Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5811

Pages:96

Published On:October 2025

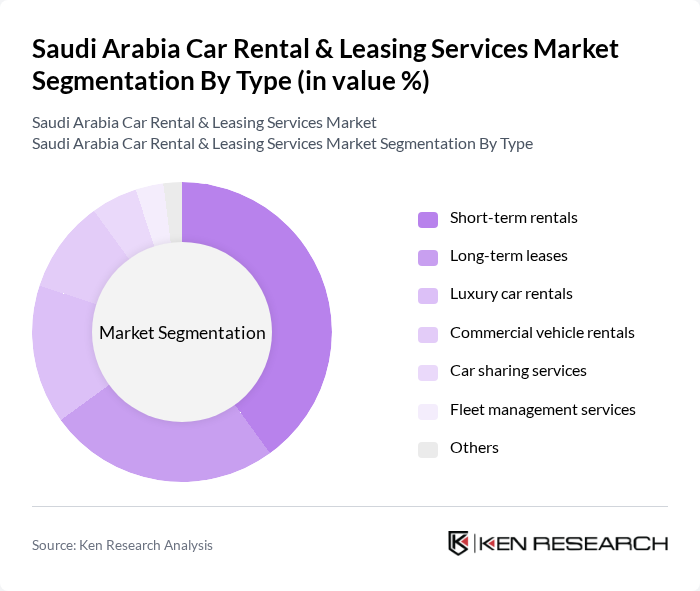

By Type:The market is segmented into various types, including short-term rentals, long-term leases, luxury car rentals, commercial vehicle rentals, car sharing services, fleet management services, and others. Among these, short-term rentals are particularly popular due to the increasing number of tourists and business travelers seeking flexible transportation options. Long-term leases are also gaining traction among expatriates and corporate clients looking for cost-effective solutions for extended periods.

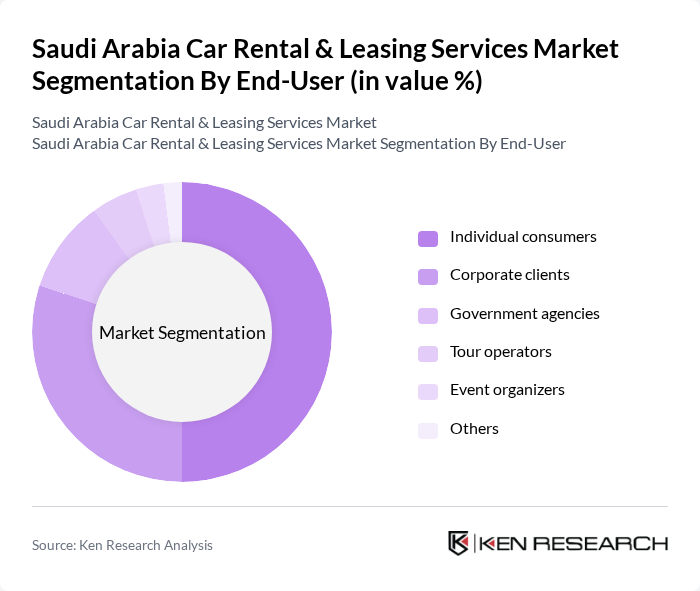

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, tour operators, event organizers, and others. Individual consumers dominate the market, driven by the increasing trend of personal mobility and the growing number of tourists. Corporate clients also represent a significant portion, as businesses often require rental services for employee travel and logistics.

The Saudi Arabia Car Rental & Leasing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Motors, Budget Saudi Arabia, Hertz Saudi Arabia, Sixt Rent a Car, Avis Saudi Arabia, Europcar Saudi Arabia, Thrifty Car Rental, National Car Rental, Careem, Udrive, Yelo Car Rental, Limo Saudi Arabia, Al-Muqarram Car Rental, Al-Jazira Vehicles, Al-Mansour Car Rental contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car rental and leasing market in Saudi Arabia appears promising, driven by ongoing urbanization and a growing tourism sector. As infrastructure projects continue to unfold, the demand for rental services is expected to rise significantly. Additionally, the integration of technology and digital platforms will enhance customer experiences, making rentals more accessible. Companies that adapt to these trends and focus on sustainability will likely capture a larger share of the market, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term rentals Long-term leases Luxury car rentals Commercial vehicle rentals Car sharing services Fleet management services Others |

| By End-User | Individual consumers Corporate clients Government agencies Tour operators Event organizers Others |

| By Vehicle Type | Economy cars SUVs Vans Trucks Electric vehicles Others |

| By Rental Duration | Daily rentals Weekly rentals Monthly rentals Annual leases |

| By Distribution Channel | Online bookings Offline bookings Travel agency partnerships Corporate contracts |

| By Payment Model | Pay-per-use Subscription-based Prepaid rentals Postpaid rentals |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Car Leasing | 100 | Corporate Fleet Managers, Procurement Officers |

| Tourism and Leisure Rentals | 80 | Travel Agency Managers, Tour Operators |

| Short-term Rental Services | 120 | Rental Service Managers, Customer Experience Leads |

| Long-term Leasing Solutions | 90 | Business Development Managers, Financial Analysts |

| Consumer Rental Preferences | 150 | End-users, Frequent Renters, Casual Users |

The Saudi Arabia Car Rental & Leasing Services Market is valued at approximately USD 1.5 billion, driven by factors such as increasing tourism, urbanization, and a growing expatriate population seeking flexible transportation options.