids Utility-Scale Projects |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies' Smart Grid Initiatives | 100 | Energy Managers, Grid Operations Directors |

| Energy Storage System Providers | 80 | Product Managers, Technical Sales Engineers |

| Government Energy Policy Makers | 60 | Regulatory Affairs Specialists, Energy Policy Analysts |

| Renewable Energy Project Developers | 70 | Project Managers, Business Development Executives |

| Research Institutions Focused on Energy | 50 | Research Analysts, Energy Economists |

The Philippines Smart Grid & Energy Storage Market is valued at approximately USD 1.2 billion, driven by the increasing demand for reliable energy supply, integration of renewable energy sources, and government initiatives focused on energy efficiency and sustainability.