Region:Asia

Author(s):Rebecca

Product Code:KRAB2942

Pages:95

Published On:October 2025

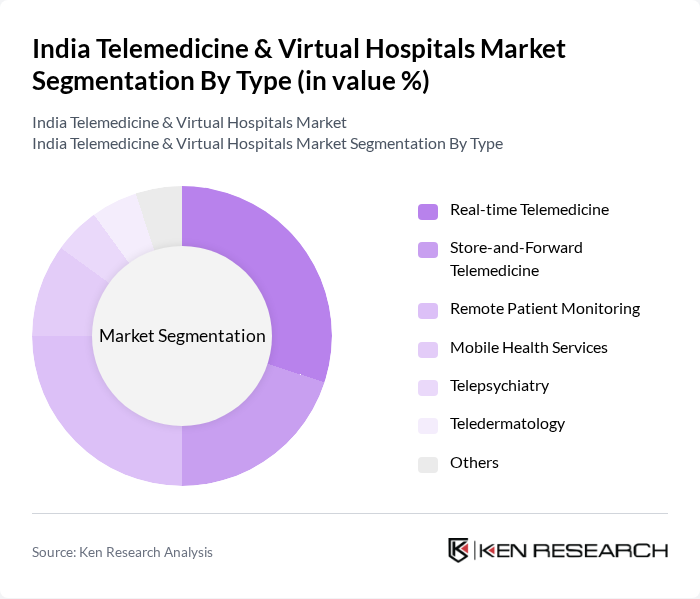

By Type:The market is segmented into various types of telemedicine services, including Real-time Telemedicine, Store-and-Forward Telemedicine, Remote Patient Monitoring, Mobile Health Services, Telepsychiatry, Teledermatology, and Others. Each of these segments caters to different healthcare needs and patient preferences.

The Real-time Telemedicine segment is currently dominating the market due to its ability to provide immediate consultations and diagnoses through video conferencing and other digital platforms. This segment has gained significant traction among patients seeking quick medical advice, especially during the pandemic. The convenience of accessing healthcare professionals from home has led to increased consumer adoption, making it a preferred choice for many. Remote Patient Monitoring is also gaining popularity, particularly among patients with chronic conditions, as it allows for continuous health tracking and timely interventions.

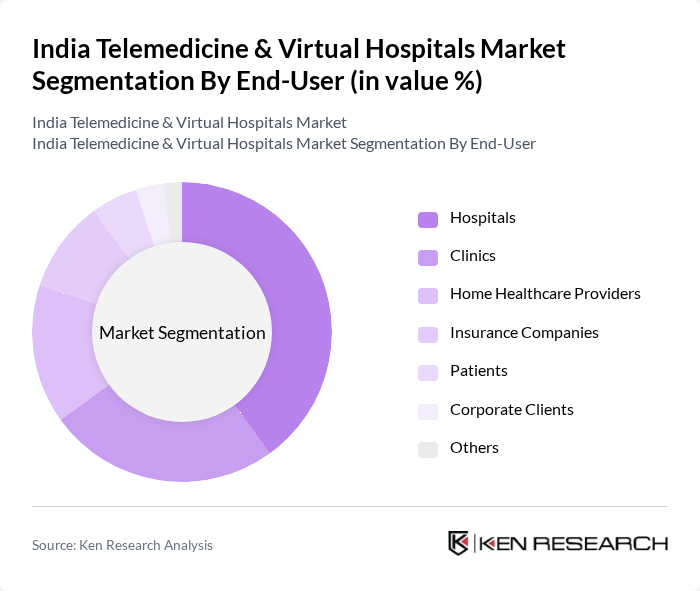

By End-User:The market is segmented based on end-users, including Hospitals, Clinics, Home Healthcare Providers, Insurance Companies, Patients, Corporate Clients, and Others. Each segment plays a crucial role in the adoption and utilization of telemedicine services.

Hospitals are the leading end-users of telemedicine services, leveraging technology to enhance patient care and streamline operations. The integration of telemedicine into hospital systems allows for better resource management and improved patient outcomes. Clinics also play a significant role, particularly in urban areas where access to healthcare is critical. Home Healthcare Providers are increasingly adopting telemedicine to offer remote consultations and monitoring, catering to the growing demand for at-home care solutions.

The India Telemedicine & Virtual Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Practo Technologies Pvt. Ltd., 1mg Technologies Pvt. Ltd., Medlife International Pvt. Ltd., Apollo Telehealth, Tata Consultancy Services (TCS), Philips Healthcare, mFine, DocOnline, Lybrate, HealthifyMe, Qure.ai, eHealth Technologies, Zyla Health, Care24, MyUpchar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telemedicine market in India appears promising, driven by technological advancements and increasing consumer acceptance. By future, the integration of AI and machine learning is expected to enhance diagnostic accuracy and patient engagement. Furthermore, the shift towards patient-centric care models will likely redefine healthcare delivery, making telemedicine an integral part of the healthcare ecosystem. As infrastructure improves, rural areas will also see increased access to telehealth services, further expanding the market's reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Telemedicine Store-and-Forward Telemedicine Remote Patient Monitoring Mobile Health Services Telepsychiatry Teledermatology Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Insurance Companies Patients Corporate Clients Others |

| By Region | North India South India East India West India Central India Northeastern India Others |

| By Technology | Video Conferencing Mobile Applications Cloud Computing Artificial Intelligence Blockchain Technology Others |

| By Application | Primary Care Specialty Care Emergency Care Follow-up Care Preventive Care Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Subsidies for Telemedicine Services Tax Incentives for Telehealth Providers Grants for Technology Development Regulatory Support for Telemedicine Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | CEOs, Product Managers, Technology Officers |

| Healthcare Professionals | 150 | Doctors, Nurses, Telehealth Coordinators |

| Patients Using Telehealth Services | 200 | Patients, Caregivers, Health Advocates |

| Healthcare Policy Makers | 80 | Government Officials, Health Policy Analysts |

| Technology Vendors in Telemedicine | 70 | Sales Directors, Product Development Managers |

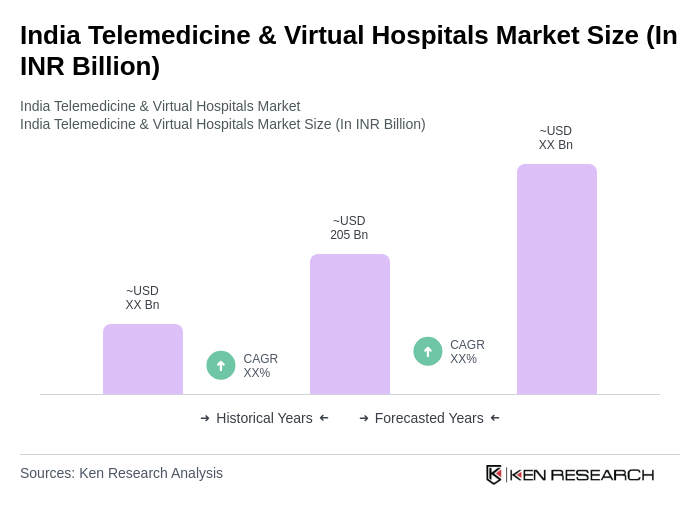

The India Telemedicine & Virtual Hospitals Market is valued at approximately INR 205 billion, reflecting significant growth driven by the adoption of digital health solutions and the increasing prevalence of chronic diseases, particularly accelerated by the COVID-19 pandemic.