Region:Asia

Author(s):Shubham

Product Code:KRAD0874

Pages:94

Published On:November 2025

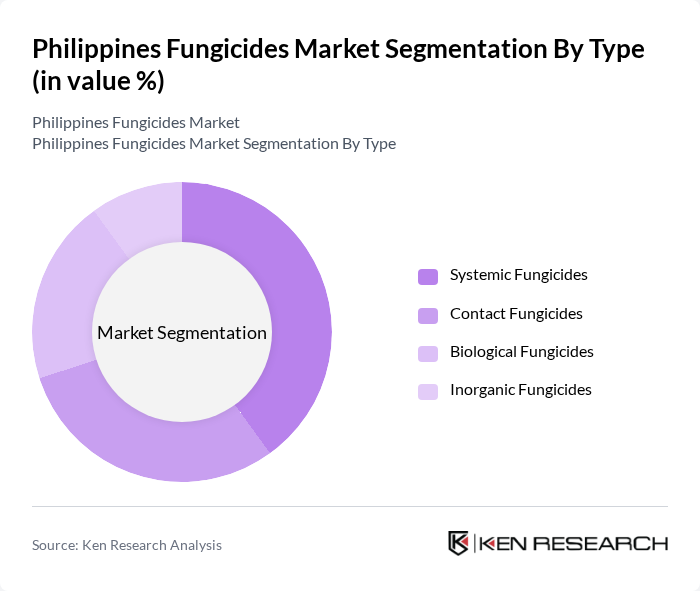

By Type:The fungicides market can be segmented into four main types: Systemic Fungicides, Contact Fungicides, Biological Fungicides, and Inorganic Fungicides. Systemic fungicides are widely used due to their ability to be absorbed by plants, providing long-lasting protection. Contact fungicides are also popular for their immediate effectiveness against fungal infections. Biological fungicides are gaining traction as sustainable alternatives, while inorganic fungicides remain essential for certain applications.

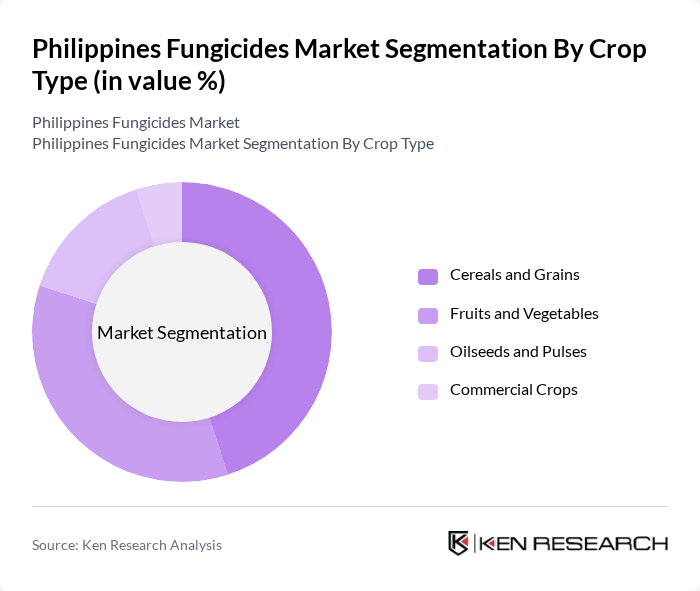

By Crop Type:The market is also segmented by crop type, which includes Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, and Commercial Crops. Cereals and grains dominate the market due to their extensive cultivation in the Philippines, followed by fruits and vegetables, which are increasingly being protected against fungal diseases. Oilseeds and pulses are also significant, while commercial crops are gaining attention as farmers seek to maximize yields.

The Philippines Fungicides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Philippines, Inc., Bayer CropScience Philippines, BASF Philippines, Inc., Corteva Agriscience Philippines, FMC Corporation (Asia-Pacific Division), ADAMA Agricultural Solutions Ltd., Nufarm Limited (Asia Operations), UPL Limited (Southeast Asia), Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Isagro S.p.A., Albaugh LLC, Certis USA LLC, Bioworks, Inc., Inoculant Philippines Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines fungicides market is poised for transformation as it adapts to evolving agricultural practices and consumer preferences. The increasing focus on sustainable agriculture and the adoption of precision farming technologies are expected to drive innovation in fungicide formulations. Additionally, the growing awareness of integrated pest management strategies will likely enhance the effectiveness of fungicides, ensuring that they meet both productivity and environmental sustainability goals. This dynamic landscape presents opportunities for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Systemic Fungicides Contact Fungicides Biological Fungicides Inorganic Fungicides |

| By Crop Type | Cereals and Grains Fruits and Vegetables Oilseeds and Pulses Commercial Crops |

| By Application Method | Foliar Spray Soil Treatment Seed Treatment Chemigation |

| By Formulation | Liquid Formulations Dry Formulations Granular Formulations Powder Formulations |

| By Distribution Channel | Direct Sales to Farmers Agricultural Retail Stores Online Sales Platforms Agrochemical Distributors |

| By Region | Luzon Visayas Mindanao |

| By End-User | Smallholder Farmers Commercial Farmers Agricultural Cooperatives Agrochemical Distributors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fungicide Usage | 100 | Farm Owners, Agronomists |

| Vegetable Crop Protection Practices | 80 | Crop Managers, Agricultural Technicians |

| Fungicide Distribution Channels | 60 | Distributors, Retailers |

| Research on Organic Fungicides | 50 | Research Scientists, Organic Farmers |

| Impact of Regulations on Fungicide Use | 40 | Policy Makers, Regulatory Affairs Specialists |

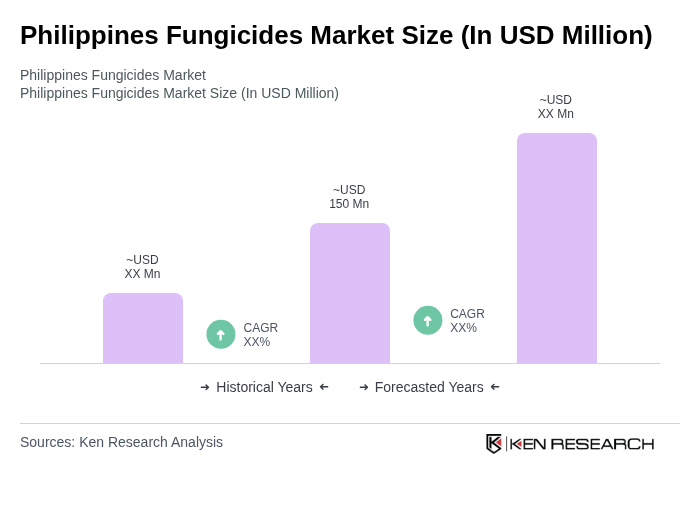

The Philippines Fungicides Market is valued at approximately USD 150 million, driven by increasing agricultural productivity, rising crop diseases, and the adoption of modern farming techniques. This market is essential for effective pest management in the agricultural sector.