India SpaceTech and Satellite Internet Market Overview

- The India SpaceTech and Satellite Internet Market is valued at USD 3.2 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in satellite technology, increasing demand for broadband connectivity—especially in rural and remote regions—and government initiatives aimed at enhancing digital infrastructure and space capabilities. The market has seen significant investments from both public and private sectors, contributing to its expansion and innovation .

- Key players in this market include major cities like Bengaluru, Hyderabad, and Delhi, which dominate due to their robust technological infrastructure, presence of leading aerospace companies, and research institutions. These cities serve as hubs for satellite manufacturing and space research, attracting talent and investment, thereby fostering a conducive environment for growth .

- The Indian government enacted the Indian Space Policy, 2023, issued by the Department of Space, which aims to promote private sector participation in space activities. This regulation facilitates the authorization and licensing of private entities for satellite launches and operations, mandates compliance with safety and security standards, and encourages innovation and investment in the space sector .

India SpaceTech and Satellite Internet Market Segmentation

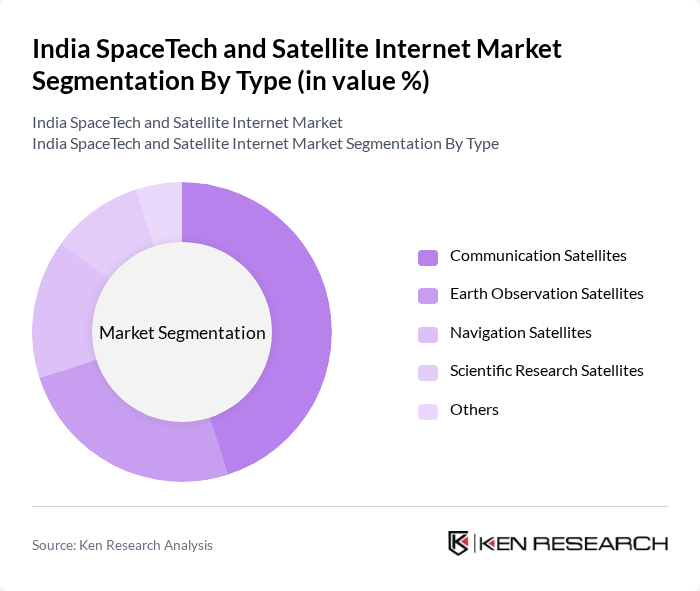

By Type:The market is segmented into various types of satellites, including communication satellites, earth observation satellites, navigation satellites, scientific research satellites, and others. Each type serves distinct purposes, catering to different sectors such as telecommunications, agriculture, and disaster management. Communication satellites are particularly dominant due to the increasing demand for internet connectivity, digital inclusion, and data services in underserved areas .

By End-User:The market is categorized based on end-users, including government, commercial enterprises, educational institutions, and non-governmental organizations. Government entities are the largest consumers, leveraging satellite technology for national security, communication, and environmental monitoring. Commercial enterprises are increasingly adopting satellite solutions for business operations, digital transformation, and connectivity in remote locations, driving growth in this segment .

India SpaceTech and Satellite Internet Market Competitive Landscape

The India SpaceTech and Satellite Internet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Indian Space Research Organisation (ISRO), Bharti Airtel, Hughes Communications India, Tata Communications, OneWeb, SpaceX, Viasat, SES S.A., Inmarsat, Globalstar, Starlink, Amazon Project Kuiper, Intelsat contribute to innovation, geographic expansion, and service delivery in this space.

India SpaceTech and Satellite Internet Market Industry Analysis

Growth Drivers

- Increasing Demand for Connectivity in Remote Areas:The demand for reliable internet connectivity in remote regions of India is surging, with over400 millionpeople lacking access to broadband services. The government aims to connect 250,000 villages through initiatives like the Digital India program, which allocates approximately?1.13 trillion (around $15 billion)for infrastructure development. This growing need for connectivity drives investments in satellite internet solutions, making it a crucial growth driver in the SpaceTech sector.

- Government Initiatives and Investments:The Indian government has committed significant resources to enhance its space capabilities, with a budget of?13,042 crore (approximately $1.6 billion)for the Indian Space Research Organisation (ISRO) in future. This funding supports satellite launches and infrastructure development, fostering a conducive environment for private sector participation. The government's push for self-reliance in satellite technology further stimulates growth, encouraging innovation and investment in the SpaceTech industry.

- Technological Advancements in Satellite Technology:The rapid evolution of satellite technology, particularly in Low Earth Orbit (LEO) systems, is transforming the SpaceTech landscape. Companies like OneWeb and Starlink are investing billions in deploying LEO satellites, with OneWeb planning to launch648 satellitesin future. These advancements enhance data transmission speeds and reduce latency, making satellite internet a viable alternative to traditional broadband, thus driving market growth in India.

Market Challenges

- High Initial Investment Costs:The SpaceTech sector faces significant barriers due to high initial investment costs, which can exceed?1,000 crore (approximately $120 million)for satellite deployment. This financial burden limits entry for new players and hinders the expansion of existing companies. Additionally, the long payback period for satellite investments, often spanning 5-10 years, poses a challenge for attracting venture capital and sustaining growth in the competitive market.

- Regulatory Hurdles and Compliance Issues:Navigating the complex regulatory landscape in India presents a significant challenge for SpaceTech companies. Compliance with the Indian Space Activities Act and obtaining necessary licenses can be time-consuming and costly. The regulatory framework is still evolving, which can lead to uncertainties and delays in project approvals. These hurdles can deter investment and slow down the pace of innovation in the satellite internet market.

India SpaceTech and Satellite Internet Market Future Outlook

The future of the India SpaceTech and satellite internet market appears promising, driven by increasing investments in satellite infrastructure and technological advancements. The government’s commitment to enhancing connectivity in rural areas, coupled with the rise of private sector participation, is expected to foster innovation. As satellite technology continues to evolve, particularly with LEO systems, the market is likely to witness significant growth, addressing connectivity challenges and expanding access to digital services across the country.

Market Opportunities

- Expansion of Internet Services in Rural Areas:The ongoing push to expand internet services in rural India presents a substantial opportunity for satellite internet providers. With over65 percentof the population residing in rural areas, the demand for reliable connectivity is immense. Targeting this demographic can lead to increased market penetration and revenue growth, as satellite solutions can effectively bridge the digital divide.

- Partnerships with Telecom Operators:Collaborating with established telecom operators can enhance market reach and service delivery for satellite internet providers. By leveraging existing infrastructure and customer bases, these partnerships can facilitate quicker deployment of services. Such collaborations can also lead to bundled offerings, combining satellite and terrestrial services, thereby increasing customer acquisition and retention in a competitive landscape.