Region:Middle East

Author(s):Dev

Product Code:KRAD7683

Pages:90

Published On:December 2025

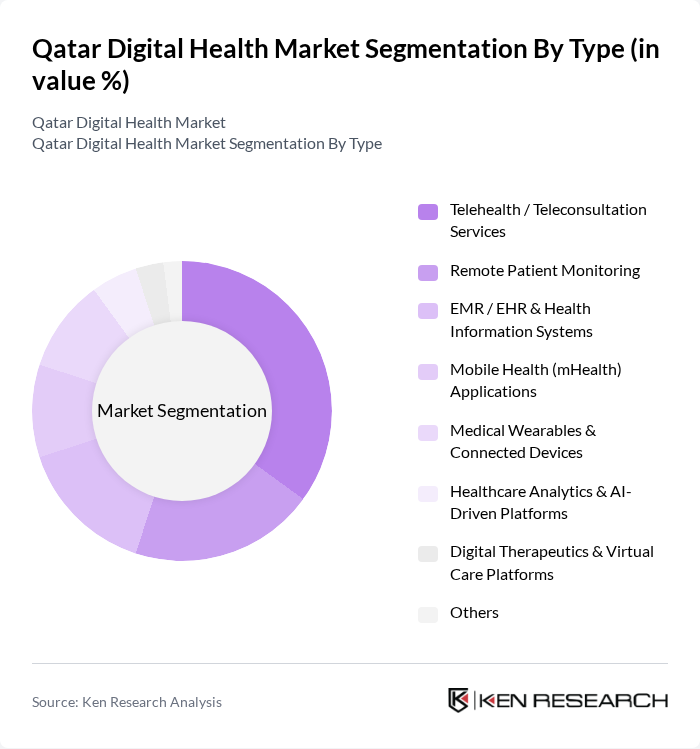

By Type:The digital health market can be segmented into various types, including telehealth, medical wearables, EMR/EHR systems, medical apps, healthcare analytics, and others. Among these, telehealth services have gained significant traction due to their convenience and accessibility, especially during the pandemic. Remote patient monitoring is also on the rise, driven by the increasing prevalence of chronic diseases and the need for continuous health management.

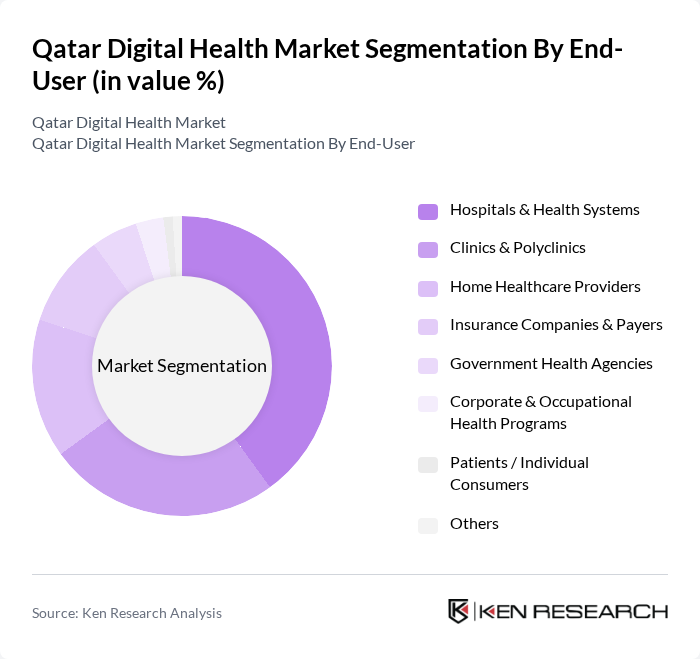

By End-User:The end-user segmentation of the digital health market includes hospitals, clinics, home healthcare providers, insurance companies, government health agencies, corporate health programs, and individual consumers. Hospitals and health systems are the primary users of digital health technologies, as they seek to improve operational efficiency and patient care. Clinics and home healthcare providers are also increasingly adopting these solutions to enhance service delivery and patient engagement.

The Qatar Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamad Medical Corporation (HMC), Ministry of Public Health (MoPH) – National Digital Health Programs, Primary Health Care Corporation (PHCC), Sidra Medicine, Ashghal Digital Health Initiatives (Public Works Authority Health Programs), Cerner Corporation (Oracle Health) – HMC & PHCC EMR Implementations, EPIC Systems – Select EMR Deployments in Qatar, Ooredoo Qatar – Digital Health & mHealth Connectivity Solutions, Vodafone Qatar – eHealth & Remote Monitoring Connectivity Solutions, Naseej (Qatar-based Health IT & Integration Provider), Malaffi / Regional HIE & Health Information Exchange Integrators Active in Qatar, Siemens Healthineers – Connected Imaging & Digital Solutions in Qatar, Philips Healthcare – Tele-ICU, Remote Monitoring & Connected Care Solutions in Qatar, GE HealthCare – Digital Imaging & Clinical IT Solutions in Qatar, Selected HealthTech Startups & Platforms Serving Qatar (e.g., Meddy / Vezeeta, DabaDoc, regional telehealth apps) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's digital health market appears promising, driven by ongoing technological advancements and increasing consumer demand for accessible healthcare solutions. As the government continues to support digital health initiatives, the integration of innovative technologies like AI and blockchain is expected to enhance service delivery in future. Furthermore, the growing emphasis on personalized medicine and patient-centric care will likely shape the market, fostering a more efficient healthcare system that prioritizes patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Telehealth / Teleconsultation Services Remote Patient Monitoring EMR / EHR & Health Information Systems Mobile Health (mHealth) Applications Medical Wearables & Connected Devices Healthcare Analytics & AI-Driven Platforms Digital Therapeutics & Virtual Care Platforms Others |

| By End-User | Hospitals & Health Systems Clinics & Polyclinics Home Healthcare Providers Insurance Companies & Payers Government Health Agencies (e.g., Ministry of Public Health, Primary Health Care Corporation) Corporate & Occupational Health Programs Patients / Individual Consumers Others |

| By Demographics | Age Groups (Children, Adults, Seniors) Gender Socioeconomic Status Geographic Location (Ad Dawhah, Al Rayyan, Al Wakrah, Others) Others |

| By Service Type | Teleconsultation & Second-Opinion Services Diagnostic & Monitoring Services Treatment, Therapy & Rehabilitation Services Preventive & Wellness Services Care Coordination & Follow-up Services Others |

| By Technology Used | Cloud-Based Digital Health Solutions Artificial Intelligence & Machine Learning Internet of Things (IoT) & Connected Devices Mobile & Web-Based Platforms Blockchain & Cybersecurity Solutions Others |

| By Geographic Coverage | Ad Dawhah (Doha) Al Rayyan Al Wakrah Other Municipalities Others |

| By Policy Support / Commercial Model | Government-Funded & Public Programs Private & Insurance-Reimbursed Solutions Subscription-Based & Pay-Per-Use Models Public-Private Partnership (PPP) Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Services | 100 | Healthcare Providers, Telehealth Coordinators |

| Health Monitoring Applications | 80 | Patients, App Developers |

| Digital Health Startups | 60 | Founders, Product Managers |

| Healthcare IT Solutions | 70 | IT Managers, System Administrators |

| Patient Engagement Tools | 90 | Patient Advocates, Healthcare Marketers |

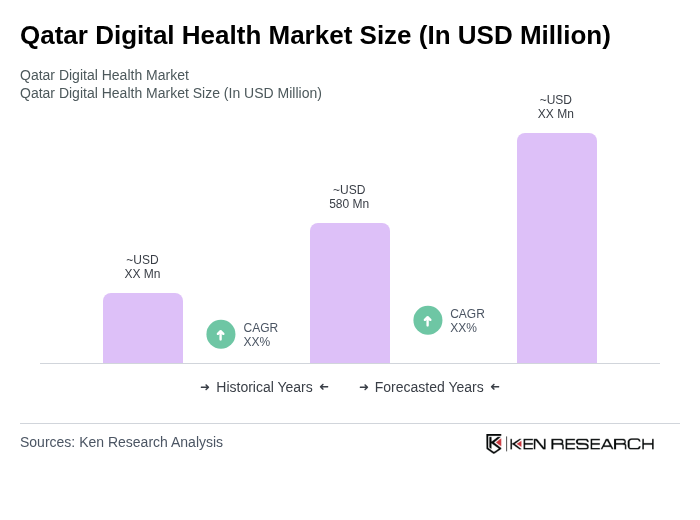

The Qatar Digital Health Market is valued at approximately USD 580 million, reflecting significant growth driven by the adoption of telehealth services, advancements in healthcare technology, and a focus on patient-centered care, particularly accelerated by the COVID-19 pandemic.