Region:Asia

Author(s):Geetanshi

Product Code:KRAA6694

Pages:99

Published On:September 2025

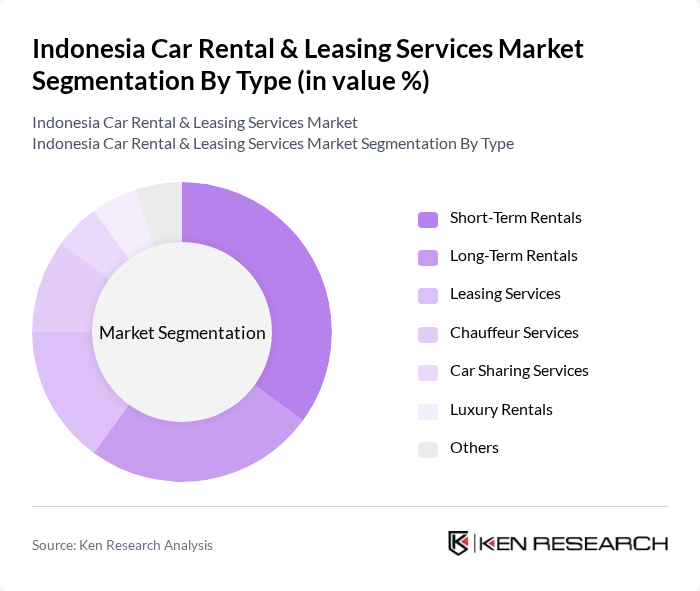

By Type:The market is segmented into various types, including Short-Term Rentals, Long-Term Rentals, Leasing Services, Chauffeur Services, Car Sharing Services, Luxury Rentals, and Others. Each of these segments caters to different consumer needs and preferences, with Short-Term Rentals being particularly popular among tourists and business travelers seeking flexibility.

The Short-Term Rentals segment is currently dominating the market due to the increasing number of tourists and business travelers in Indonesia. This segment is characterized by high demand for flexibility and convenience, allowing users to rent vehicles for short durations without long-term commitments. The rise of online booking platforms has further facilitated access to these services, making it easier for consumers to find and book vehicles quickly. As a result, Short-Term Rentals account for a significant portion of the market share.

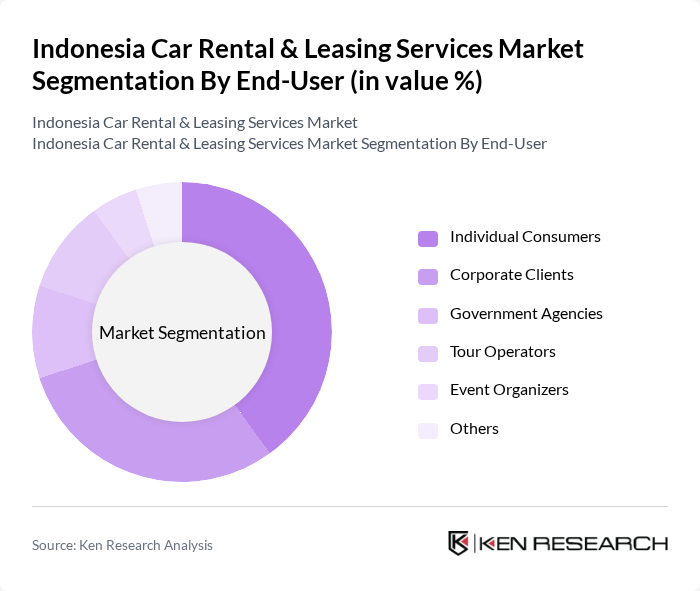

By End-User:The market is segmented by end-users, including Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, Event Organizers, and Others. Each segment has unique requirements and preferences, with Individual Consumers and Corporate Clients being the largest contributors to market growth.

The Individual Consumers segment leads the market, driven by the growing trend of personal mobility and the increasing number of domestic and international travelers. This segment benefits from the rise of digital platforms that facilitate easy access to rental services. Corporate Clients also represent a significant portion of the market, as businesses often require rental services for employee travel and events. The demand from these two segments is crucial for the overall growth of the car rental and leasing services market.

The Indonesia Car Rental & Leasing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bluebird Group, TRAC Astra, Rent Car Indonesia, Orix Indonesia, Garuda Indonesia, Sixt Rent a Car, Hertz Indonesia, Avis Indonesia, Europcar Indonesia, Koperasi Rental Mobil, Jakarta Car Rental, Bali Car Rental, Indorent, Rent A Car Bali, Car Rental Jakarta contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car rental and leasing market in Indonesia appears promising, driven by technological advancements and changing consumer preferences. The integration of digital platforms for booking and fleet management is expected to enhance operational efficiency. Additionally, as urbanization continues, the demand for flexible transportation solutions will likely increase. Companies that adapt to these trends and invest in sustainable practices, such as electric vehicle adoption, will be well-positioned to capitalize on emerging opportunities in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Rentals Long-Term Rentals Leasing Services Chauffeur Services Car Sharing Services Luxury Rentals Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Event Organizers Others |

| By Vehicle Type | Economy Cars SUVs Vans Luxury Cars Electric Vehicles Others |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly Rentals Annual Rentals Others |

| By Payment Model | Pay-Per-Use Subscription-Based Prepaid Rentals Postpaid Rentals Others |

| By Distribution Channel | Online Platforms Offline Agencies Direct Corporate Contracts Travel Agencies Others |

| By Customer Segment | Business Travelers Leisure Travelers Local Residents Tourists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Car Leasing | 100 | Fleet Managers, Procurement Officers |

| Tourist Car Rentals | 150 | Travel Agency Managers, Tour Operators |

| Local Car Rental Services | 80 | Small Business Owners, Rental Service Managers |

| Long-term Leasing Clients | 70 | HR Managers, Employee Benefits Coordinators |

| Ride-sharing Partnerships | 60 | Operations Managers, Business Development Executives |

The Indonesia Car Rental & Leasing Services Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by urbanization, tourism, and a rising middle class seeking flexible transportation options.