Region:Europe

Author(s):Dev

Product Code:KRAA3577

Pages:98

Published On:September 2025

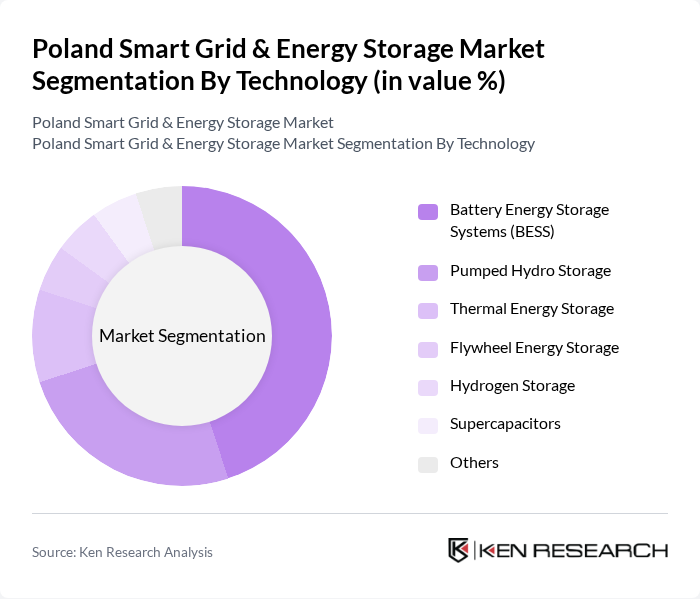

By Technology:The technology segment includes a range of energy storage solutions addressing diverse grid and user needs. Battery Energy Storage Systems (BESS) are the leading sub-segment, favored for their rapid response, modularity, and suitability for both grid-scale and distributed applications. Pumped hydro storage and thermal energy storage remain important for large-scale and industrial uses, but BESS dominates due to its scalability and integration with renewables .

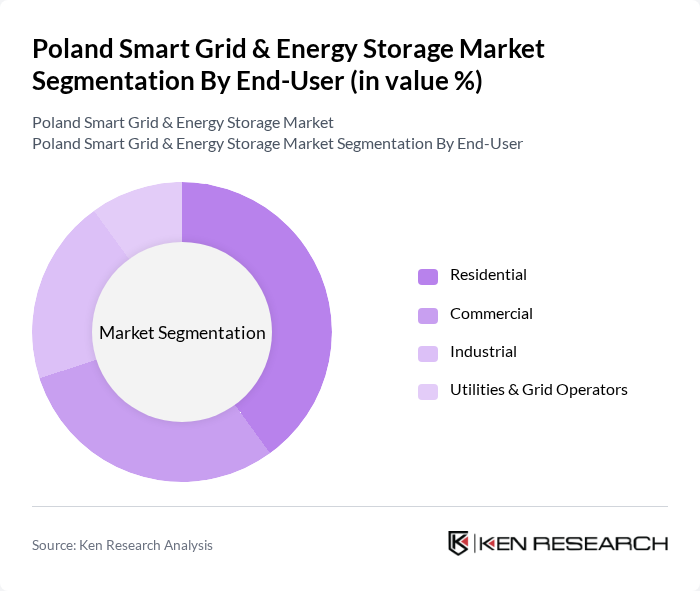

By End-User:The end-user segment covers a broad spectrum of market participants. The residential sector leads, driven by growing adoption of smart meters, home energy management systems, and distributed storage. Commercial and industrial users are increasingly investing in smart grid and storage solutions to optimize energy costs, ensure power quality, and meet sustainability goals. Utilities and grid operators play a crucial role in deploying large-scale grid modernization and storage projects .

The Poland Smart Grid & Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as PGE Polska Grupa Energetyczna S.A., Tauron Polska Energia S.A., Enea S.A., Energa S.A., LG Energy Solution Wroc?aw Sp. z o.o., Greenvolt Power Poland Sp. z o.o., Siemens AG, Schneider Electric SE, ABB Ltd., General Electric Company, Tesla, Inc., Samsung SDI Co., Ltd., Vestas Wind Systems A/S, Enel X Polska Sp. z o.o., RWE Renewables Polska Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Poland Smart Grid and Energy Storage Market appears promising, driven by increasing investments in renewable energy and technological advancements. In future, the integration of AI and IoT in energy management systems is expected to enhance operational efficiency significantly. Additionally, the expansion of electric vehicle infrastructure will further stimulate demand for energy storage solutions, creating a more resilient and sustainable energy ecosystem. Collaborative efforts between public and private sectors will be crucial in overcoming existing challenges and unlocking market potential.

| Segment | Sub-Segments |

|---|---|

| By Technology | Battery Energy Storage Systems (BESS) Pumped Hydro Storage Thermal Energy Storage Flywheel Energy Storage Hydrogen Storage Supercapacitors Others |

| By End-User | Residential Commercial Industrial Utilities & Grid Operators |

| By Application | Grid Stabilization & Frequency Regulation Renewable Energy Integration Backup Power & Emergency Supply Peak Shaving & Load Shifting Off-Grid & Microgrid Solutions |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes & EU Funding |

| By Policy Support | Subsidies & Grants Tax Exemptions Renewable Energy Certificates (RECs) Capacity Market Participation |

| By Distribution Mode | Direct Sales Online Sales Distributors & Integrators |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 100 | Energy Managers, Grid Operations Directors |

| Energy Storage Providers | 60 | Product Development Managers, Sales Directors |

| Government Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

| Technology Integrators | 50 | Project Managers, Technical Leads |

| Research Institutions | 45 | Energy Researchers, Academic Professors |

The Poland Smart Grid & Energy Storage Market is valued at approximately USD 1.1 billion, driven by investments in grid modernization, renewable energy integration, and advancements in battery and digital grid technologies.