Region:Asia

Author(s):Geetanshi

Product Code:KRAD7133

Pages:93

Published On:December 2025

By Type (Active Ingredient):

The market is segmented into four main types of active ingredients: First-Generation Anticoagulants, Second-Generation Anticoagulants, Combination / Multi-Feed Anticoagulant Formulations, and Others. Among these, Second-Generation Anticoagulants dominate the market due to their higher efficacy and lower required dosages compared to first-generation options. The increasing prevalence of resistant rodent populations has further driven the demand for these more potent formulations. Additionally, the convenience of combination products is gaining traction among users, particularly in urban pest control applications.

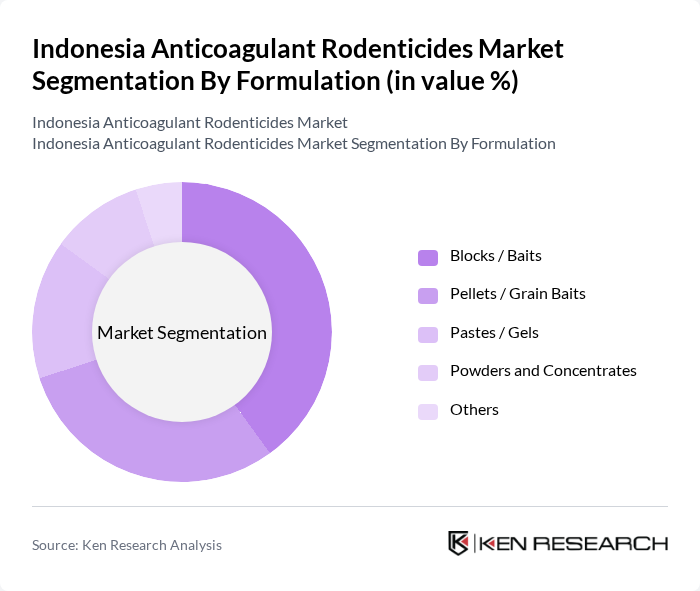

By Formulation:

The market is further segmented by formulation types, including Blocks / Baits, Pellets / Grain Baits, Pastes / Gels, Powders and Concentrates, and Others. Blocks / Baits are the leading formulation type due to their ease of use and effectiveness in various environments. The convenience of ready-to-use baits appeals to both professional pest control operators and residential users. Pellets and grain baits are also popular, particularly in agricultural settings, where they can be easily distributed in fields.

The Indonesia Anticoagulant Rodenticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bayer Indonesia, PT BASF Indonesia, PT Syngenta Indonesia, PT Sumitomo Chemical Indonesia, PT Sumi Agro Indonesia, PT Fumakilla Indonesia, PT Petrokimia Kayaku, PT Nufarm Indonesia, PT Ecolab International Indonesia, PT Antis Jaya, PT Cisa Agro Indonesia, PT Biotis Agrindo, PT Panca Prima Wijaya, PT Multiguna Agrisatwa, Other Notable Local Rodenticide & Pest Control Product Manufacturers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anticoagulant rodenticides market in Indonesia appears promising, driven by urbanization and heightened health awareness. As the population continues to grow, the demand for effective pest control solutions will likely increase. Additionally, advancements in technology and the development of eco-friendly products are expected to shape the market landscape. Companies that adapt to these trends and address regulatory challenges will be well-positioned to capture market share and meet evolving consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Active Ingredient) | First-Generation Anticoagulants (e.g., warfarin, chlorophacinone, coumatetralyl) Second-Generation Anticoagulants (e.g., brodifacoum, bromadiolone, difenacoum, difethialone, flocoumafen) Combination / Multi-Feed Anticoagulant Formulations Others (including anticoagulant blends and emerging actives) |

| By Formulation | Blocks / Baits Pellets / Grain Baits Pastes / Gels Powders and Concentrates Others |

| By Application Sector | Agriculture (rice, corn, plantation crops, livestock facilities) Urban Pest Control (residential and commercial premises) Food & Feed Storage and Processing Facilities Public Health & Municipal Programs Others |

| By End-User | Professional Pest Control Operators Commercial & Industrial Users Farmers & Producer Cooperatives Household / Residential Users Government & Municipal Authorities Others |

| By Distribution Channel | Agrochemical & Farm Input Dealers Pest Control Product Distributors & Wholesalers Modern Retail & Home Improvement Stores Online / E-commerce Channels Direct Institutional & Government Procurement Others |

| By Packaging Type | Sachets / Small Pack SKUs (<500 g) Bottles, Tubs & Canisters Bulk Packaging (bags, drums, cartons) Child-Resistant & Tamper-Evident Packaging Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua & Maluku |

| By Regulatory & Stewardship Compliance | Products Registered with Indonesian Ministry of Agriculture / KLHK Compliance with International Stewardship & Environmental Standards Certified for Food-Handling and Export-Oriented Facilities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Farmers using Anticoagulant Rodenticides | 120 | Crop Farmers, Livestock Farmers |

| Pest Control Operators | 80 | Business Owners, Field Technicians |

| Retailers of Agricultural Chemicals | 60 | Store Managers, Sales Representatives |

| Government Agricultural Officials | 40 | Policy Makers, Regulatory Officers |

| Environmental NGOs | 30 | Research Analysts, Program Coordinators |

The Indonesia Anticoagulant Rodenticides Market is valued at approximately USD 10 million, based on a five-year historical analysis. This valuation reflects the growing demand for effective rodent control solutions driven by urbanization and agricultural activities.