USA SpaceTech and Satellite Internet Market Overview

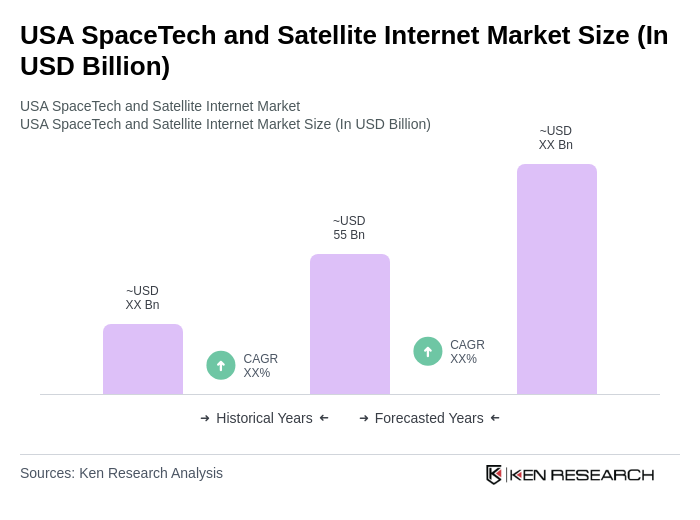

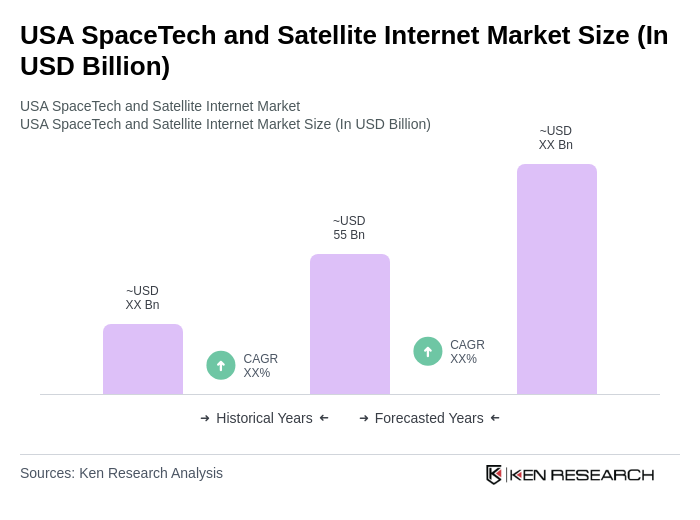

- The USA SpaceTech and Satellite Internet Market is valued at USD 55 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in satellite technology, increasing demand for high-speed internet services, and the expansion of satellite constellations aimed at providing global coverage. The market has seen significant investments from both private and public sectors, enhancing the infrastructure and capabilities of satellite communications.

- Key players in this market include major cities such as San Francisco, Seattle, and Washington D.C., which dominate due to their technological hubs, access to venture capital, and proximity to government agencies. These regions foster innovation and collaboration among tech companies, research institutions, and regulatory bodies, making them critical centers for the development and deployment of satellite technologies.

- In 2023, the Federal Communications Commission (FCC) implemented new regulations to streamline the licensing process for satellite operators. This initiative aims to reduce bureaucratic hurdles and promote competition in the satellite internet sector, facilitating faster deployment of services and encouraging innovation among new entrants in the market.

USA SpaceTech and Satellite Internet Market Segmentation

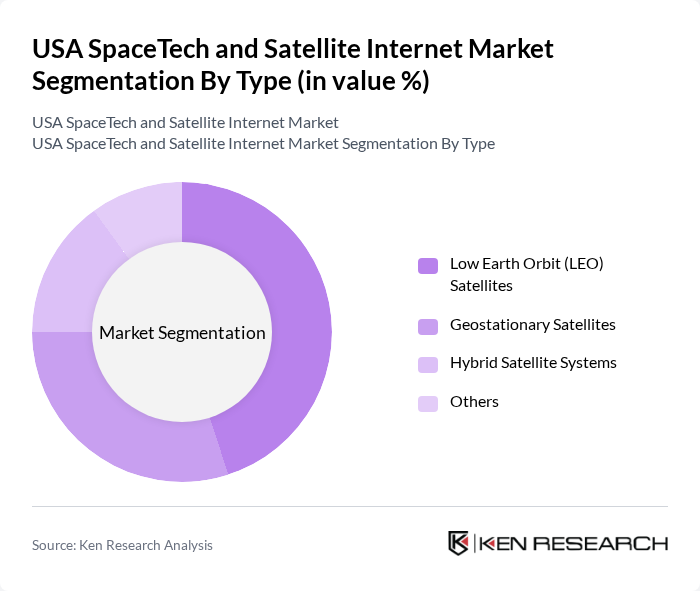

By Type:The market is segmented into various types of satellite systems, including Low Earth Orbit (LEO) Satellites, Geostationary Satellites, Hybrid Satellite Systems, and Others. Each type serves distinct purposes and applications, catering to different consumer needs and technological advancements.

The Low Earth Orbit (LEO) Satellites segment is currently dominating the market due to their ability to provide low-latency internet services and enhanced coverage. Companies like SpaceX and OneWeb are leading the charge in deploying large constellations of LEO satellites, which are particularly appealing for rural and underserved areas. The demand for high-speed internet and the growing reliance on cloud services further bolster the adoption of LEO systems, making them a preferred choice for both consumers and businesses.

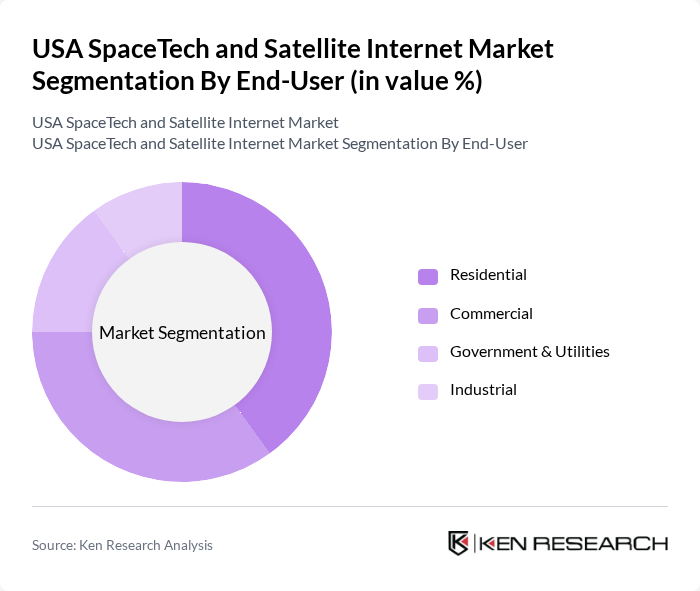

By End-User:The market is segmented by end-user into Residential, Commercial, Government & Utilities, and Industrial. Each segment has unique requirements and applications for satellite internet services, influencing the overall market dynamics.

The Residential segment is leading the market, driven by the increasing demand for high-speed internet access in homes, especially in rural and remote areas. The proliferation of smart devices and the need for reliable connectivity for remote work and online education have further accelerated the adoption of satellite internet services among residential users. This trend is supported by competitive pricing and service offerings from various satellite internet providers.

USA SpaceTech and Satellite Internet Market Competitive Landscape

The USA SpaceTech and Satellite Internet Market is characterized by a dynamic mix of regional and international players. Leading participants such as SpaceX, OneWeb, Amazon (Project Kuiper), Viasat Inc., Hughes Network Systems, SES S.A., Iridium Communications Inc., Telesat Canada, Globalstar, Inc., Inmarsat Global Limited, Eutelsat Communications, Intelsat S.A., Maxar Technologies, Planet Labs PBC, Northrop Grumman Corporation contribute to innovation, geographic expansion, and service delivery in this space.

USA SpaceTech and Satellite Internet Market Industry Analysis

Growth Drivers

- Increased Demand for High-Speed Internet:The USA has seen a surge in demand for high-speed internet, with over 90% of households now requiring reliable connectivity. According to the Federal Communications Commission (FCC), approximately 42 million Americans lack access to broadband, highlighting a significant market opportunity. The push for remote work and online education has further intensified this demand, with the broadband market projected to reach $100 billion in revenue in the future, driven by consumer needs for faster and more reliable internet services.

- Expansion of Satellite Constellations:The deployment of satellite constellations is transforming the SpaceTech landscape. Companies like SpaceX and OneWeb are launching thousands of low Earth orbit (LEO) satellites, with SpaceX alone planning to deploy over 12,000 satellites in the future. This expansion is expected to enhance global internet coverage, particularly in underserved areas. The U.S. government has also recognized this trend, investing $1.5 billion in satellite broadband initiatives to improve connectivity across rural regions, further driving market growth.

- Government Investments in Space Infrastructure:The U.S. government is significantly investing in space infrastructure, with the National Aeronautics and Space Administration (NASA) allocating $24 billion for its budget in the future. This funding supports various initiatives, including satellite technology development and space exploration. Additionally, the Federal Communications Commission (FCC) has introduced programs to facilitate satellite broadband deployment, aiming to bridge the digital divide. These investments are crucial for fostering innovation and enhancing the competitive landscape of the SpaceTech market.

Market Challenges

- High Initial Capital Investment:The SpaceTech and satellite internet sectors require substantial initial capital investments, often exceeding $1 billion for satellite launches and infrastructure development. This financial barrier can deter new entrants and limit competition. According to industry reports, the average cost of launching a satellite is around $10,000 per kilogram, which can significantly impact profitability. As a result, companies must secure substantial funding or partnerships to navigate these financial challenges effectively.

- Regulatory Hurdles:Navigating the regulatory landscape poses significant challenges for SpaceTech companies. The FCC's licensing requirements for satellite operations can be complex and time-consuming, often taking several years to obtain necessary approvals. Additionally, compliance with international space treaties, such as the Outer Space Treaty, adds layers of complexity. These regulatory hurdles can delay project timelines and increase operational costs, hindering the growth potential of satellite internet providers in the competitive market.

USA SpaceTech and Satellite Internet Market Future Outlook

The future of the USA SpaceTech and satellite internet market appears promising, driven by technological advancements and increasing demand for connectivity. The trend towards low Earth orbit satellites is expected to continue, enhancing global internet access and reducing latency. Furthermore, as partnerships between satellite companies and telecommunications providers grow, the market will likely see innovative service models emerge. These developments will not only improve service delivery but also foster competition, ultimately benefiting consumers and expanding market reach.

Market Opportunities

- Growth in IoT Applications:The rise of Internet of Things (IoT) applications presents a significant opportunity for satellite internet providers. With an estimated 75 billion connected devices expected in the future, satellite technology can facilitate seamless connectivity in remote areas. This growth can drive demand for satellite services, particularly in sectors like agriculture, logistics, and smart cities, where reliable internet access is crucial for operational efficiency.

- Partnerships with Telecommunications Companies:Collaborations between satellite internet providers and telecommunications companies can enhance service offerings and expand market reach. By leveraging existing infrastructure, these partnerships can facilitate the deployment of satellite services in underserved regions. For instance, partnerships can enable bundled services, combining satellite and terrestrial internet solutions, thereby improving customer access and satisfaction while driving revenue growth for both parties.