Region:Africa

Author(s):Shubham

Product Code:KRAB5022

Pages:81

Published On:October 2025

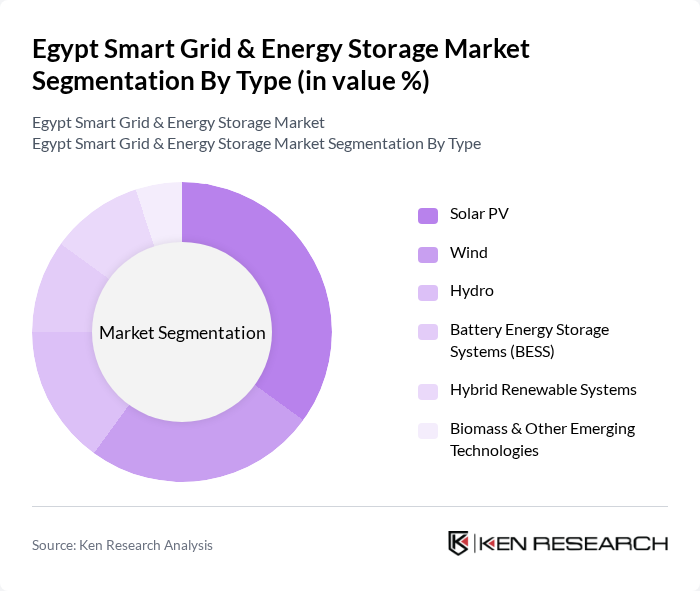

By Type:The market is segmented into Solar PV, Wind, Hydro, Battery Energy Storage Systems (BESS), Hybrid Renewable Systems, and Biomass & Other Emerging Technologies. Each segment plays a vital role in the energy landscape, with Solar PV and Battery Storage being the most prominent, driven by the increasing adoption of renewables and the need for efficient energy storage. Smart meters and energy management systems are also gaining traction as consumers seek better energy management tools .

TheSolar PVsegment is currently dominating the market due to its cost-effectiveness and strong policy support for renewables. The increasing installation of solar panels in residential, commercial, and utility-scale projects is driven by favorable incentives and net-metering schemes.Wind energyis also expanding, particularly in coastal and Suez regions, whileBattery Energy Storage Systems (BESS)are becoming essential for balancing supply and demand and supporting grid integration of renewables.Hybrid systemsare emerging as a viable solution for integrating multiple energy sources, enhancing reliability and efficiency .

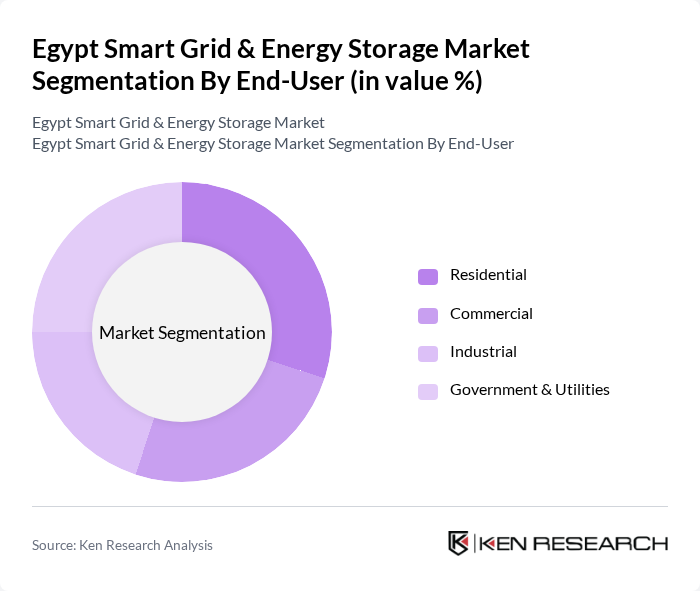

By End-User:The market is segmented into Residential, Commercial, Industrial, and Government & Utilities. Each end-user category has distinct energy needs and preferences, influencing the adoption of smart grid and energy storage technologies. TheResidentialsegment is leading due to growing adoption of home automation and energy efficiency solutions.CommercialandIndustrialsegments are significant contributors, driven by cost savings and sustainability initiatives, whileGovernment & Utilitiesare crucial for infrastructure development and policy implementation .

TheResidentialsegment is leading the market as homeowners increasingly adopt solar PV systems and energy storage solutions to reduce electricity bills and enhance energy independence. TheCommercialsector follows closely, driven by businesses seeking to lower operational costs and improve sustainability. TheIndustrialsegment is also significant, with large-scale energy consumers investing in smart grid technologies to optimize energy usage.Government and utilityprojects are crucial for infrastructure development and policy implementation .

The Egypt Smart Grid & Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric, ABB Ltd., General Electric (GE), AMEA Power, Trina Solar (Trina Storage), Elsewedy Electric, Infinity Power, ACWA Power, Vestas Wind Systems A/S, First Solar, Inc., JinkoSolar Holding Co., Ltd., Scatec ASA, Hitachi Energy, Huawei Digital Power contribute to innovation, geographic expansion, and service delivery in this space .

The future of Egypt's smart grid and energy storage market appears promising, driven by increasing investments and technological advancements. The integration of smart technologies is expected to enhance grid efficiency and reliability, supporting the country's renewable energy goals. As urbanization accelerates, the demand for decentralized energy systems will rise, prompting further innovation. Additionally, collaboration between government and private sectors will likely foster a conducive environment for growth, positioning Egypt as a regional leader in smart energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar PV Wind Hydro Battery Energy Storage Systems (BESS) Hybrid Renewable Systems Biomass & Other Emerging Technologies |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Utility-Scale Projects Microgrids Distributed Generation |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Grid Implementation Projects | 100 | Utility Managers, Project Directors |

| Energy Storage System Providers | 80 | Product Managers, Technical Directors |

| Government Energy Policy Makers | 50 | Regulatory Officials, Energy Advisors |

| Renewable Energy Developers | 70 | Business Development Managers, Technical Leads |

| Energy Efficiency Consultants | 60 | Consultants, Sustainability Officers |

The Egypt Smart Grid & Energy Storage Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for renewable energy and government initiatives aimed at enhancing energy efficiency under Egypt Vision 2030.