Region:Europe

Author(s):Geetanshi

Product Code:KRAA6703

Pages:89

Published On:September 2025

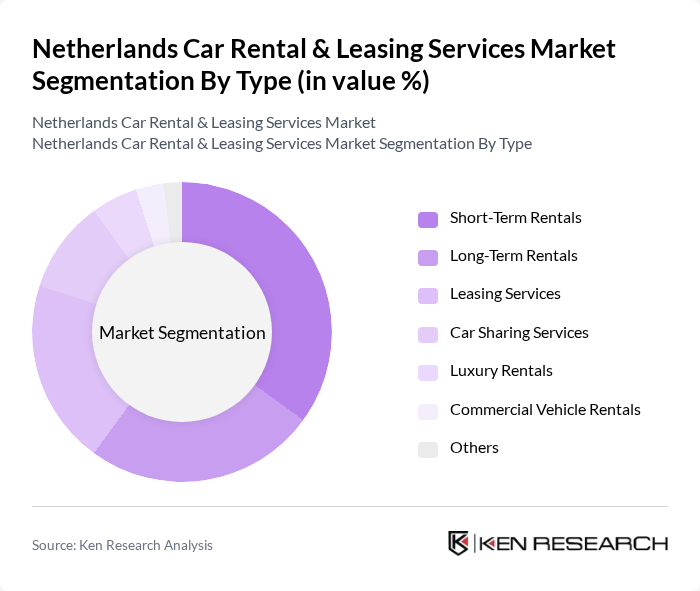

By Type:The market is segmented into various types, including Short-Term Rentals, Long-Term Rentals, Leasing Services, Car Sharing Services, Luxury Rentals, Commercial Vehicle Rentals, and Others. Among these, Short-Term Rentals are particularly popular due to the increasing trend of travel and tourism, while Leasing Services are favored by businesses seeking cost-effective vehicle solutions.

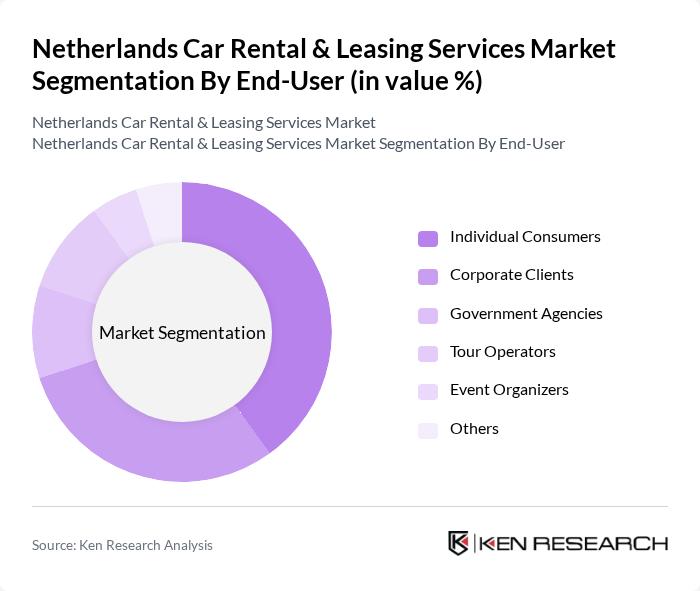

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, Event Organizers, and Others. Individual Consumers dominate the market, driven by the increasing trend of travel and the need for flexible transportation options. Corporate Clients also represent a significant portion, as businesses often require rental services for employee travel and events.

The Netherlands Car Rental & Leasing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Netherlands, Sixt Rent a Car, Europcar Nederland, Avis Budget Group, Enterprise Rent-A-Car, Green Motion, LeasePlan Corporation N.V., ALD Automotive, Arval Nederland, TUI Cars, Drivus, SnappCar, MyWheels, B2B Car Rental, CarNext contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands car rental and leasing services market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for flexible mobility solutions is expected to rise. Additionally, the integration of electric vehicles into rental fleets will likely gain momentum, aligning with sustainability goals. Companies that adapt to these trends and enhance customer experiences through digital platforms will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Rentals Long-Term Rentals Leasing Services Car Sharing Services Luxury Rentals Commercial Vehicle Rentals Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Event Organizers Others |

| By Vehicle Type | Economy Cars SUVs Vans Luxury Cars Electric Vehicles Others |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly Rentals Annual Rentals |

| By Distribution Channel | Online Platforms Travel Agencies Direct Rentals Corporate Contracts |

| By Payment Model | Pay-As-You-Go Subscription Models Prepaid Rentals Postpaid Rentals |

| By Fleet Size | Small Fleet Operators Medium Fleet Operators Large Fleet Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Car Leasing | 150 | Fleet Managers, HR Directors |

| Short-term Car Rentals | 100 | Rental Branch Managers, Customer Service Representatives |

| Long-term Leasing Solutions | 80 | Procurement Officers, Financial Analysts |

| Tourism-related Rentals | 70 | Travel Agency Managers, Tour Operators |

| Electric Vehicle Rentals | 60 | Sustainability Officers, Marketing Managers |

The Netherlands Car Rental & Leasing Services Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by increasing tourism, urbanization, and a preference for flexible mobility solutions over vehicle ownership.